Vietnam's economic outlook for 2022: Exports to resume expansion

Exports would continue to be a key growth driver for Vietnam’s economy in 2022.

Vietnam's steel export increased 132.1% YoY in 10M21.

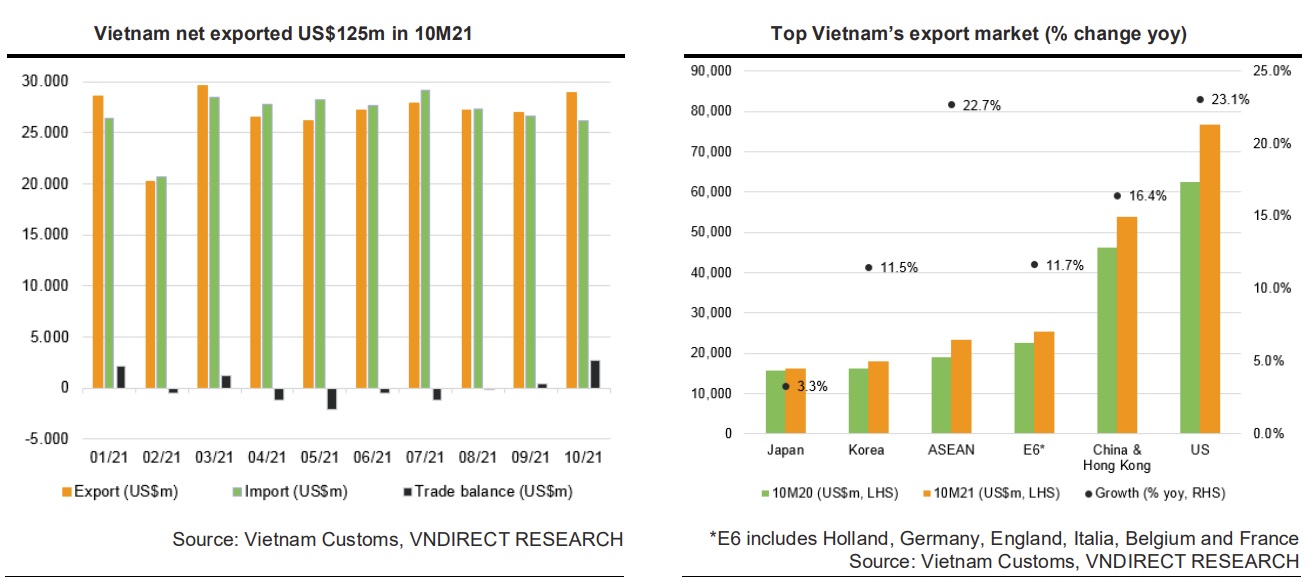

Despite a slowing growth rate since late-2Q21 due to the negative effects of Delta-variant and rising shipping costs, exports recorded an impressive performance in the first ten months of this year, with value increasing by 17.4% year on year to US $269.8 billion.

All Vietnam's main export markets recorded positive growth in the first 10 months of 2021, led by the U.S. market with an increase of 23.1% YoY, followed by ASEAN (22.7% YoY) and China & Hong Kong (16.4% YoY).

Among Vietnam’s export products, the items that recorded a strong growth rate in 10M21 include steel (132.1% yoy), coal (125.1%), plastic materials (71.2% yoy), camera & camcorders (56.1% yoy), textile fibres (55.0% yoy), rubber (47.1% yoy) and petroleum (46.4% yoy).

VNDirect is optimistic about Vietnam’s export prospects in 2022 by basing on the following factors.

First, global trade is expected to remain resilient in 2022. Based on the latest report of the World Trade Organization (WTO), trade volume growth is expected to increase by 4.7% in 2022F, up from 4.0% in the previous report, and it could approach its pre-pandemic long-run trend at the end of 2022.

Second, increased shipping costs are expected to gradually normalize from late 2021 onwards as anti-coronavirus measures are mitigated thanks to high vaccination rates as well as increased container volumes following a sharp increase in container production orders since mid-2021. Since October 2021, major freight indexes have declined, including the Baltic Dry Index and Shanghai (Export) Containerized Freight Index. The cooling of transportation costs will create favorable conditions for Vietnamese enterprises to promote exports in 2022, especially to the US and European markets.

Third, the Regional Comprehensive Economic Partnership (RCEP) that is expected to come into force at the beginning of 2022 will boost Vietnam's exports to partner countries in 2022. The agreement includes 10 ASEAN countries and five countries that have signed FTAs with ASEAN, including Japan, Korea, China, Australia, and New Zealand. RCEP is considered a "super agreement" because, when implemented, it will become one of the largest free trade areas in the world with a scale of 2.2 billion consumers, accounting for about 30% of the world's population and about 30% of the global GDP. Without having to wait until the agreement officially takes effect, Vietnam's exports to countries in Southeast Asia have increased sharply, with export value increasing by 24% YoY to $24 billion in the first 10 months of 2021.

Fourth, the EU-Vietnam Free Trade Agreement (EVFTA) officially took effect on August 1, 2020. Since it took effect, Vietnam's export prospects to the EU have improved significantly. With Vietnam's export tax to be cut in 2022 according to the agreement's roadmap and the European economic outlook remaining strong in 2022, VNDirect believed that Vietnam's exports to the EU would maintain strong momentum in 2022.

"We expect Vietnam’s exports to enjoy a strong growth rate of 12.5% YoY in 2022F (vs. our forecast of 15.0% YoY for 2021F)", VNDirect said.

As for imports, VNDirect said that Vietnam’s import spending would remain strong in 2022 for the following reasons: (1) a recovery in domestic demand for imported consumer products, (2) high demand for raw materials and inputs amid resurgent manufacturing activity; and (3) commodity prices may remain high in 2022. Some imported products will see strong demand in 2022, including machinery and equipment, auxiliary materials for textiles and footwear, phones and components, automobiles, and steel. As a result, it expects Vietnam’s import value to increase by 10.9% YoY in 2022F and Vietnam’s trade surplus to widen to $5.6bn in 2022F from an expected trade surplus of $0.3bn in 2021F.