Vietnam's economic outlook for 2022: leverage from support policies

Vietnam’s support policies are expected to continue in 2022 to step up economic recovery amid the COVID-19 pandemic.

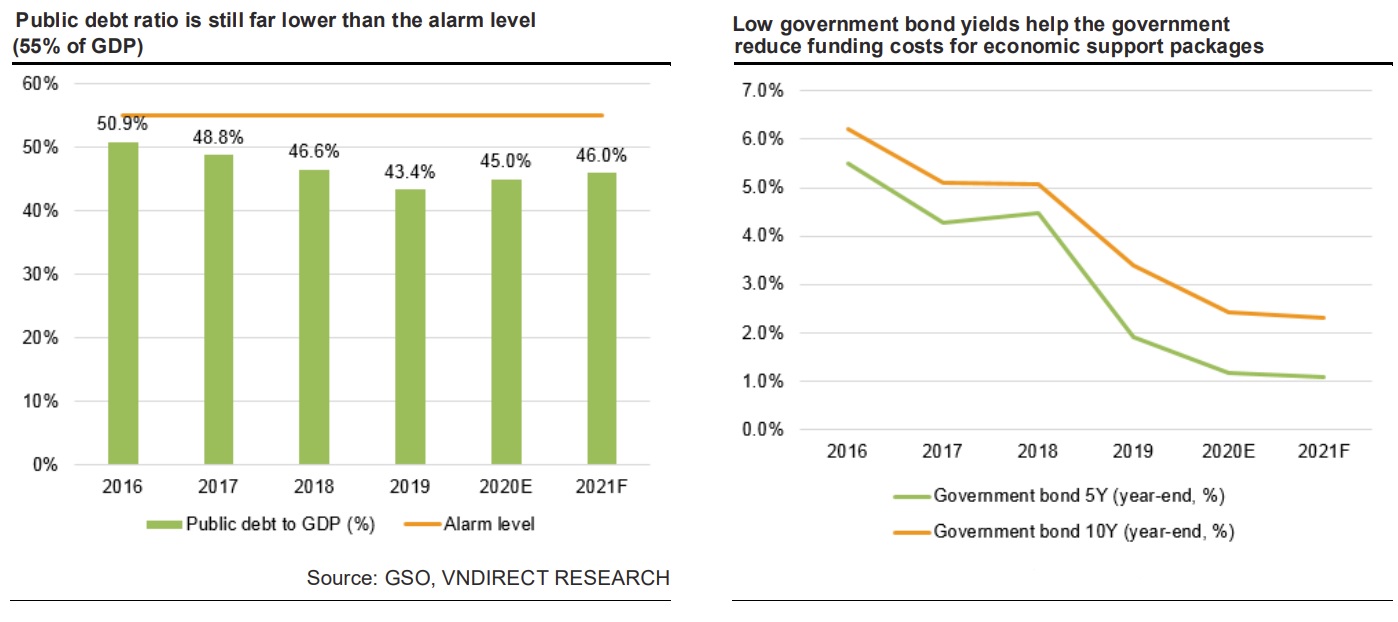

Room for more fiscal policy support

Recently, the scale of Vietnam’s COVID-19 fiscal stimulus packages was only 2.85% of GDP (according to the Ministry of Planning and Investment), which is much lower than that of advanced economies and Asian economies. In addition, VNDirect estimates that Vietnam's public debt-to-GDP ratio at the year-end of 2020 was about 45% of GDP (re-calculated GDP), which is much lower than Vietnam’s public debt ceiling of 60% of GDP.

Given that government bond interest rates are at historic lows and inflation is well-managed, VNDirect anticipated that the government would release additional fiscal stimulus packages to support economic recovery, focusing on cash subsidies for coronavirus victims; tax reduction (VAT; corporate income tax); and increasing the value of the public investment in transportation infrastructure and social-housing project development."We expect that the size of the new additional fiscal stimulus package could be 3–4% of GDP (excluding additional medical expenses to combat the pandemic) and that it will strongly support Vietnam's economic recovery in 2022," VNDirect said.

Along with upcoming fiscal support packages, the government plans to step up public investment in 2022 to counter the slowdown in other growth engines. The government plans to spend VND526tr on public investment in 2022F (10% versus the public investment plan for 2021) to support growth. VNDirect believes that the disbursement of public investment in 2022 can increase by 15–25% compared to the actual disbursement in 2021 due to three factors: (1) the bottleneck of construction stone shortage has been solved as the government has licensed for new mines; (2) construction material prices such as steel, cement, and construction stone are expected to cool down next year; and (3) the actual disbursement of public investment is expected to be low in 2022.

In addition, the government is expected to focus on accelerating the progress of major public investment projects in 2022, such as the Long Thanh International Airport and the North-South Expressway, thereby accelerating the disbursement of public investment. It is known that the government has submitted to the National Assembly a policy to convert all 12 sub-projects of the North-South Expressway into the public investment to speed up the implementation progress.

An accommodative monetary policy will continue

We saw a strong improvement in credit demand since mid-Sep after the economy was reopened, with credit growing 12.68% YTD on December 22 (accelerating from the 6.4% YTD rise seen on June 30). Credit growth is expected to increase by about 14.57% YoY in 2021F.

According to SBV, the total amount of interest exempted or reduced by credit institutions for customers from July 15, 2021 to September 30, 2021 was about VND12,236bn, equivalent to 59.4% of the commitment.

In July, SBV required commercial banks to reduce lending interest rates to support business recovery. Following this, commercial banks committed to cutting off VND20.6tr of profit to lower lending rates by 0.5-2.0% for outstanding loans of pandemic-hit clients. According to SBV, the total amount of interest exempted or reduced by credit institutions for customers from July 15, 2021 to September 30, 2021 was about VND12,236bn, equivalent to 59.4% of the commitment.

Despite the rising inflationary pressure, VNDirect expects the SBV to maintain its accommodative monetary policy until at least the end of 2Q22. Although it does not expect the SBV to cut its key policy rates further, it would not lift them either in 1H22, in a bid to continue supporting the economy by maintaining a loose monetary policy. Nevertheless, VNDirect expects the SBV to channel its money market activities via the open market, such as buying foreign exchange or raising the credit growth ceilings. It forecasts credit growth to increase by 13–14% YoY in 2022.