USD/VND exchange rate rises slightly after easing period

After more than two weeks of cooling thanks to intervention and guidance from the State Bank of Vietnam (SBV), the exchange rate has shown signs of a slight rebound.

In September 2025, SBV continued to manage liquidity through the use of repurchase agreements (repos) on the open market (OMO). The main trend was issuing repos to balance maturing loans, which kept interbank rates on a downward trend before ticking back up in the final week of September.

Also in September, after a two-day meeting, the US Federal Reserve (Fed) as expected cut the Federal Funds Rate (FFR) by 25 basis points, bringing it down to 4.0–4.25%. The Fed offered no specific guidance on the pace of future cuts, but the general consensus among governors in favor of easing has led markets to expect two more rate cuts by the end of the year, potentially with larger increments per cut.

This move, combined with prospects of further Fed cuts, has lowered average overnight USD lending rates in the interbank market. These factors have nearly eliminated the VND–USD interest rate differential.

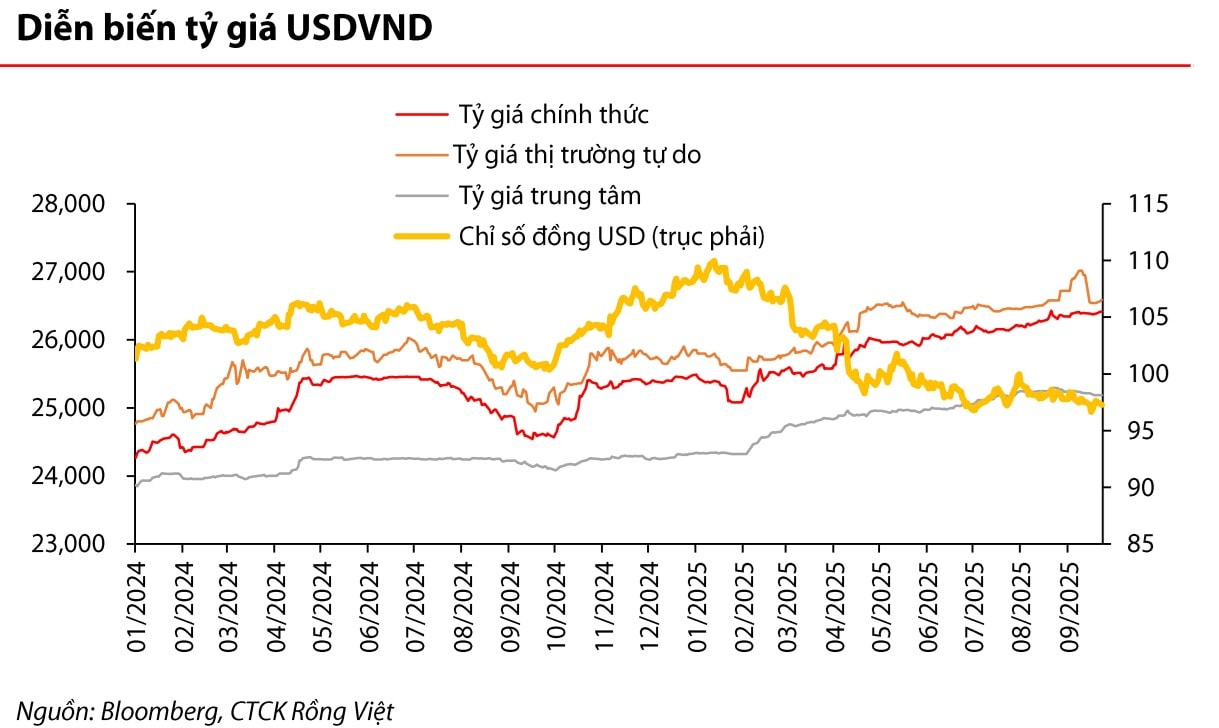

According to VDSC’s September monetary report, the official and unofficial exchange rate markets showed diverging trends.

On the official market, the USD/VND rate weakened by another 0.3% month-on-month, bringing cumulative depreciation to 3.7% since the beginning of the year. On the unofficial market, however, the rate fell by 0.5% month-on-month, for a cumulative decline of 2.9% since the start of the year. VDSC noted that the overall depreciation of the dong remains within SBV’s targeted band (/-5%).

Previously, on August 25–26, SBV had intervened in the market with forward, non-cancellable USD purchase agreements totaling around USD 1.5 billion with commercial banks. MBS Securities viewed this as a flexible measure—helping stabilize market sentiment while preserving foreign exchange reserves in case banks later canceled transactions when exchange rate pressures subsided. Combined with USD weakness, VND depreciation pressures eased from mid-September.

Exchange rate developments in September

However, in the week of September 22–29, the exchange rate showed a slight rebound. The US dollar strengthened globally, supported by more positive US economic data that reduced pressure for aggressive Fed rate cuts: August core PCE came in as expected, new home sales hit their highest since early 2022, and Q2 GDP was revised upward, signaling resilience.

In addition, comments by several Fed governors and Chair Jerome Powell reflected caution about cutting rates too quickly. Speaking in Providence, Rhode Island, Powell said the Fed faces the delicate task of balancing two key objectives: keeping inflation low and stable, while supporting a healthy labor market. According to him, the “two-sided risks” mean there is no path without vulnerabilities. Cutting rates too fast could keep inflation stuck near 3%, above the 2% target. On the other hand, keeping rates too high for too long could unnecessarily weaken the labor market. His message once again left the door open for further monetary easing, but without committing to specific cuts.

Thanks to these factors, the US Dollar Index (DXY) rebounded from the previous week’s low, spiking midweek before facing selling pressure on September 26 after core PCE data met expectations. The index closed the week up 0.52% from the prior week.

Domestically, the USD/VND exchange rate also edged up. The central rate rose 0.03% week-on-week, while both buying and selling rates at commercial banks also increased 0.03%. On the free market, the rate jumped 0.19% after sharp declines in the two preceding weeks.

According to YSVN analyst Nguyen The Minh, the USD/VND rate is likely to remain stable this week as short-term upward momentum has eased. At the same time, with the Fed having cut rates and the dollar facing possible adjustment as it nears the 98-point resistance level, there are short-term factors supporting stability.

Exchange rate pressures will continue to be closely monitored by SBV, banks, businesses, and investors. Nguyen Phi Lan, Director of Forecasting, Statistics, and Monetary–Financial Stability at SBV, affirmed that the central bank will closely track domestic and global developments, manage the exchange rate flexibly, and coordinate with other monetary policy tools to intervene when necessary—helping stabilize the forex market and support macroeconomic stability.

Still, several factors may sustain upward pressure ahead: the VND–USD interest rate differential remains high; import demand may rise as 0% tariffs on US goods take effect, while slower exports narrow the trade surplus; FDI inflows are showing signs of slowing amid tariff-policy uncertainty; and the domestic–global gold price gap remains wide.

MBS forecasts the average 2025 exchange rate at 26,600–26,750 VND/USD, up 4.5–5% from the start of the year. This increase remains within SBV’s expected band.