What prospects for tech stocks in the DeepSeek storm?

The market capitalization of FPT and the technology-telecommunications sector fell during the early Spring trading session, owing to the delayed impact of the DeepSeek storm and concerns about a new technology war.

Vietnam's stock market underperformed in the first trading day following the Tet At Ty 2025 holiday. Unlike previous years, the post-Tet bullish trend did not persist.

At the end of the first session of the year, VN-Index fell 12.02 points (0.95%) to 1,253.03 points. Foreign investors had a negative stance, with net sales of up to VND 1,464 billion, especially targeting technology and finance equities.

Over 3.59 million FPT shares, or 52.2% of total trading volume, were offloaded. The net selling value reached VND 316.5 billion, accounting for 36.6% of the entire net selling value on HoSE. Due to selling pressure, FPT completed the session 5.15% lower than its opening price, finishing at VND 145,500 per share. The stock's liquidity for the session totaled VND 1,016 billion, accounting for approximately 14.1% of the total matched value on HoSE. Within a single trading session, FPT lost approximately VND 10 trillion in market capitalization, making it the leading blue-chip stock, dragging down large-cap stocks such as VNM, VCB, VIC, GAS, BID, VHM, TCB, and MWG, causing the VN30 index to fall by 1.39%, with only 6 gainers versus 24 declines.

Alongside FPT, other stocks such as CMG, FOC, and ELC, as well as telecom stocks like FOX, VGI, CTR, and MFS, also experienced simultaneous declines. The downturn was broad, with MFS losing over 10%, FOC dropping nearly 6%, CTR and CMG down 5%, VGI falling nearly 3%, and ELC losing over 1%. Many of these stocks saw increased trading volume during the session.

Despite its high-profile agreements with U.S. tech giant NVIDIA, FPT's rapid collapse, along with the larger slowdown in the technology-telecommunications industry, underlined the impact of the global tech stock sell-off prompted by China's DeepSeek. This AI powerhouse is viewed as a competitive challenge to the United States' dominant position in artificial intelligence (AI). DeepSeek was only launched in December 2024, with a reported investment of less than $5.6 million (though some estimates put the actual investment at $1 billion). This means that, despite its minimal AI development budget, its efficiency could rival that of established AI companies.

Although a comprehensive assessment of DeepSeek will take time, the AI R1 wave, which previously sent major global tech indices tumbling when Chinese AI advancements were first embraced, has now reverberated in Vietnam’s stock market. The delayed reaction was due to the 9-day Lunar New Year holiday.

A New U.S.-China Tech War?

Commenting on FPT’s sharp decline and the broader sell-off in tech-telecom stocks at the beginning of both the week and the new year, one expert suggested that beyond the "DeepSeek storm," another factor exerting downward pressure was the possibility of a large-scale U.S.-China trade war, exacerbated by new tariff policies under President Donald Trump.

The tech battle is predicted to heat up, with US tech behemoths—including NVIDIA, an FPT partner—forced to reaffirm their dominance, while China is unlikely to sit back and accept unilateral tariffs. Even before the Lunar New Year holiday, in mid-December 2024, China's State Administration for Market Regulation (SAMR) announced an antitrust investigation into NVIDIA's 2019 acquisition of chip design company Mellanox Technologies, which was widely interpreted as a retaliatory move in response to the United States' latest restrictions on the export of memory chips and chip-making equipment to China.

While hostilities in the US-China tech war are predicted to flare up in 2025 after years of simmering, many Vietnamese securities firms remain bullish about the prospects for technology-telecom equities.

Positive Outlook for Tech Stocks in 2025

Based on the growth of data center demand, Agriseco forecasts that telecom and 5G infrastructure companies will benefit significantly in the future, driven by an increasing number of internet subscribers.

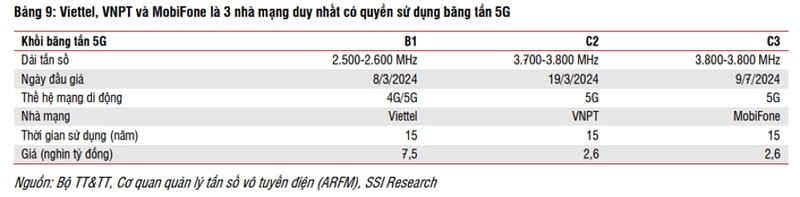

Similarly, SSI Research predicts that the telecommunications sector will grow as data center expansion accelerates. The commercialization of 5G is expected to fuel the advancement of cutting-edge technologies such as AI, IoT, big data, and blockchain, offering promising prospects for key data center companies, including Viettel IDC (the market leader), VNPT, FPT Telecom (Ticker: FOX), and CMC Technology Group (Ticker: CMG).

According to SSI Research, the uptrend in tech-telecom stocks began in 2023, driven by optimism about AI’s potential—particularly generative AI—exploding in 2024 and continuing into 2025. AI infrastructure development and increased data center spending are expected to rise by 15.5% in 2025. Additionally, IT service and software companies are poised to benefit as AI-driven spending rebounds globally.

The strong performance of listed tech-telecom stocks in 2024 has fueled investor expectations for continued growth in 2025. Investors also anticipate major telecom players to capitalize on the "5G revolution."

BSC Securities predicts that in 2025, the technology-telecom sector will maintain robust growth, supported by new contract signings and solid earnings results from the second half of 2024. The sector will also benefit from AI-driven digital transformation, large-scale 5G rollouts enabling telecom firms to invest in infrastructure, and the expected launch of Intelligent Transportation System (ITS) projects in 2025.

FPT’s software exports to key markets such as the U.S., Japan, and APAC are expected to maintain strong growth in 2025. This growth will be fueled by the company’s enhanced product and service competitiveness through its partnership with NVIDIA, coupled with cost advantages that continue to attract contracts. Additionally, FPT’s new contract revenue saw a 20% year-on-year increase in the first nine months of 2024, ensuring growth momentum for Q1 2025. Over the long term, its collaboration with NVIDIA is seen as a strategic "leverage point" across multiple areas, including education and workforce development, positioning Vietnam as a semiconductor industry hub.

BSC also emphasizes the potential of CRT, ELC, and ITD, which are expected to benefit from government initiatives promoting digital technology, policies encouraging investment in digital products and services, and special incentives for talent and businesses in digital transformation, cybersecurity, and cloud computing. The government is anticipated to encourage investment in data centers and cloud infrastructure, as well as public-private partnerships, in order to upgrade digital infrastructure, improve nationwide telecom and internet networks, and drive comprehensive digitalization throughout all levels of government. The goal is to create a digital government, economy, society, and citizens through substantial database construction.

From a Feng Shui investment perspective, BSC recommends technology stocks as a top choice for investors with a Fire-element destiny in the year of At Ty 2025.