VN-Index’s uptrend is still continuing?

BVSC said the VN-Index would continue going up despite another drop in yesterday's session.

Yesterday, the VN-Index was shaken vigorously in the derivatives expiration session yet remained unchanged.

At the end of the meeting on June 14, 2023, the US Federal Reserve (FED) decided to pause raising interest rates after 10 consecutive increases, keeping the rates unchanged at 5-5.25%. However, the dot-plot chart shows that Fed officials expect rates to rise to a median of 5.6%. This means that the Fed will probably continue to raise interest rates 1-2 times this year, depending on the scale of each increase, to 5.5–5.75%.

In the new report, despite lowering its headline inflation forecast from 3.3% to 3.2%, the Fed raised its core inflation forecast from 3.6% to 3.9%. The economy is expected to stay strong, with the median estimate for GDP growth in 2023 raised from 0.4% to 1%, while the estimate for the unemployment rate falls from 4.5% to 4.1%. The results of the Fed meeting caused the US stock market to cool down while the USD rose again.

However, for the DXY, a measure of the USD's strength, BVSC does not appreciate the possibility of its strong rebound in the near future, as the Fed's plan to raise interest rates is no longer long-lasting and the US economy still has certain difficulties. Therefore, the pressure on the exchange rate this year will not be large. BVSC maintained its forecast that VND will have a stable movement throughout this year, fluctuating around /- 2%.

Yesterday, the VN-Index was shaken vigorously in the derivatives expiration session yet remained unchanged. Last night after the Fed's crucial meeting, US stocks whipsawed after the Fed held interest rates steady following 10 consecutive increases while also implying more rate hikes to come. These elements combined sparked cautious sentiment among investors, and liquidity slumped to the lowest level since June. Since the opening bell, the market has been swinging back and forth as it splits into separate sides.

Speculative mid-cap and pennies felt the correction heat, while VN-30 was more resilient. Porker stocks went against the stream, with DBC reaching its ceiling price. The oil and gas sector led the bull side, performing significantly well today, notably PVD (4.3%). The market drivers, including VCB (0.9%), GAS (2.1%), CTG (1.1%), and GVR (0.8%), added points to the index’s advance. In contrast, VHM (-0.9%), SAB (-1.9%), and VNM (-1.2%) were the top laggard stocks. Ending a choppy session, the VN-Index inched down by 0.04%, closing at 1,117.0 points, while the HNX-Index rose by 0.3% to 229.5 points.

Energy (1.3%), utilities (1.1%), and health care (0.4%) rose, while consumer staples (-0.9%), real estate (-0.6%), and consumer discretionary (-0.5%) lost ground today. Top index movers included VCB (0.9%), GAS (2.1%), CTG (1.1%), GVR (0.8%), and PVD (4.3%). The top index laggards consisted of VHM (-0.9%), SAB (-1.9%), VNM (-1.2%), MSN (-1.2%), and VIC (-0.6%). The top three major put-through transactions were EIB with 7.6 million shares (VND159.2 billion), VSC with 4.8 million shares (VND145.8 billion), and VPB with 5.7 million shares (VND115.1 billion).

Foreigners net bought on HOSE to the amount of VND409bn and also net bought on HNX to the amount of VND12.8bn. They mainly bought HPG (VND141.3bn), VND (VND130.8bn), and VNM (VND102.6bn), and mainly sold VNM (VND212.4bn), CTG (VND134.1bn), and VCB (VND59.4bn).

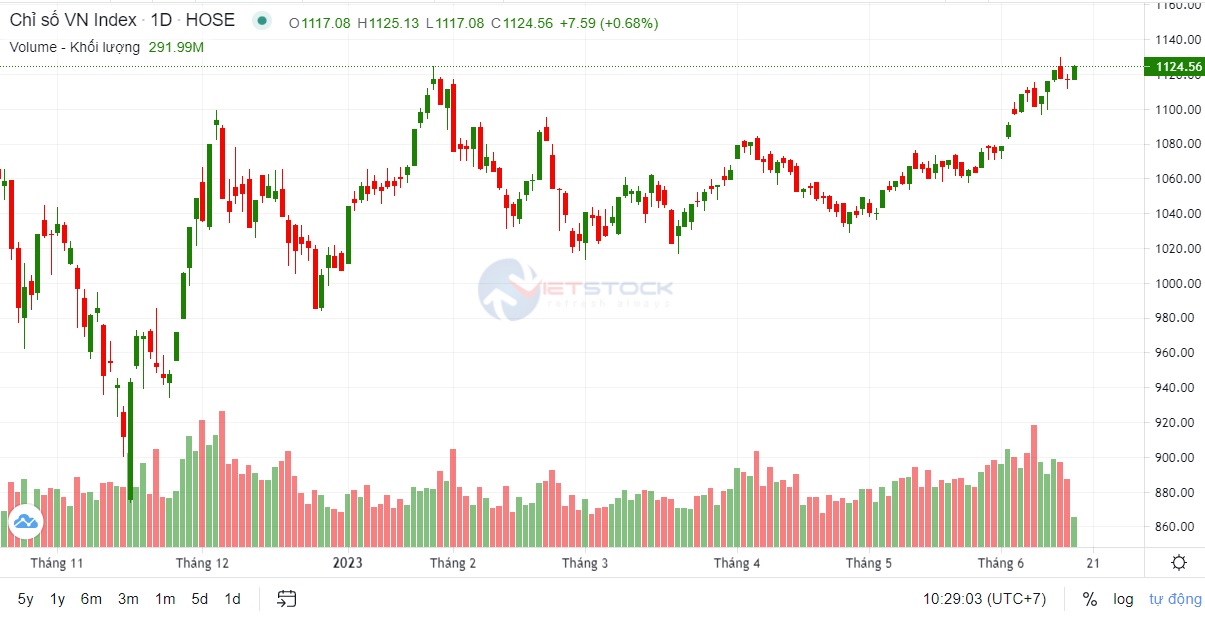

VN-Index had another drop in yesterday's session with lower volume, forming a doji candlestick, showing a somewhat hesitant sentiment among investors. The index recovered during the session after approaching the uptrend line formed in mid-March. BVSC thinks that this trend line, corresponding to the 1,105–1,110 point range, will continue to support the index in the coming sessions. On the technical chart, the ADX continued to advance and is now above 25 points, with the DI line being above the -DI line, showing that the index's uptrend is still continuing. The index's resistance lies at 1,133–1,137 points and 1,175–1,180 points. The index's support is at 1,105–1,100 points and 1,092-1,100 points.