VN-Index is expected to hit 1,414 points in 2024

According to Mr. Nguyen The Minh, Director of Research and Analysis at Yuanta Securities Vietnam, the VN-Index is predicted to reach 1,414 points by 2024 under the base scenario. However, the market remains entangled with possibilities and risks that investors should be aware of.

Multiple economic growth drivers

Amid a dismal global economy, high interest and inflation rates, as well as poor consumer demand, have had a substantial influence on local import-export and industrial production operations, all of which contributed considerably to economic growth prior to the epidemic.

Nonetheless, thanks to domestic economic development strategies and drivers, Vietnam's GDP is projected to increase by 5.05% in 2023. The macroeconomic parameters are relatively steady, with inflation within the target range, low interest rates, and economic recovery support programs being supported despite several hurdles posed by the global economic setting.

With economic momentum in following quarters stronger than in prior quarters in 2023, Vietnam is likely to sustain its development momentum in 2024, but at a slower rate, since the openness of Vietnam's economy remains dependent on major global economies.

Yuanta predicts that various factors will boost development in 2024, including: First, the disbursement of public investment is expected to increase in comparison to 2023, as many projects have begun construction and many bottlenecks have been removed, such as contractor designation, new quarry licenses, and cooling raw material prices.

Second, substantial credit expansion in 2024 is likely to boost economic development, as will policies aimed at supporting the real estate market and corporate bonds.

Third, FDI inflows are likely to continue their robust growth pattern from 2023, adding to industrial output and import-export activity in the medium and long term. Vietnam's recent extensive strategic relationships with Japan and the United States are also expected to help drive future FDI inflows.

Fourth, the industrial output and export-import sectors have recovered in recent months, but at a moderate pace, which is likely to accelerate in the second half of 2024 as demand rebounds in key economies.

"We expect Vietnam's economic growth to be around 5.8% in 2024, based on these drivers. However, it is also vital to be cognizant of dangers that might lead to lower-than-expected growth, such as geopolitical difficulties; slower-than-anticipated recoveries in the US and China; and the timing and size of interest rate reduction by the US Federal Reserve (Fed) being slower and lower than projected", said Mr. Nguyen The Minh.

VN-Index to reach 1,414 points

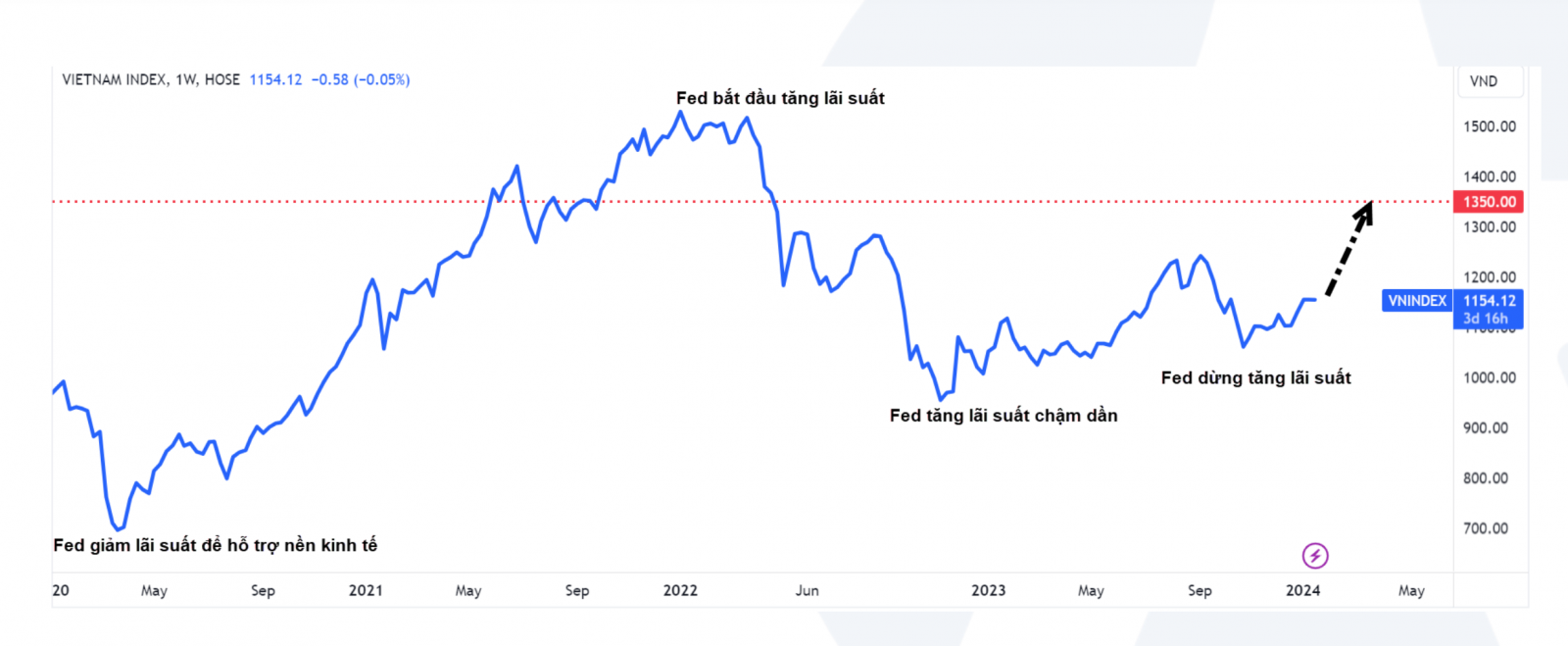

In the stock market, opportunities and problems will continue to coexist in 2024, with opportunities stemming from the Fed perhaps relaxing early in 2024, with three rate decreases expected. The Fed's base interest rate is expected to be 4.59%, down 0.74 basis points from 2023.

Furthermore, global economic growth is predicted to remain flat relative to the previous year, with a minimal risk of a recession. Europe and China, in particular, are predicted to have rapid growth in 2024, acting as economic catalysts for Southeast Asia.

Notably, lower inflation encourages central banks to loosen monetary policy early in 2024. Global inflation is predicted to be between 5.8 and 5.9%, with Vietnam around 4%. As a result, interest rates are likely to stay low, with deposit rates remaining low in the first half of 2024 before rising somewhat in the second half of the year. The EPS growth rate for HSX-listed businesses in 2024 is expected to be 28% higher than in 2023.

In 2024, the market will also see two helpful factors: the first is the installation of the KRX system, which promises new financial products. Another major development is the State Securities Commission's issuance of derivative products based on the VN100 index. The second consideration is a market upgrade, with the FTSE expected to make a decision in September 2024, when the margin ratio issue for overseas investors is resolved.

In terms of barriers, a recession is still a possibility, given the recovery is sluggish. Geopolitical tensions are an unknown factor that will affect inflation in 2024. This year's monetary policy was not properly coordinated, which might have an influence on global economic development. The pressure from real estate companies' bond due in 2024 remains intense.

The expert provides three projection scenarios for the VN-Index in 2024, with the base case expectation of 1,414 points, the optimistic scenario of 1,583 points, and the pessimistic scenario of 1,183 points.