US government shutdown extended, will the gold prices exceed $3,900/oz?

Many experts believe that the US government shutdown will continue to have a strong impact on gold prices next week.

Gold prices may continue its uptrend on US government shutdown

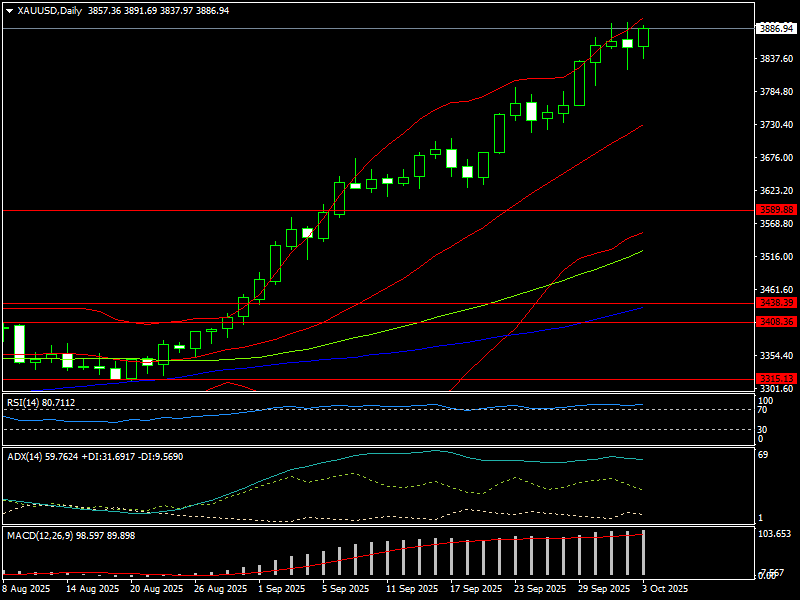

This week, gold prices rose sharply and consistently, from $3,761/oz to $3,897/oz, closing the week at $3,886/oz. In the Vietnamese gold market, the price of SJC gold bars listed by DOJI also increased sharply from VND135 million/tael to VND138.6 million/tael.

The US government has been partially shut down since October 1st because the two parties in the US Congress cannot agree on a federal budget bill, which has caused the gold prices to surge this week. Gold has also become more appealing due to rising prospects for Fed rate cuts. Particularly, there are no indications that the geopolitical disputes in the Middle East and Eastern Europe will stop. Furthermore, several central banks still buy gold aggressively to boost their national foreign exchange reserves, even if the price of the metal has hit all-time highs.

Many analysts predict that next week's gold prices will still be impacted by the US government shutdown. Because this will impede the expansion of the US economy. As to a recent prediction by the Congressional Budget Office, the United States' GDP growth will decline by around 0.1-0.2% each week, or a loss of roughly 2-3 billion USD, if the government continues to shut down in the upcoming weeks. Given the global economic crisis and the spike in inflation brought on by the Trump administration's tariffs, the current US government shutdown might be significantly more devastating than the 35-day shutdown in 2018–2019, which cost $1 billion in damage.

More worrisomely, the US government shutdown will stop statistical operations and the publication of regular economic statistics, which will force firms to delay investments and leave them without a foundation upon which to build their business plans. A more substantial "downward spiral" in the labor market will result from companies ceasing to hire and possibly terminating employees. Numerous analysts have predicted that during the September reporting period, this government shutdown may result in the loss of almost 900,000 jobs.

In light of this, the Fed could need to lower interest rates earlier than anticipated in order to boost the US economy overall and the labor market specifically.

Many analysts predict that next week's gold prices will be mostly influenced by market mood due to the protracted US government shutdown. For the eighth week in a row, gold prices are expected to climb next week, according to Mr. Alex Kuptsikevich, senior market analyst at FxPro. A new factor contributing to the increase in gold prices is the US government shutdown, which has gotten worse due to the inability of Democrats and Republicans to reach a deal. "The decline in the USD index and Treasury yields, as well as the increased demand for safe-haven assets like gold... will create new momentum for gold prices next week amid expectations that the Fed's interest rate cuts will be deeper and longer-lasting," said Alex Kuptsikevich.

The US government shutdown will only have a short-term effect; the growing global economic turmoil will have a longer-term effect on gold prices. Although the US government shutdown is garnering investor attention, structural reasons such as currency instability, fiscal pressures, and global risk appetite are shaping the economic landscape, according to Mr. Eugenia Mykuliak, Founder and CEO of B2PRIME Group. These are the real determinants of short, medium, and long-term gold prices.

Several analysts predict that the price of gold will continue to increase next week, maybe reaching $3,900/oz this time. However, when the two parties in the US Congress agree on the federal budget deal, which permits the US government to reopen, investors must also be wary of rising pressure to take profits.