Was Vietnam economy out of the woods yet?

Despite no further deterioration in economic activity data in May, there is no clear sign that Vietnam is bottoming out amid intensifying headwinds to growth. Indeed, sluggish external data remains the biggest downside risk to growth, said HSBC.

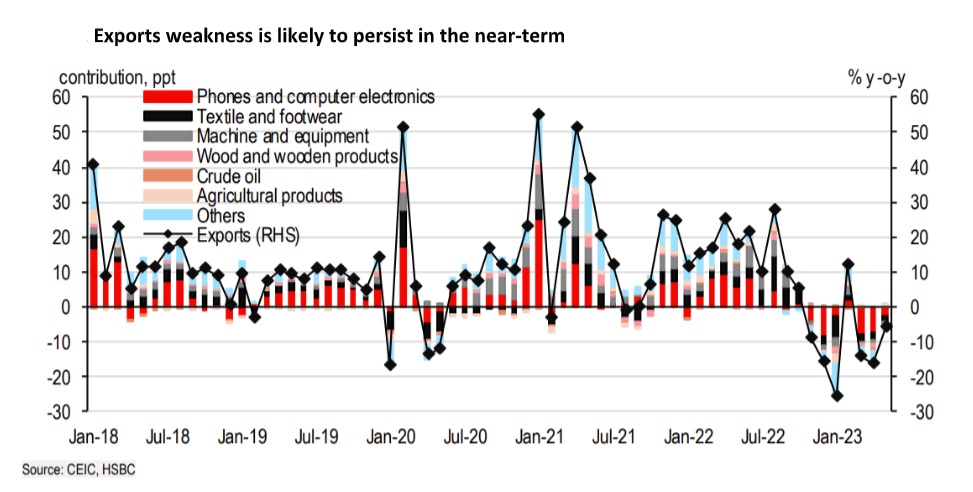

While Vietnam’s May trade data points to no further deterioration, there is still a long way to see

a meaningful rebound in its trade cycle.

While exports fell 5.8% y-o-y, a much smaller magnitude compared to the double-digit decline in previous months, base effects came to a partial rescue. After all, lingering broad-based exports weakness continues to weigh on Vietnam’s growth prospects. Indeed, none of the major categories, including electronics, machinery, textiles/footwear and wooden furniture showed signs of a meaningful rebound. Although exports data by country is not yet available in May, data as of April 2023 suggests substantial falling shipments in Vietnam’s three largest exporting destinations: US, China and the EU. In particular, with a hefty share of 30%, Vietnam is particularly sensitive to a US economic slowdown.

“Despite exports falling by single-digit, imports declined at a much faster pace of 18.3% y-o-y. Arguably this is beneficial to Vietnam’s trade surplus, registering at USD2.2bn, twice of 2022’s monthly average. Indeed, its improving trade balance is partially the reason why VND has stayed relatively stable amid strength in USD in the past two weeks, outperforming peers like KRW and MYR, which are also highly correlated to RMB. However, given Vietnam’s import-intensive nature in its manufacturing sector, the extreme weakness in imports signals a sluggish rebound in future exports”, emphasized HSBC.

That said, HSBC said it is not all doom and gloom. Vietnam’s services sector remains a bright spot, partially offsetting some external weakness. However, there is a clear divergence between big-ticket items, such as automotive sales, and tourism-related services – a trend that is occurring in regional peers as well.

Encouragingly, Vietnam continues to see a positive influx of tourists. Despite falling slightly from April’s high, Vietnam welcomed more than 900k tourists again, bringing its tourism recovery to around 70% of 2019’s level. In particular, tourists from mainland China recovered to 35% of 2019’s level – though still slow, the progress is ongoing. Indeed, Vietnam has made good progress to restore direct flights with China, now recovering to 44% of 2019’s level.

Vietnam has received 4.6 million international tourists YTD, approaching 60% of its annual target of 8 million in 2023. With the approaching summer holidays and potential easing of visa restrictions, which are under considerations by the National Assembly, Vietnam will likely see a punchier boost from international tourism, a much-needed support for its sharply slowing economy. The proposal includes extensions of e-visa to 90 day (from 30 days) and visa-free stays to 45 days (from 15 days), as well as expanding the list of countries eligible for e-visas, aiming to catch up with regional peers.

Lastly some good news, inflation has been consistently cooling down. Headline inflation momentum remained flat in May, bringing y-o-y headline inflation to 2.4% y-o-y. Although ‘housing and construction materials’ costs rose 1.0% m-o-m, mainly reflecting a one-month lag of electricity prices hike, significantly lower transport costs (-3% m-o-m) offset some upside risks. Indeed, moderating inflation is one of the reasons behind the State Bank of Vietnam’s (SBV) third rate cuts recently.