Vietnam to see a rosy start to 2022

HSBC said Vietnam would see a rosy start to 2022, thanks to recovering domestic consumption and strong external metrics.

After the Tet holidays, over 90% of workers have returned to Ho Chi Minh City (HCMC)

A rosy start

After a tough 2021, Vietnam’s economy started 2022 on a firm footing, as reflected in the January data prints. Despite rising daily COVID-19 infections, Vietnam has refrained from re-imposing harsh restrictions. Policymakers have been sticking with their policy to “co-live with the virus”, partly thanks to the accelerated vaccination drive.

On the domestic front, this is fuelling consumer sentiment, leading to an ongoing rebound in local consumption. Indeed, after an almost 4% y-o-y fall in 2021, retail sales grew 1.3% y-o-y in January 2022. While the increase may seem small, it was partly distorted by a high base in January 2021.

Manufacturing roaring back

Most importantly, Vietnam’s key growth engine is set to see a strong recovery, as the labour shortage continues to ease. After the Tet holidays, over 90% of workers have returned to Ho Chi Minh City (HCMC). January’s export growth of 1.6% y-o-y may also seem low, but it was weighed down by a 34% y-o-y fall in phone shipments. However, this is mainly because of base effects: Samsung had an earlier-than-usual release of its flagship Galaxy S21 in January 2021.

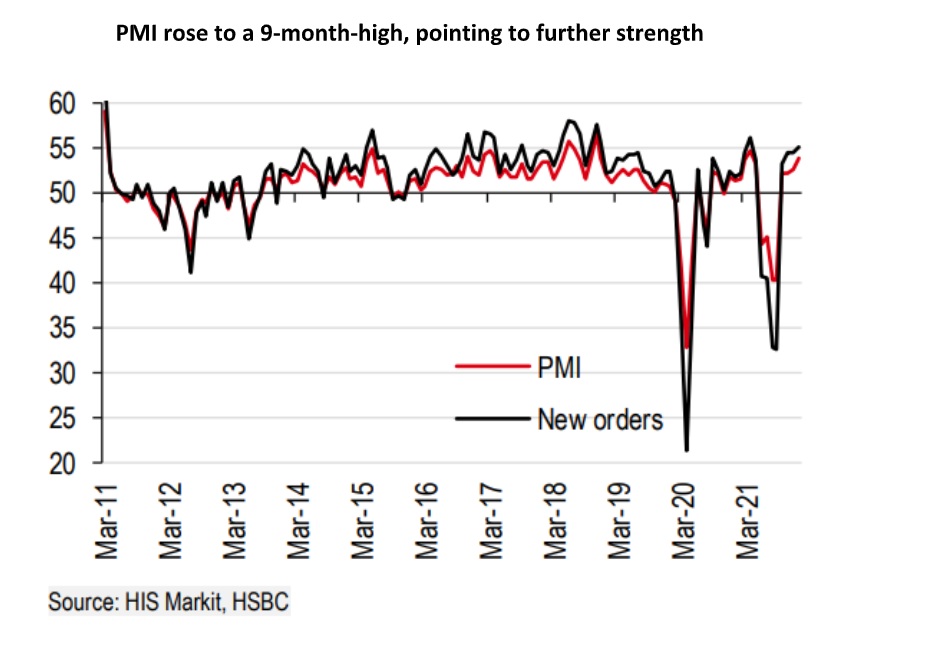

“As last year’s S21 release pushed up exports firmly, we expect a similar trend in this year’s February export data, as the S22 will be released on 25 February. In addition, the PMI rose to a 9-month-high, indicating a strong rebound in industrial output. Most of the key sub-indicators continue to show a sustained recovery, offering optimism that manufacturing will likely return to its pre-COVID-19 levels”, HSBC said.

What about inflation?

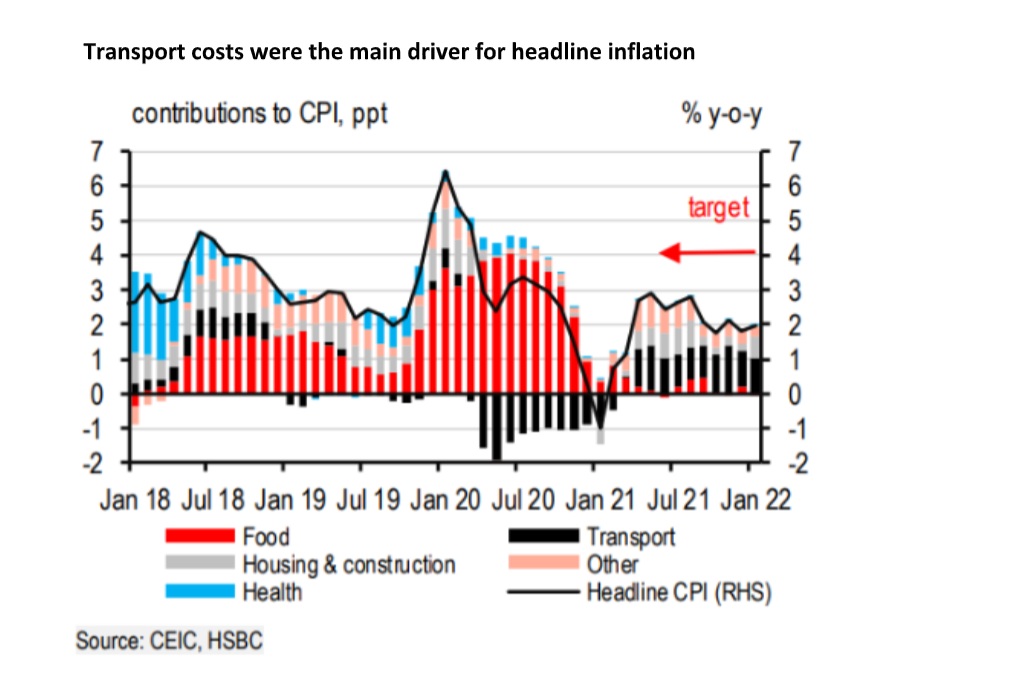

While rising inflation in parts of ASEAN (e.g. Thailand and Singapore) has gained attention, Vietnam’s inflation is unlikely to be a big concern this year. Granted, energy inflation continues to gain momentum, driving the January print of 1.9% y-o-y. That said, food prices are in better shape while demand-side inflation is yet to pick up.

“As such, we are raising our 2022 average inflation forecast slightly to 3%, from 2.7% previously, but it should not pose a major risk to the State Bank of Vietnam (SBV), as it will likely remain well below the 4% inflation target”, HSBC forecasted.