What is the 2022 global outlook?

According to the International Monetary Fund (IMF), the world economy is projected to grow by 4.9% YoY in 2022F, from an unusually high level in 2021F (5.9% YoY).

The US is the main pillar of the world economic recovery, with IMF forecasting a 5.2% YoY growth in 2022F

Strong US and EU; slowing down China

While new COVID-19 variants pose a high risk to the world economy, most leading research institutions still believe that the global economic recovery continues to progress through 2022, but momentum will slow down. Growth will be accelerated in several countries, including Japan, South Korea, Australia, and Southeast Asian countries as strict social-distancing measures are gradually lifted thanks to vaccine availability. Meanwhile, the outlook for advanced economies, including the United States and European countries, is expected to remain resilient thanks to stronger public investment, a more efficient labor market, rebuilding of depleted inventories, and improved consumer confidence. On the other hand, the recovery of China, the second-largest economy, could be hampered by high prices of raw materials, power shortage, and the rising bad debts of Chinese property developers.

According to IMF, the world economy is projected to grow by 4.9% YoY in 2022F, from an unusually high level in 2021F (5.9% YoY). The recovery is expected to slow down in the next year, however, this growth rate is still considered positive compared to an average of 2.8%/year seen in the pre-pandemic period within 2016-2019. The US is the main pillar of the world economic recovery, with IMF forecasting a 5.2% YoY growth in 2022F, while the recovery of the Chinese economy could slow down to 5.6% YoY in 2022F, from a high level in 2021F (8.0% YoY). For Europe, the economy could expand 4.3% YoY in 2022F (vs. 5.0% in 2021F).

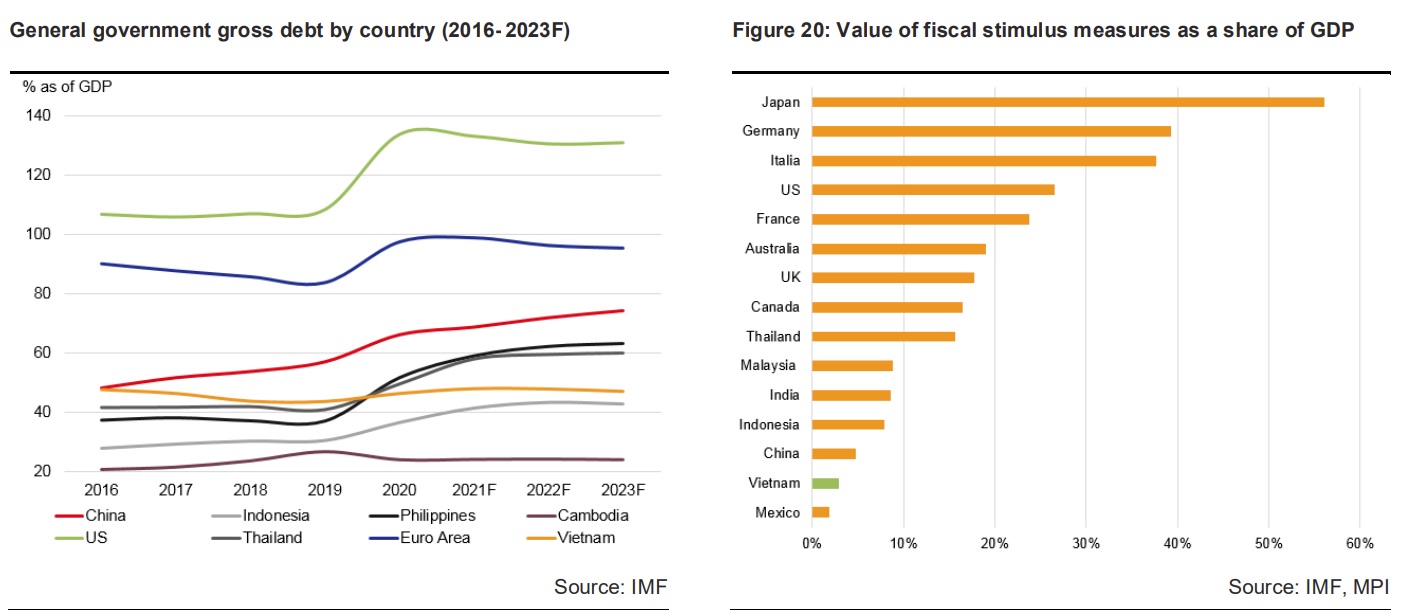

Fiscal policies remain flexible

Given the uneven recovery across countries and regions around the world and the inherent risks from new COVID-19 variants, fiscal policy needs to be flexible and adaptive to the economic situation. For economies with high vaccination rates and strong recovery in 2021, fiscal policies need to focus on mid-and long-term goals, rather than short-term ones. Accordingly, uncommon measures such as the direct distribution of funds to those affected by COVID-19 could be withdrawn and replaced by public investment programs in transport, education, and health. The US Senate approved a US$1tr infrastructure bill to rebuild the nation’s deteriorating roads and bridges and fund new climate resilience and broadband initiatives. In addition, investment in Eastern Europe’s infrastructure is expected to increase significantly in the 2022-2023 period to underpin medium-term growth prospects. Accelerated public investment in developed countries will boost huge demand for construction materials such as iron and steel, cement, and asphalt.

For economies hit hard by the Delta variant in 2021, accommodative fiscal policy is essential to preserve people's incomes and support the economic recovery. The fiscal action needs to focus on limit ing the negative impacts of the Covid-19 pandemic on people’s living standards, employment, and economic activities. Fiscal measures are aimed at supporting the liquidity of households and firms by providing loans and guarantees, as well as pumping capital into the economy through the public sector. The other measures consist of additional spending and foregone revenue, including temporary tax cuts.

Monetary policies have turned more neutral in some developed markets. At the Federal Reserve’s (FED) meeting held on 2 Nov and 3, US. Federal Reserve announced to start withdrawing the bond purchasing program in Nov 2021. They intend to complete tapering by Jun 2022. Regarding policy rate, FED announced to keep near-zero federal fund rate target. According to the CME Group survey, the market expects that FED can raise the policy rate by 50-75bp in 2022, starting from Jul 2022.

Regarding European Central Bank (ECB), the euro area’s recovery should allow the ECB to end its EUR1.85tr (US$2.2 trillion) pandemic bond-buying program in March 2022. However, VNDirect expects the ECB to keep their policy interest rates at a historic low of 0% in 2022 to finance accommodative fiscal policy and support the economic recovery. Noted that, the ECB has kept the key policy rate at 0% since Mar 2016 to support economic growth.

In Asia, major central banks such as the People’s Bank of China (PBOC) and Bank of Japan (BOJ) have yet to raise their key policy rates to support economic recovery. Moreover, the PBOC has further loosened monetary policy by lowering the required reserve ratio in Jul and Dec 2021. VNDirect expects PBOC and BOJ to keep key policy rates at a low level in 2022 to strengthen the economic outlook.

“The normalization of monetary policy by several central banks such as FED and ECB should not be seen as a tightening of global monetary policy and we believe that conditions in global financial markets in 2022 will still be more favorable than in the pre-pandemic period. For economies hit hard by the Delta variant in 2021, accommodative monetary policy should be maintained to combine with loosening fiscal policy to support the economic recovery. Lower interest rate and a more open financial environment have made it easier for governments to mobilize capital to offset budget deficits”, VNDirect said.