Wary of bank stocks

Cash flows have started to exhibit traces of a recent decrease in bank stocks.

>> Bank stocks are expected to go higher

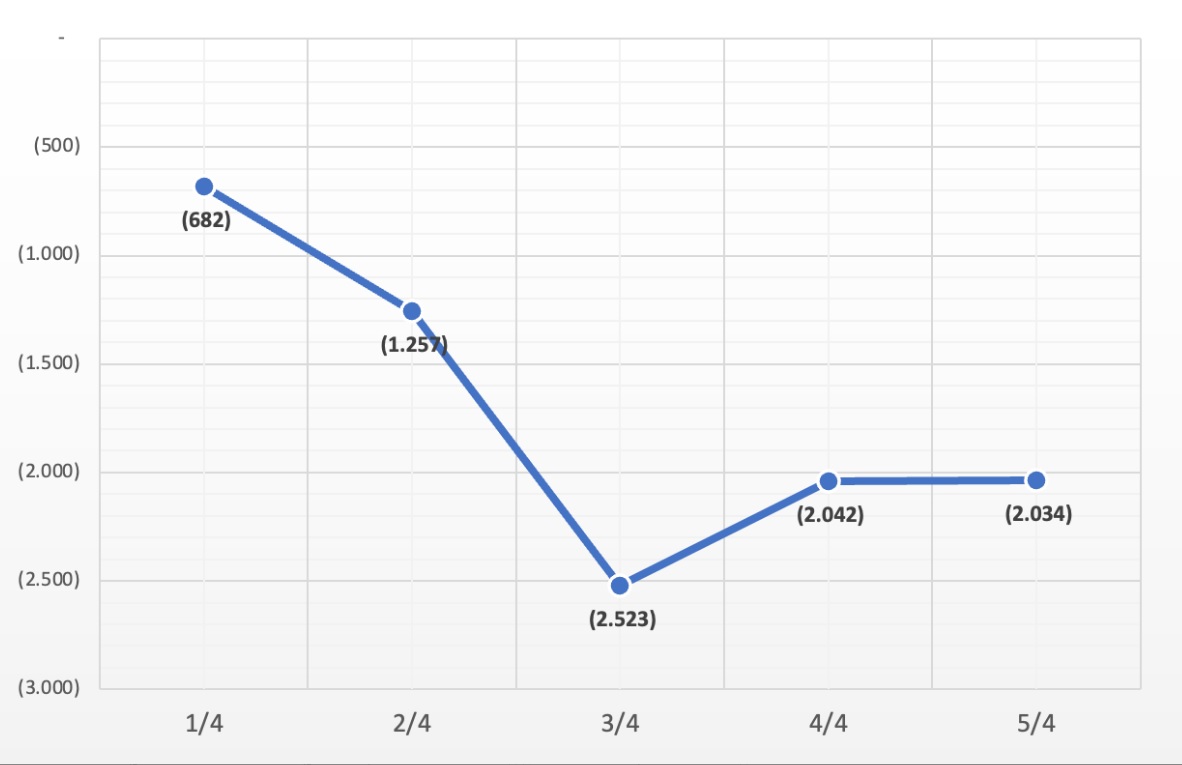

In early April, foreign investors sold VND2,034 billion on the Vietnamese stock market. Because of the absence of a consensus on cash flows, the VN-Index has not yet escaped the accumulation zone. However, cash flow is still being created, relieving the pressure on the stock market from net sales by foreign investors.

Dragon Capital argues that the primary cause of foreign investors' net sales was a shift in capital flow from China to other nations, such as India and Japan. Meanwhile, Vietnam continues to have a scarcity of new technology fields that suit foreign investors' risk tolerance. In addition, they are concerned about a number of socioeconomic concerns that do not meet their expectations.

Ms. Do Hong Van, Head of Data Analysis at FiinGroup, said the Vietnam stock market had noteworthy swings in cash flows in March, with a shift away from riskier companies such as stocks, steel, and banks. Cash flows have begun to fall sharply in the banking sector alone. As you can see, commercial banks' asset quality was low in 3Q2023, but the turnaround in 4Q2023 is linked to strong loan growth. As a result, with sluggish loan growth in 1Q2024, most banks' bad debt predictions for the end of Q1 2024 may rise significantly.

Furthermore, commercial banks' credit risk provisioning has decelerated in each quarter of 2023, that is not good news for the banking industry. The reason for this decline might be that asset quality has improved marginally, and banks want to guarantee that performance outcomes do not deviate too far from their overall business plan.

Provisioning pressure may continue to be a drag on commercial banks in 2024, as they try riskier tactics to maintain lending growth.

Financial analysts agreed that investors should be wary of possible risks in bank stocks. As a result, mounting bad debt, increased provisioning pressure, and the return risk of accumulating losses in some institutions following years of stability will present substantial issues. Furthermore, corporate bond liquidity is still under pressure.

Ms. Do Hong Van pointed out that investors ought to exercise caution while picking bank stocks. Priority is given to banks that have great credit growth prospects, acceptable market values, and a high bad debt coverage ratio.

>> Market struggles, bank stocks face strong sell-off

"Investors should pay attention to banks that have clear intentions to increase capital, provide appealing dividends, and are controlled by significant investment funds as part of their overall investment strategy," Ms. Do Hong Van said.

Dr. Can Van Luc, an economist, recommended: For the best investing strategy, investors must first clearly define their risk tolerance and taste.

Second, the sensible use of leverage requires attention. Financial leverage may enhance profitability, but it must be properly assessed so that investors can manage their risks.

The third risk is that of crowd psychology in investing. Many people make the mistake of getting caught up in broad market trends rather than carefully analyzing the underlying nature and potential of sectors, which can result in unproductive investment decisions and even losses.

Fourth, investors who do not have a thorough grasp of stock markets or investment products should seek the advice of experienced financial intermediaries. This not only provides investors with a more holistic and accurate perspective of investment prospects, but it also allows them to better manage risk.