What is the 4Q21 stock market outlook?

2021 P/E to be 17.5x on the assumption that big cities like Hanoi and Ho Chi Minh will achieve herd immunity in the second half of 4Q, said KB Securities.

According to KB securities' forecast, 2021 average EPS of businesses on the Ho Chi Minh Stock Exchange (HSX) will increase by 25% YoY. Photo: Quoc Tuan

Positive signs

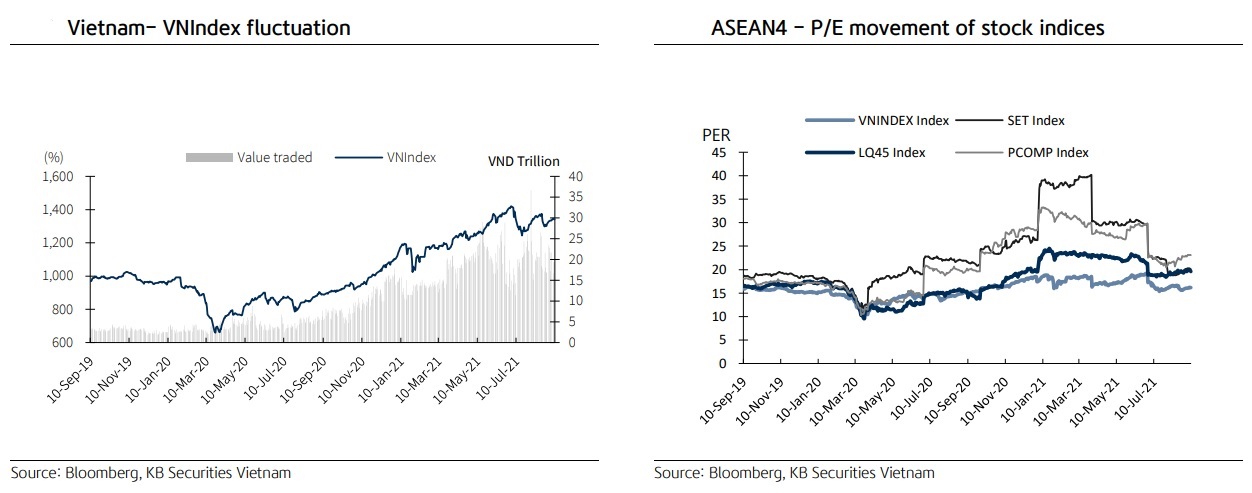

Stocks surged in 1H21 before experiencing corrections and sideways fluctuations in 3Q under the influence of the fourth wave of COVID-19. The VN-Index has grown 20% in points, and the trading value has risen 290% YoY since the beginning of the year (down 5% and 291% respectively in 3Q alone).

Given big corrections of the VN-Index from the peak set in early July and EPS strong growth of listed companies in 1Q and 2Q, the current market P/E has lowered to 16 times, equivalent to the past-two-year average of 15.8 times and much lower than the average P/E level of regional markets.

Gauging the impacts of the Coronavirus fourth wave, KB Securities lowered its forecast for 12-month average trailing EPS growth in 2021 to 25% from 31% published at the end of 2Q on the assumption that the growth was underpinned by the surge in the first two quarters, decreased in 3Q, and may slightly rebound in 4Q. Accordingly, the 2021 forward P/E of the VN-Index is 16.8 times. This is not a low level but still quite attractive given that earnings of listed companies will grow strongly again on the basis of recovering economy and low-interest rates after the pandemic is over.

The VN-Index has outstanding attractiveness compared to other regional peers because: (1) In normal conditions, Vietnam listed companies can outperform regional peers in terms of earnings as they benefit from a strong economy, low-interest rates, and low market P/E; and (2) Vietnam stock market has more attractive P/B and ROE than most other Asian markets.

KB Securities expected 2021 P/E to be 17.5x on the assumption that big cities like Hanoi and Ho Chi Minh will achieve herd immunity (70-80% of the population gets two vaccine shots) in the second half of 4Q, inflation is under control, fiscal and monetary policies are supportive, interest rates are low, exchange rates are stable, public investment is accelerated, and the economy and businesses return to the growth cycle in early 2022 despite heavy damage from the pandemic. “We forecast that 2021 average EPS of businesses on the Ho Chi Minh Stock Exchange (HSX) will increase by 25% YoY, and the target price of the VNIndex at the end of this year should be 1,400 points”, KB Securities said.

Better business performance

Most listed companies, especially large caps, performed well in 1H21 as Vietnam has the advantages of stable pandemic control vs many other countries in the region, low-interest rates (interest expense/revenue ratio dropped in most industries), and sharp increases in the sales of raw materials thanks to higher global commodity prices (vs the Coronavirus-hit low base in the same period last year). Statistics on the HSX show that the total profit of enterprises grew by 71.8% YoY and revenue increased by 21.7% YoY, of which industries leading the profit growth momentum were raw materials (191.6% YoY), real estate (81.8%), and finance (58.9%).

The fourth wave of the pandemic imposed bad impacts on the business operation of many businesses, especially ones in the Southern region, slowed down the growth achieved since the beginning of the year, and threatened business prospects in 4Q.

The strength of the economic recovery in the last quarter of the year will mainly depend on the domestic control of the COVID-19, the plan to ease the distancing measures, and the supportive policies of the government. KB Securities expects the business performance of enterprises in 4Q will be better than that in 3Q thanks to (1) The government's promotion of public investment and additional support packages, (2) easing social distancing protocols, and (3) incentive financial measures from banks like low-interest rates and extended deadline for debt restructuring. However, this stock company assessed that the business situation in 4Q may not have a strong breakthrough because there are still spillover effects from the strict social distancing in 3Q, and the protocols are not likely to be totally removed in major cities in 4Q. Accordingly, it lowered its 2021 forecast for average EPS of companies listed on the HSX to 25% from 31% published in our previous strategy report. The EPS growth should be mainly supported by the growth in the first half of the year and led by materials (89%) and finance (33%).