What are the prospects for the tourism stocks?

Vietnam's tourist industry is returning after a three-year hiatus owing to the COVID-19 epidemic. This has resulted in positive growth outcomes for some tourism enterprises that are publicly traded on the stock exchange. However, investors must carefully screen and choose tourist stocks with a solid base and promising future possibilities.

Signs of Recovery

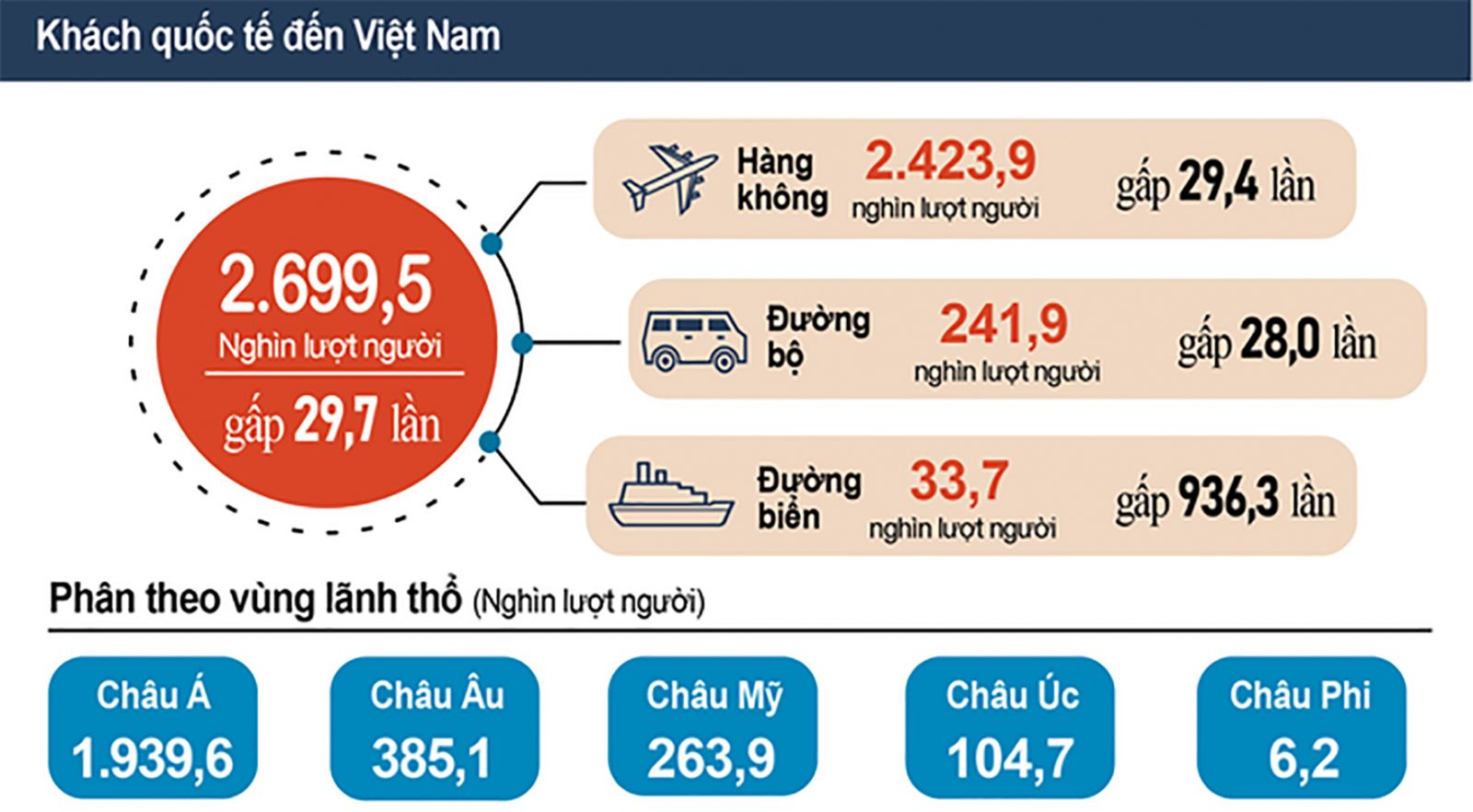

According to Mr. Minh Bui, Head of Analysis and Investment Advisory at HSC Securities Company, once Vietnam reopened its economy in late 2022 and early 2023, the number of international tourists began to rise steadily.

