Vietnamese economy: Challenges ahead

With yearly GDP growth of 8.0% in 2022, Vietnam is poised to be one of the fastest-growing economies in Asia-again. That said, there is no room for complacency, as intensifying trade headwinds have taken a toll on the economy.

Intensifying trade headwinds have taken a toll on Vietnamese economy

>> Vietnam rides through economic difficulties

Three days before entering 2023, Vietnam became the first Asian country to release its 2022 transcript – an impressive one in a year full of challenges. Vietnam’s 4Q economy expanded 5.9% y-o-y, slightly below HSBC’s expectation of 6.2%, but beating consensus’ 4.6%. This brings Vietnam’s full-year growth to 8.0% in 2022, broadly in line with our forecast of 8.1%, marking the fastest growth the country has seen since 1997. Vietnam is likely to easily be one of Asia’s outperformers, again, possibly just trailing Malaysia (HSBC: 8.4%), according to our forecasts. That said, there is no room for complacency, as the rosy headline number belies rising downside risks to growth in 2023.

Similar to 3Q, a steady recovery in domestic demand fuelled robust service sector development in 4Q. Retail sales carried momentum into 4Q, growing at c13% y-o-y. Thanks to an improving labor market, Vietnam’s private consumption returned to its fast pace prior to the pandemic of around 7%. That said, initial signs point to fading domestic tailwinds. Indeed, retail sales have peaked, and December momentum showed a mild contraction. Part of the weakness is explained by a slow recovery in the tourism sector.

Indeed, Vietnam’s tourism recovery has lagged behind its peers. In 2022, Vietnam welcomed around 3.6 million tourists, or 70% of its annual target. However, HSBC said this only represents 20% of 2019’s level, lagging behind Singapore’s 28% (5m in November) and Thailand’s 25% (11m according to officials). Although Vietnam is not as heavily reliant on tourism as Thailand, the significance of the sector to its job market should not be underestimated. Approximately 25% of the workforce works in the food, beverage, and accommodation-related sectors, and, in particular, its informal job market is even more sensitive to tourism.

China’s reopenings on January 8, 2023, may provide a much-needed boost to tourism in Vietnam. Similar to Thailand, Vietnam’s biggest source of tourists is typically mainland China, with a 30% share. In addition, Vietnam is considering measures to help achieve its 2023 target of attracting 8 million tourists. For example, officials are calling for an extension of visa exemptions for foreign tourists to 30 days and making e-visas available to citizens of all markets. For now, Vietnam issues visa- free stays of 15 days for travellers from 24 markets, mostly OECD and ASEAN countries, compared to 162 markets for Malaysia, 157 for the Philippines and 65 for Thailand.

"Despite some silver linings, the biggest downside risk to growth is trade headwinds. This is why 4Q GDP delivered a small downside surprise, with manufacturing output growing by only 3% y-o-y. Indeed, Vietnam’s tepid manufacturing performance is a reflection of its weakening external sector, as it is particularly sensitive to faltering demand in the West. Exports slumped by 14.0% y-o-y in December, with broad-based weakness across major items, especially in electronics shipments. Meanwhile, imports also fell sharply by 8.1% y-o-y, mostly driven by tech-related imports. This suggests that Vietnam has been on the frontlines of a cooling global tech cycle, given its import-intensive nature in electronics manufacturing. Indeed, Vietnam’s manufacturing outlook is set to be challenging, as evidenced by the latest forward-looking indicator PMI, which continued to plunge to a 1.5-year-low of 46.4 in December 2022", said HSBC.

While the trade surplus improved in 4Q, Vietnam’s total external balance advantage shrank again, given slowing exports and high energy imports in 1H22. This led to a small trade surplus of only $4.1 billion (1% of GDP) in 2022. While the full-year BoP data are not available, a small trade surplus is unlikely to offset deficits in primary income and services. Therefore, Vietnam is likely to see a small current account deficit for the second consecutive year, possibly around 1.4% of GDP, affecting its VND recovery pace.

>> Economy quite resilient to external shock

"The VND has been facing mounting depreciation pressure amid a strong USD, waning current account, and a fading yield advantage. To defend the currency, the authorities have been selling off FX reserves, which fell sharply by 20% as of 3Q22 from a peak at the end of 2021. However, the recent USD correction coupled with improved USD liquidity have offered some respite to the VND. That said, the appreciation in VND will likely be a gradual process", emphasized HSBC.

That said, resilient FDI remains a firm anchor for Vietnam’s trade, though its near-term outlook is still challenging. While new FDI fell 18% in 2022, it declined only slightly, by 1%, in the manufacturing sector. For one, traditional tech giants such as Samsung and LG have announced ongoing expansion plans, with investments worth USD2 billion from the former and USD4 billion from the latter, to deepen supply chains in Vietnam. Meanwhile, it has also been reported that Apple will start making MacBooks in Vietnam by mid-2023. The decision was not entirely surprising, as its supplier Foxconn leased 50.5 hectares of land in Bac Giang last August, citing an investment of more than USD300m. This all points in the same direction: Vietnam remains an attractive destination in ASEAN for foreign investors.

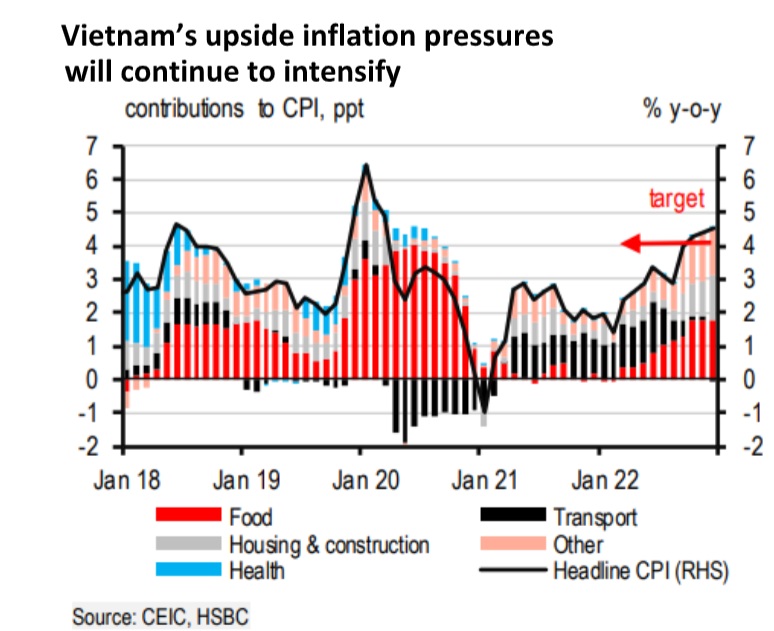

While yearly headline inflation was relatively low at 3.2%, Vietnam continues to see stronger inflation pressures. December was the third consecutive month of inflation overshooting the State Bank of Vietnam’s (SBV) 4% "ceiling". Not only has core inflation accelerated to 5% y-o-y, but Vietnam has also seen elevated prices for raw materials. This means the SBV will likely continue its tightening cycle. As the last central bank in ASEAN to move, the SBV has been actively ‘playing catch up’, hiking by 200 bps in 2022. "While we expect the SBV to slow its monetary tightening pace as the Fed is expected to slow and FX volatility has eased, its hiking cycle will be still under way. We expect the SBV to raise its refinancing rate by 50bp each in 1Q23 and 2Q23, taking the refinancing rate to 7.0% by mid-2023", said HSBC.

HSBC expects Vietnam’s GDP to moderate to 5.8% in 2023, given external weakness and waning re- opening effects.