VN-INDEX’s downward trend may continue

In the context of not much supportive macroinformation and policies and increasing external risks, the VN-INDEX may be under downward pressure in March 2023, said VNDirect.

The VN-INDEX decreased in February 2023 and closed at 1,054.28 points (-5.1% mtd, 4.7% ytd).

>> VN-Index to struggle at 1,060 points due to weak demand force

The VN-INDEX decreased in February 2023 and closed at 1,054.28 points (-5.1% mtd, 4.7% ytd). VNDirect believes that the correction of the Vietnam stock market can come from the following reasons:

First, the net cash inflow from foreign investors was weaker, recording only almost VND1,300bn (a 70% decrease).

Second, there are the rising concerns about the extension of the Fed rate hike following the US inflation being higher than consensus in January 2023.

Third, the default risk gradually appeared in the context of increasing bond maturity pressure.

Meanwhile, the HNX-INDEX slumped by 5.6% mtd. and the UPCOM-INDEX also surged 2.1% mtd. Since the beginning of 2023, the HNX-INDEX has edged up 2.3% ytd, and the UPCOMINDEX has also risen by 8.1% ytd.

The average trading value of three bourses fell 2.2% mom (-57.0% yoy) to VND11,857bn (HOSE: VND10,362bn/trading day, -2.8% mom; HNX: VND1,066bn/trading day, 6.3% mom; UPCOM: VND429bn/trading day, -7.2% mom).

The number of new securities accounts decreased to 35,813 accounts in January (-63.7% mom), the lowest level in two years. However, this is still a higher-than-average increase for 2020 (32,757 accounts), the beginning of the bull cycle.

Foreign investors net purchases dropped sharply by 70.5% in February 23 to VND 1,237bn due to: (1) capital from Fubon ETF, which is one of the largest net asset value ETF funds, stopped flowing due to reaching the unit limit ; and (2) capital flows tend to flow into dollar-denominated assets in the context that interest rates in the US are likely to continue to rise compared to stationary or falling interest rates in Vietnam.

The total net bought by foreign investors in 2023 is VND5,434 billion, which is 18.8% of the total net bought in 2022. From January 20, 2023, until February 23, 2023, the proportion of foreign investors to the daily trading value had compressed from 16.2% to 9.2% of the total trading value.

After two months of positive performance, tourism and entertainment posted the worst performance (-12.6% mtd) in February 2023 due to (1) negative investor sentiment about Vietnam not being included in the pilot list of China's group tourism and (2) 4Q22 business results continuing to suffer losses due to high fuel costs.

Chemical prices were negatively affected by the increase in supply due to China reopening the economy, leading the Chemicals sector's performance to slump by 9.5% mtd in Feb. 23. In the context of many potential risks from the macro, the defensive strategy still outperformed, supported by positive business results in 4Q22. Water and gas supply recorded positive performance of 0.8% mtd in February 23.

>> VN-Index struggles to begin a strong upswing

The average deposit interest rate for a 12-month term is currently 7.8% per year. Meanwhile, current earnings to price of VN-INDEX have been compressed to 8.4% (vs. 9.5% in Dec-22) due to inefficient 4Q22 earnings results. Plus the dividend yield of 1.7%, the market earnings yield is estimated at about 10.1%. As a result, the spread (between market earnings yield and deposit rate) contracted to 2.3% (-1.4% pts vs. Dec-22).

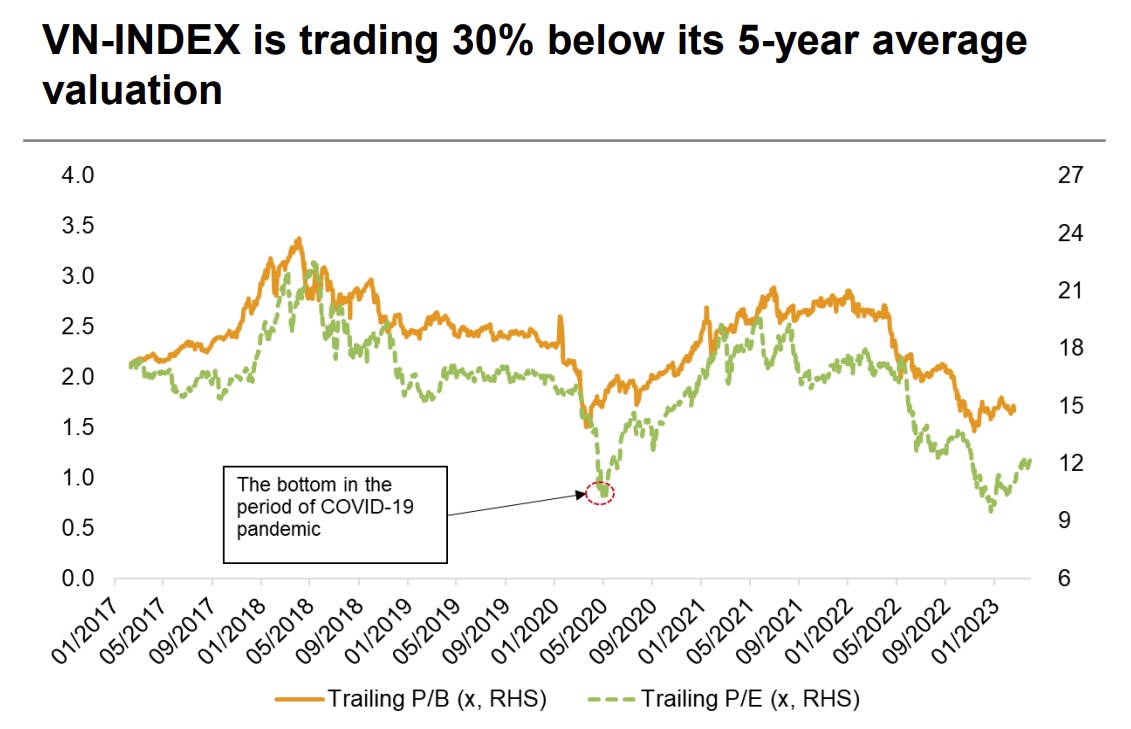

"Vietnam's stock market is trading at 0.7x the 5-year P/E average, and TTM P/B is also trading at 0.7x the 5-year P/B average. Overall, Vietnam's valuation looks less attractive due to falling earnings", said VNDirect.

VNDirect said in the context of not much supportive macro information and policies and increasing external risks, the VN-INDEX will be under downward pressure in March 2023. The nearest support zone of the VN-Index is around 1,000 pts, and the strong support zone of the market is around 950 pts. Due to the short-term correction trend, investors should prioritize portfolio risk management and actively lower the proportion of margin and stocks.

"Upside catalysts include the government issuing policies to support the real estate market (revising Decree 65/2022, debt relief, a credit package for social housing, etc.). Downside catalysts include the Fed's more hawkish stance on monetary policy and information regarding corporate bond defaults", emphasized VNDirect.