USD/VND exchange rate expected to cool down

With regulatory interventions and flexible monetary policies, along with a temporary decline in foreign currency demand, the USD/VND exchange rate is signaling a gradual cooling trend toward the end of the year.

Monetary Operations and Liquidity

From October 27 to 31, the State Bank of Vietnam (SBV) continued its net injection operations, though at a much smaller scale than the previous week. Specifically, the SBV issued VND 38.5 trillion through the open market operation (OMO) channel (a 67.6% week-on-week drop) while withdrawing VND 37.7 trillion in maturing OMO contracts, resulting in a net injection of roughly VND 0.9 trillion (a 98.8% decline WoW). The total outstanding OMO volume by the end of the week remained high at VND 224.3 trillion.

According to Nguyen The Minh, Head of Individual Customer Analysis at Yuanta Vietnam Securities, system liquidity improved compared with mid-October thanks to SBV’s support in money supply. Interbank rates cooled across all maturities, leading to a slight negative overnight interest rate differential between VND and USD.

On the retail market, deposit rates at some banks rose slightly across 1–12 month tenors, by about 20–30 basis points (bps). Since the end of September, when certain banks began raising rates, many small and mid-sized private banks have increased deposit rates by 10–50 bps, mainly for 3–12 month terms. In contrast, large state-owned and joint-stock commercial banks have not raised their deposit rates yet.

In addition, various promotional programs offering bonus rates for new or long-term deposits are being applied. As year-end funding pressures mount, banks are likely to expand such campaigns to attract deposits while keeping rate increases modest, Minh said.

Global Monetary Developments

Beyond domestic liquidity improvements, the easing of interbank rate pressure and the narrowing VND–USD overnight interest gap, global monetary moves also played a role.

At its meeting on October 29, the U.S. Federal Reserve (Fed) cut interest rates by 25 bps to 4%, as widely expected. However, Chair Jerome Powell cautioned that due to a lack of economic data amid the U.S. government shutdown, further cuts in December were not guaranteed.

In Asia, the Bank of Japan (BoJ) kept its policy rate unchanged at 0.5% on October 30 and hinted at a possible hike in December, causing the JPY to weaken significantly. In Europe, the European Central Bank (ECB) held rates at 2%, as inflation neared its target, leading to a mild decline in the EUR. The GBP also continued to fall as UK inflation cooled and markets increasingly expected the Bank of England (BoE) to continue cutting rates.

As a result, the DXY index initially declined early in the week amid improved U.S.–China trade sentiment but rebounded to 99.8 points by week’s end, supported by the Fed’s rate cut and broader weakness in major currencies.

The official USD/VND rate declined slightly from the previous week despite the global USD recovery

USD/VND Market Dynamics

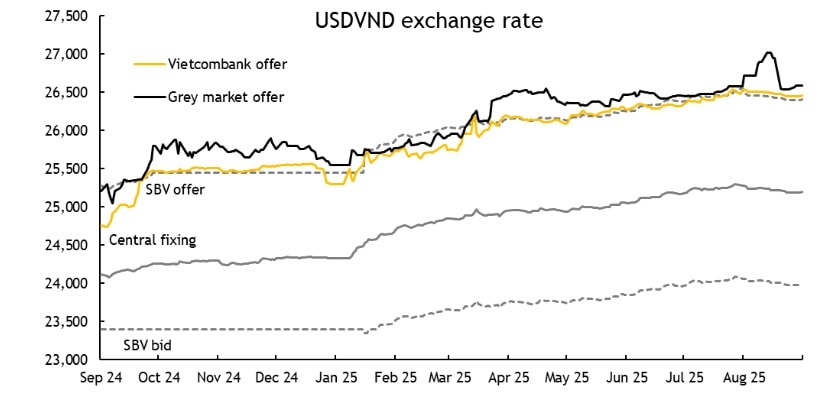

After the SBV gradually raised the central exchange rate in July, the market rate climbed sharply in August, up 0.4–0.6% from the previous month.

Following short-term seasonal demand peaks, the free market rate has cooled, though the gap with official rates remains wide.

The official USD/VND rate declined slightly from the previous week despite the global USD recovery. The central rate hovered around VND 25,093/USD, while commercial bank selling rates ranged VND 26,345–26,351/USD, both down 0.02% WoW.

The free market rate paused its upward momentum (0.4% WoW) but remained much higher than the bank rate, ending at VND 27,760/USD — a gap of around VND 1,400/USD, according to Yuanta Vietnam’s late-October monetary report.

Mr. Nguyen The Minh added that after the SBV sent an official letter to the Ministry of Public Security, the Ministry of Industry and Trade, and the Government Inspectorate to coordinate foreign exchange market management, the free market rate has stabilized after three weeks of sharp increases. However, the spread remains wide due to year-end USD demand and the widening domestic–global gold price gap, which has also boosted USD demand in the parallel market.

“We expect that although USD demand will stay elevated during the year-end period, the exchange rate will not fluctuate as strongly as in Q2, and the free market rate will likely continue to cool over the next 1–2 weeks,” Minh said.

According to Sacha Dray, Economist at the World Bank Vietnam, the Fed’s high interest rate still has an impact on inflation, which, together with U.S. tariff policies increasing consumer costs and dampening import demand, has affected Vietnam’s export performance.

“High U.S. rates also influence Vietnam’s own rates and exchange rate. Vietnam has implemented measures to manage capital flows and monetary stability, but this remains a challenging task given the current uncertainty,” he said.

“What’s positive is that Vietnam has accumulated a healthy level of foreign reserves to support stabilization — a crucial factor at this time. Combined with flexible monetary tools and interest rate policies, the SBV is taking the right direction to help the economy adapt to global volatility,” Dray added.

Meanwhile, Le Anh Tuan, CEO of Dragon Capital Vietnam, observed that while Vietnamese banks’ interest rates have inched up, global rates are trending downward. He forecast that by 2026, the exchange rate will stabilize and monetary policy will continue to ease — though the degree of easing remains uncertain.