Vietnamese economy expected to rebound strongly in 4Q23

HSBC maintained its 2023 growth forecast for Vietnamese economy at 5.0%, expecting a strengthening rebound in 4Q23.

Although due in part to base effects, exports saw their first growth in more than six months.

>> Vietnam’s economic performance in the first 9 months of 2023

After a tough 1H23, Vietnam’s economy is seeing light at the end of the tunnel. Its growth ended 3Q on a decent footing at 5.3%, overshooting market expectations (HSBC: 4.8%; Bloomberg: 5.0%; Prior: 4.1%). While challenges remain, Vietnam appears to be on track for a robust recovery. Nonetheless, inflation risks warrant a close watch.

The biggest surprise to us is the rebound in Vietnam’s manufacturing sector. While it is still too early, in our view, to call a material recovery in the global trade cycle, Vietnam’s trade sector has had a much-needed reprieve recently. Although due in part to base effects, exports saw their first growth in more than six months, reducing the severity of export falls from the double-digits in 1H to less than 2% y-o-y in 3Q. While export weakness remains largely broad-based, decent growth in both computer and agriculture shipments offsets some risks.

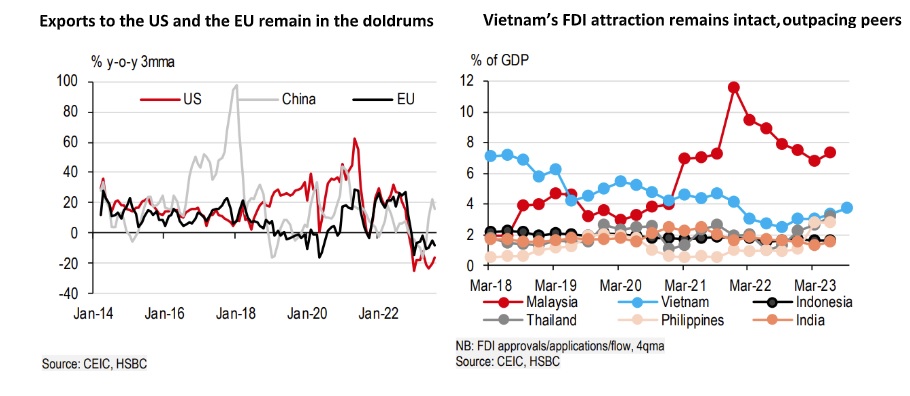

The trend is also reflected in Vietnam’s shipments to major trading partners. While exports to the US (30% share) and the EU (15% share) have yet to see a turnaround, they have halted further deterioration. Meanwhile, Vietnam’s exports to China (15% share) saw double-digit growth sequentially, largely thanks to its impressive growth in agriculture products.

Although China accounts for only 15% of Vietnam’s total exports, more than 20% of the latter’s agricultural exports are shipped to the former, ranging from fruits and rice to cashew nuts and coffee. In particular, China’s demand for tropical fruits, including durian, dragon fruit and jackfruit, has gathered pace in the past two years, with Vietnam as the main beneficiary along with Thailand.

Meanwhile, recent rally in the global rice market, proxied by Thailand’s benchmark rice price, jumped by a striking pace of 40% y-o-y lately, pushing up Vietnam’s rice exports. That said, an impressive performance in agriculture exports has been unable to reverse the broad weakness in Vietnam’s trade – its export share remains small, at only 10%.

Despite near-term cyclical challenges to trade, Vietnam’s long-term FDI prospects appear intact. While FDI has come off its 2017 peak due in part to tighter global monetary conditions, the country remains an outperformer in ASEAN in terms of attracting FDI, second only to Malaysia. Its manufacturing sector accounts for the bulk of FDI, providing hopes that it can climb up the value chain, paving the way for a robust rebound when the trade tide turns. New FDI continues to pour into the manufacturing space, this year already exceeding the total in each of the past three years.

Tech supply chain relocation remained in focus during President Biden’s visit to Vietnam in September as the two countries elevated their relationship to a comprehensive strategic partnership. President Biden announced that US tech companies, including Amkor and Marvell, plan to invest in Vietnam, but not only the US is investing there – a few weeks later, South Korea’s Hana Micron joined in by announcing an expansion of its chip production with a USD1bn investment by 2025.

Outside of manufacturing, services remain the bedrock of Vietnam’s growth. At first glance, the sectors that have enjoyed close to 10% y-o-y growth are all tourism-related. Broadly speaking, ASEAN has seen a return of tourists to around 60-80% of 2019’s levels, with Vietnam’s recovery pace approaching 70% in September. Despite some monthly volatility in tourism data, Vietnam has welcomed 8.9m tourists as of September, prompting authorities to upgrade its full-year target to 13m, from 8m earlier. Given the upcoming winter season in the northern hemisphere and the recent visa relaxations, Vietnam looks to be on track to see a continued tourism boom.

>> Overcoming headwinds, Vietnam finds new opportunities: Insiders

However, it’s a mixed picture. Tourists from Korea and the US have almost fully returned, but European tourists only recovered to 70% of 2019’s level. While the recovery of Chinese visitor numbers dropped from 44% in August to only 29% in September, likely reflecting monthly data volatility, it lags behind regional peers like Singapore (54%) and Malaysia (47%). While Thailand has also seen subdued Chinese tourist inflows, it has announced a five-month visa exemption from late September. It has immediately born fruits: travel bookings to Thailand jumped by a shocking rate of 6000%, according to Ctrip data, though the recent shooting incident raises questions on the sustainability of the recovery. While Vietnam remains one of the frontrunners in the region to push for direct flight restorations with China (52%), competition over attracting its biggest source of tourism has obviously intensified.

While growth saw some good news, risks have emerged on the inflation front. While September inflation was contained at 3.7%, below the SBV’s 4.5% ceiling, sequential growth raises concerns. For one, food prices had risen around 3% m-o-m for two straight months, pushing y-o-y inflation to overshoot 10%. While Vietnam’s trade benefits from higher rice prices, international prices have pushed up the local prices of staple goods. Meanwhile, Vietnam is sensitive to the global oil market’s recent volatility. Not only have transport costs ceased to decline on a y-o-y basis for the first time in a year, but domestic gas prices have seen sizeable increases.

“While we do not expect recent developments to push average inflation beyond the SBV’s 4.5% ceiling, the double whammy poses significant upside risks. We have tweaked our quarterly inflation forecasts and raised our forecast of average inflation slightly to 3.4% (prev: 3.2%) for 2023”, said HSBC.

Therefore, HSBC no longer expects the SBV to cut rates this year. The conditions that previously warranted another 50bp rate cut have dissipated: the recovery is under way while inflation and FX pressures are rising. HSBC expects the SBV to hold its policy rate steady at 4.5% until end-2024, barring any external shocks. That said, it also does not expect a repeat of what happened last October, when a rally in USD-VND propelled the SBV to hike aggressively. This is because VND’s fundamentals have improved. For example, its current account surplus has almost returned to its previous peak of close to 5% of GDP, on a rolling basis, thanks to a robust trade surplus, strong remittances, and rising tourism receipts.

“All in all, Vietnam’s economy has seen some much-needed green shoots, particularly in its trade and tourism sectors. We maintain our 2023 growth forecast at 5.0%, expecting a strengthening rebound in 4Q. However, inflation risks have resurfaced. Alongside the strength in USD-VND, we are thus removing our earlier call of a last 50bp rate cut”, emphasized HSBC.