What is the agribusiness stock pick?

Although the Vietnamese agricultural sector has had certain difficulties, many of its listed companies have a promising future.

BAF’s net profit could grow by an average of 16.2% over FY23–24, driven by capacity expansion.

>> Stronger USD and its impacts on Vietnam's agribusiness

Ms. Ha Thu Hien, an analyst at VNDirect, said this stock company has a positive view on BAF Viet Nam Agriculture Joint Stock Company (HoSE: BAF) in the short and long term for some reasons.

First, herd size will increase significantly in 2023F. This company will enter a heavy investment cycle during FY22-23F, with 2 slaughter factories, 5 porker farms, 2 piglet farms, and 3 combined piglet and porker farms coming online between 3Q22 and 1Q23F. These projects will lift BAF’s pig herd up 226% from its current scale and also finalize its "Food" segment in the 3F business model.

Second, BAF’s net profit could grow by an average of 16.2% over FY23–24, driven by capacity expansion. Gross margin will improve by 0.7% points as the 3F business segment contributes 6.1% points to BAF's gross profit in FY23F, compared to GM's much higher agribusiness segment.

Third, BAF can get support from Tan Long Group in terms of input costs, so the company will be less affected by the rising exchange rate than its peers.

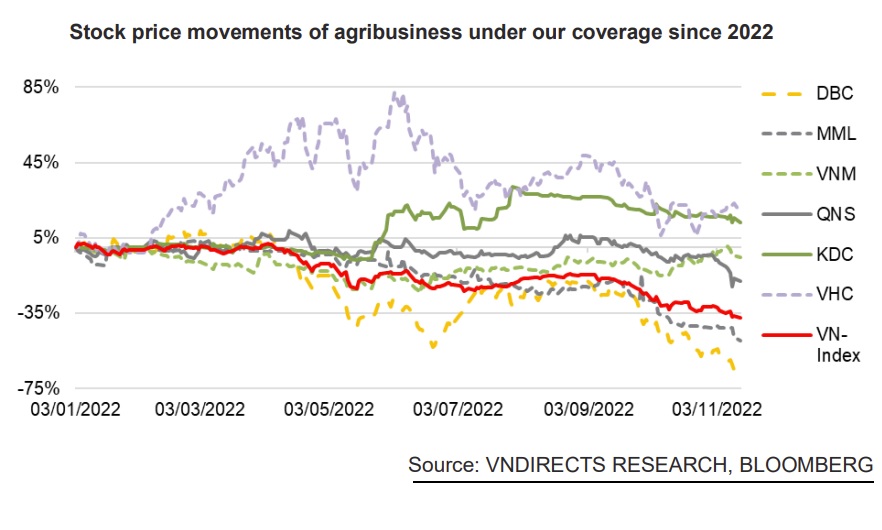

For Dabaco Group (HoSE: DBC), swine prices are expected to increase by 5% yoy in 2023F, which will impact positively on this company’s gross margin. Ms. Ha Thu Hien anticipates a 1.5% yoy increase in DBC's gross margin.The company’s net profit is expected to grow 68.9% year over year in FY23F after a sharp decrease of 60.7% yoy in FY22F due to the sharp increase in animal feed input costs. DBC’s share price has slumped 64.8% ytd, which has been largely priced into the weak FY22 result.

Ms. Ha Thu Hien of KIDO group (HoSE: KDC) expects its cooking oil input costs to fall due to a sharp drop in raw cooking oil price (palm oil) after peaking in June 2022.Kido Bakery opened a factory with a capacity of 19.000 metric tons and officially returned to the confectionery segment, in which KDC has a lot of experience and a wide distribution chain with the largest market share (nearly 50% market share). This will help KDC maintain revenue and net profit growth in FY23–24F.

>> Vietnam’s sugar producers could take back its position

Quang Ngai Sugar Joint Stock Company (UPCoM: QNS), according to Ms. Ha Thu Hien, can take advantage of the upward sugar price trend and expand the gross margin as the company has the second largest scale in sugarcane materials, which is well positioned to capture the increasing demand for domestic sugar. Besides, the global soy bean price is expected to decrease in 2023F, which will ease pressure on input material costs for the soybean milk segment. "We expect QNS to deliver an 8.5% yoy revenue growth and better GM, making net profit increase by 10.3% yoy in FY23F," said Ms. Ha Thu Hien.

Global inflation has reduced the demand for many seafood products, but pangasius products still have advantages because they are affordable for consumers. As a result, Ms. Ha Thu Hien believes that pangasius prices and export volume will remain stable in the near future.The main export market for Vinh Hoan Corporation's (HoSE: VHC) pangasius products is the US market. Although in 2023 it may be difficult for the company to maintain an exceptional high export volume like in 2022, VHC will still benefit quite a lot in the environment of an increasing USD rate. However, the current valuation is not attractive in VNDirect’s view, as it expects that VHC's net profit may decrease in the next 2 years after recording an outstanding performance in FY22F thanks to pent-up demand in the US market.