The number of international tourist arrivals in April 2023 increased by 9.7 times compared to the same period last year, and the total number of tourist arrivals in Vietnam increased by about 19.2 times compared to the same period last year, reaching 3.7 million people. However, this figure remains low in comparison to pre-pandemic levels, only reaching roughly 62%, since China's gradual reopening has yet to have a meaningful influence. As a result, Vietnam continues to lack a huge number of tourists from this country.

To compensate for the loss of Chinese tourists, the first four months of the year saw a surge in South Korean visitors, with over 1.1 million arrivals. There were also around 263,000 tourists from the United States.

"Although China reopened in January 2023, Chinese tourists began visiting Vietnam only on March 15, which is relatively new due to certain constraints." As a result, we can anticipate that the return of visitors to Vietnam will contribute greatly to the tourism industry's recovery by the end of 2023 and early 2024," said Mr. Minh Bui.

The number of foreign visitor arrivals in Vietnam is expected to reach 8.5 million in 2023, up from 3.6 million in 2022, according to HSC. Furthermore, the number of international visitors is predicted to rise further by 2024, with Chinese tourists serving as the primary driving factor.

Promising stocks to watch

Tourism equities have performed well on the stock market since the beginning of the year. VIR (15%), VTD (14.56%), DSN (12.45%), SRT (8.7%), and VTR (2.81%), to name a few.

TOPI's research team has discovered numerous interesting tourist stocks, including DSN from Dam Sen Water Park. DSN earned net sales of VND 232 billion in 2022, which was nine times more than the same period the previous year, and profit of about VND 108 billion, which was four times higher than in 2021. This is a record profit in the history of DSN's operations.

DSN continually focuses on innovation and enhancing service quality, with a variety of customer-attracting activities. As a result, the firm sees consistent annual growth in the number of visitors, resulting in consistent stable income over many years.

DAH from Dong A Hotel Corporation is another important stock. It is one of the stocks with high potential and quick growth in the restaurant and hotel industry. DAH has a large amount of land in strategic locations throughout numerous provinces and cities. Its hotels are primarily rented on long-term leases by foreign professionals, resulting in considerable monthly earnings.

SKG from Superdong - Kien Giang High-Speed Boat Company is also worth mentioning. SKG's revenue in 2022 was VND 409.85 billion, which was 2.5 times greater than in 2021. Its after-tax profit was VND 44.38 billion, a 113% improvement over the previous year (it lost VND 38.54 billion in 2021). In comparison to the 2022 plan, SKG surpassed its revenue target by 13.48% and profit objective by roughly 140%.

Many experts advise investors to avoid short-term trading and instead focus on long-term investment while investing in tourist stocks. Several aspects should be addressed while selecting good tourist stocks.

First, assess the company's financial performance, which should include a debt-to-short-term assets ratio of less than 1.1, profitability, current payment ratios more than 1.5, and regular dividend payments. These elements ensure that the stock has the ability to reward investors.

Second, look for equities with a P/E ratio of less than 9, since this indicates low pricing and the possibility for better resale value. However, it is equally critical to analyze firms with strong growth but a high P/E ratio.

To minimize misunderstanding in situations when corporations make irregular gains through asset liquidation or financial income, it is advised that the P/B ratio be less than 1.2. Stocks with good EPS growth over the last five years are also thought to have promise and are worth investing in.

Finally, investors should investigate market movements and determine if the stock is actively developing and has future potential. This judgement might be based on the stock price chart's industry indicators. After that, filter equities that correspond to one's investing objectives and techniques.