Establishing a gold exchange: Which model fits Viet Nam?

The State Bank of Viet Nam (SBV) is developing a legal framework for a national gold exchange, which is expected to be submitted to the Government soon and launched in 2026.

The gold exchange is expected to be launched in 2026

During the National Assembly’s 10th session on socio-economic affairs, Deputy Prime Minister Le Thanh Long stated that the Government has taken multiple measures to stabilize the gold market, including intensified inspections and enforcement. Decree No. 232/2025/ND-CP, which amends Decree No. 24 on gold business management, took effect on October 10 and officially removed the State’s monopoly on gold bullion trading. In parallel, the SBV is preparing a legal framework for the establishment of a gold exchange.

According to the Deputy Prime Minister, the proposed exchange will help make gold trading more transparent and strengthen the State’s ability to supervise the market.

Earlier in mid-October, the SBV’s Foreign Exchange Management Department announced a pilot roadmap for a national gold exchange, to be implemented in three phases. The specific steps and timeline for each stage may be adjusted based on actual implementation progress. At the initial stage, the exchange will focus on spot trading of physical gold and operate entirely within the domestic market, without international connections. Later phases may gradually expand to include raw gold, gold bullion, and finally derivative products.

Across the world, several countries have already established and operated gold exchanges. According to analysts from Rong Viet Securities (VDSC), most platforms, such as COMEX in the United States, SGC in Singapore, or the decentralized London OTC market in the United Kingdom, are privately operated under state supervision, primarily trading in gold futures contracts. This model, however, may not be suitable for Viet Nam’s market at the current stage.

In Europe, the London OTC market—founded in 1993—is the oldest and largest decentralized gold market in the world, accounting for around 70 percent of global nominal trading volume. It is supervised by the London Bullion Market Association (LBMA), an independent body established by the Bank of England to regulate and oversee gold trading. In the United States, COMEX, operated by CME Group, is the world’s largest futures exchange for precious metals, including gold, and serves as a key benchmark for global gold prices.

In Southeast Asia, Singapore’s SGC has been operating since 2009 as a private exchange. More recently, in June 2025, Abaxx Exchange—backed by BlackRock—began trading U.S. dollar-denominated gold futures contracts, aiming to attract gold transactions from other Asian financial centers and capitalize on growing investor interest in gold.

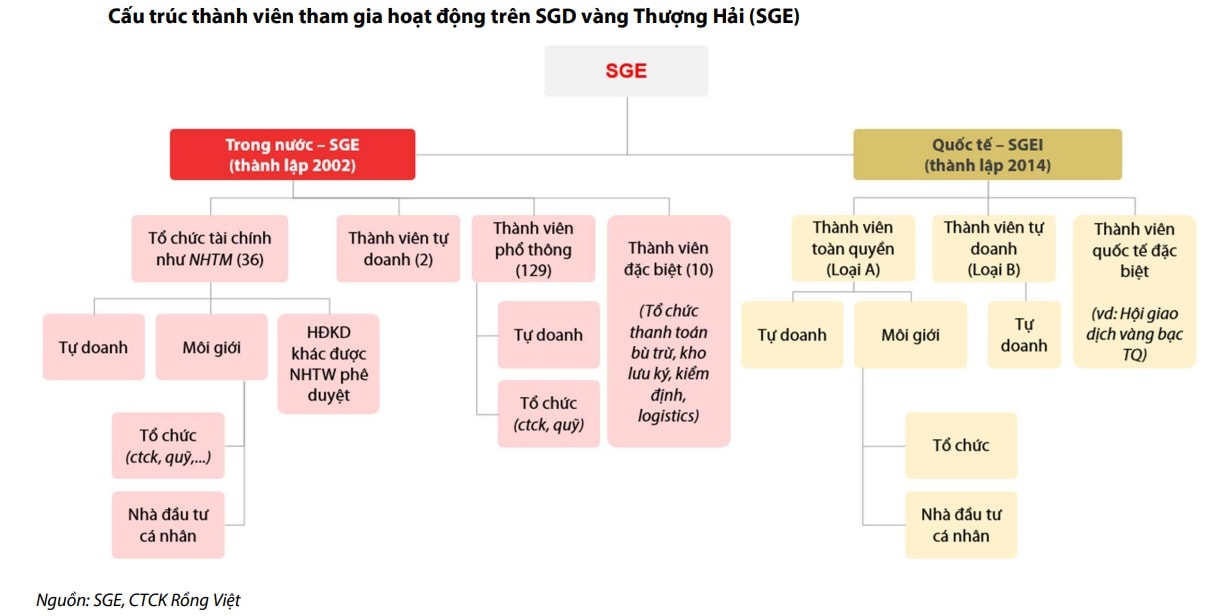

According to VDSC, the Shanghai Gold Exchange (SGE) could serve as a reference model for Viet Nam’s pilot phase. The SGE was established and is managed by the People’s Bank of China. It operates under a mature regulatory framework and focuses primarily on spot physical gold trading, which aligns with Viet Nam’s initial pilot direction. The exchange has a clear membership structure and an expansion roadmap that moves from domestic participation to international investors.

The SGE is currently the world’s largest spot market for physical gold. Its spot and deferred contracts are complemented by gold futures trading on the Shanghai Futures Exchange (SHFE), although the two exchanges are not directly linked.

In terms of operation, SGE’s membership structure includes domestic and foreign commercial banks, gold producers, refiners, investors, and clearing institutions. Designated settlement banks, including the Bank of China (Hong Kong), facilitate payments and settlements. Gold traded on SGE must comply with the SGE Standard Gold Bar specifications, and only certified refiners are authorized to produce eligible gold bars.

Gold stored in SGE’s vault system is classified into two categories: deliverable gold, which can be used for physical settlement, and deposited gold, which cannot be used for delivery but may be converted internally upon approval. Ownership transfers are executed electronically between unique, identifiable gold accounts assigned to each member or client. These accounts may be restricted to withdrawals from their original vaults or, depending on the product type, allow withdrawals from any certified vault.

SGE itself does not directly assay or certify gold but supervises accredited testing and depository institutions, conducting random inspections to ensure quality and compliance. Settlement and delivery processes are carried out in strict contractual order, ensuring transparency and accountability in every transaction.

As Viet Nam advances its gold market reforms, transparency, traceability, and institutional trust will be key priorities. A centralized and well-regulated physical gold exchange, modeled after the Shanghai experience, could provide Viet Nam with a sustainable framework to manage domestic gold demand and align its market with international standards.