What are the top stock picks in Vietnam’s wood industry?

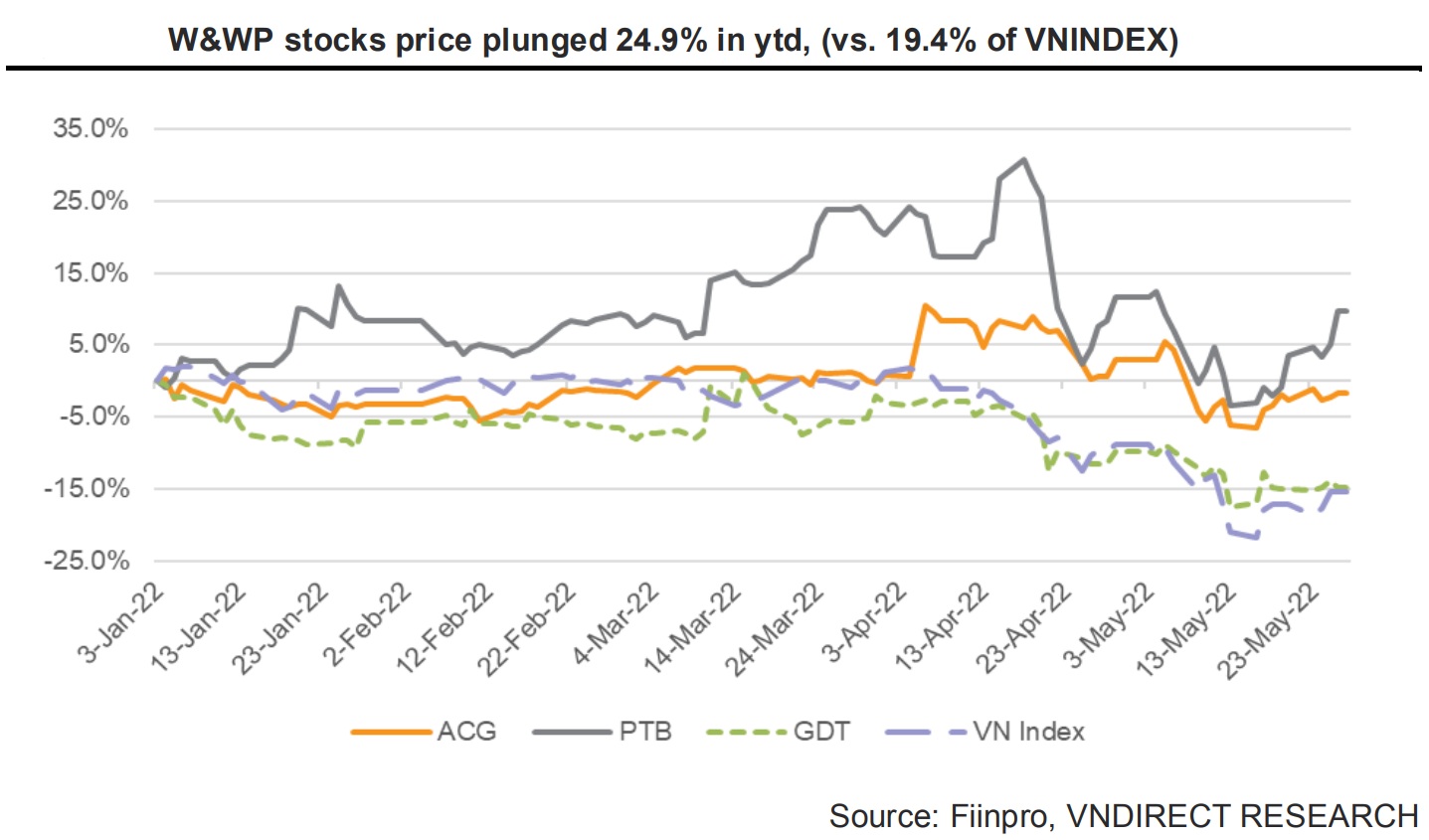

Following the Vietnam stock market correction, shares in wood industry have fallen by around 24.9 percent from their peaks.

Even though the valuation of stocks related to wood and wood products appears to have decreased, it is still not favorable.

>> Vietnam's wood industry will benefit from residential construction

The average TTM PE for equities of wood industry in Vietnam is 15.7x. VNDirect believes that even though the valuation of stocks related to wood and wood products appears to have decreased, it is still not favorable.

Mr. Nguyen Duc Hao, an analyst at VNDirect stated: "We choose equities that have a strong local market share and substantial export income to the US market. As a result, PTB and ACG are our top picks".

VNDirect favors PTB because of its ability to 1) capitalize on the U.S. market's strong demand and 2) increase gross margin in 2H22-23F thanks to economies of scale and PTB's support for clients' purchasing decisions despite high shipping costs.

"Despite the risk of demand declining due to the slowdown in the housing sector in the U.S, PTB's customer demand remains high in 4M22. Currently, PTB has received customer orders for delivery until the end of September 22. We expect PTB's GM to improve in 2H22 vs. 1Q22 thanks to the decrease in material wood and economic scales. Overall, we forecast PTB's gross margin to reach 22.0% in FY22 (- 0.4% pts). Additionally, the Phu Cat 3 factory is expected to be inaugurated in 4Q22 and come into commercial operation in 1Q23F, bringing PTB's total wood working capacity to 102,000m3/year in 2023 (21% vs. 2022). We forecast PTB’s wood segment to reach VND4,056bn (18.2 yoy)/VND4,783bn (17.9% yoy) in FY22/23F, respectively," said Mr. Nguyen Duc Hao.

Due to its dominant position in the home market and robust clientele, ACG will profit the most from the domestic residential property market's rebound. Mr. Nguyen Duc Hao also thinks that switching the market from UPCOM to HOSE will benefit ACG by increasing liquidity and drawing a lot of interest from investors, particularly international investment funds.

>> What is Vietnam wood industry's export market outlook?

"On the strength of the residential real estate market's revival, we anticipate a growth in ACG's revenue in FY22-23F. We think that the company is well-positioned to take advantage of the active construction period and execute residential projects in FY22-23F thanks to a solid ready-to-build backlog of significant developers, including ACG's devoted customers. Therefore, we expect ACG's topline and bottom line to rise 37.7% and 29.7% yoy in FY22F and 28% respectively "and 28.7% yoy in 2023F", according to Mr. Nguyen Duc Hao.

According to Mr. Nguyen Duc Hao, investors should keep a watch on GDT because of three factors: 1) a significant increase in the revenue from the small product sector in FY22; 2) an anticipated 20% increase in revenue from a new plant in FY22F; and 3) a high dividend yield policy.

When purchasing wood stocks, however, investors run some risks. Because the average available home price in March increased 15% year over year due to a supply shortfall, hitting US$375,300, and mortgage rates in the US are again at 5%, returning to the highest level since 2011.

"The market for homes and interior wood goods in the United States in 2022 may decline as a result of rising mortgage rates and home prices. The 2022 gross margin for wood and wood products companies may also suffer from higher-than-anticipated logistics and input expenses", Mr. Nguyen Duc Hao predicted.