What prospects for DPR?

Dong Phu Rubber JSC (HOSE: DPR)’s 2025 outlook is expected to be positive based on: (1) Growth in demand and prices of rubber/latex; (2) DPR can gain rental revenue from Bac Dong Phu (expansion) and Nam Dong Phu (expansion) Industrial Parks in the next 1-2 years.

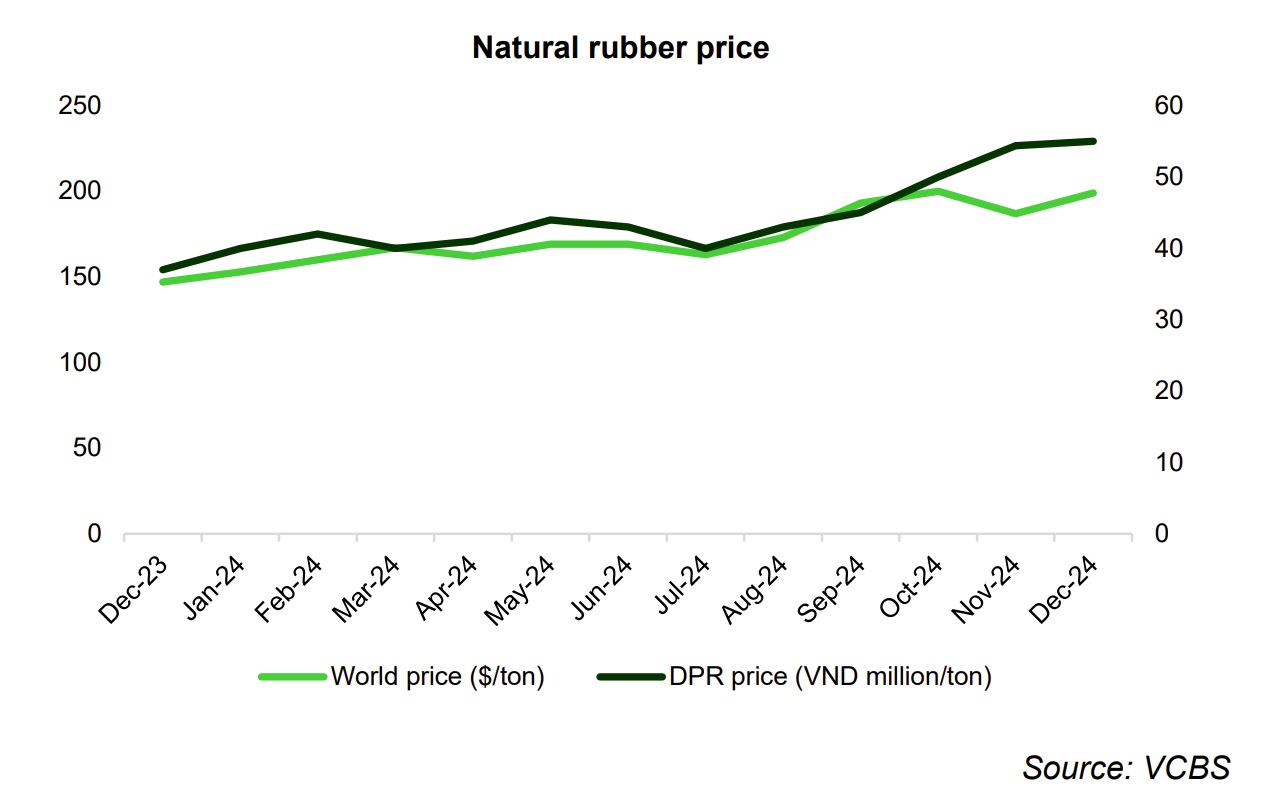

Rubber price could remain high

In 2024, rubber export prices recorded a significant increase (30% yoy), mainly due to (1) unfavorable weather conditions in major production areas in Asia (especially Thailand) and (2) gradual recovery of the electric vehicle manufacturing industry in China, followed by increasing demand for tires.

VCBS expects that the natural rubber price in 2025 will remain stable due to supply shortages and unfavorable weather conditions that might continue until 2026. We estimate that DPR's rubber price will remain above VND 38 million/ton in 2025. With an average capacity of over 2 tons of rubber/ha, we expect the rubber segment of DPR will gain over VND 900 billion in revenue in 2025.

Potential from new industrial park projects

In the second half of 2024, Binh Phuoc province announced the plan for land use and new land prices—enabling the development of new DPR's industrial park projects. Bac Dong Phu Industrial Park (expansion) and Nam Dong Phu Industrial Park (expansion) are allocated 133ha and 75 ha respectively, according to the 2025 land use plan, which were expected to start generating rental cash flow in the period 2026 – 2027, specifically:

Bac Dong Phu Industrial Park (expansion): On January 16th, Deputy Prime Minister Tran Hong Ha signed Decision No. 145/QD-TTg. Phase 1 of the project (133 hectares of a total of 317 hectares) is expected to start construction in the first half of 2025 with fast progress thanks to the infrastructure and human resources from the existing Bac Dong Phu Industrial Park.

Nam Dong Phu Industrial Park (expansion): waiting for approval from the Prime Minister. Currently, the project has been allocated 75ha out of a total area of 480ha. The two industrial parks are in Binh Phuoc, connecting major traffic routes including National Highway 13, Provincial Road 741 and Provincial Road 747A. With lower rental costs (about 70 USD/m2) compared to industrial parks in Binh Duong, DPR's industrial parks are an ideal choice for enterprises in Binh Duong that want to expand their business, saving costs while still ensuring convenient connectivity.

VCBS expects that DPR will start recording rental revenue from Bac Dong Phu Industrial Park (expansion) and Nam Dong Phu Industrial Park (expansion) from 2026 and 2027 respectively. It expects that each industrial park will sign a lease contract for 20-30ha/ year with a rental price of about 75 USD/m2 - bringing in a rental cash flow of over VND 500 billion/year.

Higher land compensation cash inflow

The approval of the general plan for land use of Binh Phuoc is an important factor for (1) approving necessary legal steps for new industrial parks in the area and (2) land compensation estimation. Accordingly, DPR's income from land compensation is expected to improve significantly in the next few years.

In 2025, VCBS forecasts that DPR will continue to receive VND 85 billion in compensation from the Tien Hung 1 project. In addition, DPR currently owns about 1,600 hectares of convertible rubber land in Binh Phuoc. With the compensation price of about VND1 billion/ha, the company can gain the land compensation of about VND 100 - 200 billion/year from now until 2030.

For 2025, VCBS forecasts DPR to achieve revenue of VND 1,290 billion (5.4% yoy), NPAT of VND 357 billion (3.8% yoy) - equivalent to EPS of VND 3,339/ share.

However, DPR could face some challenges. In the short term, KBVS reiterates its view that FDI disbursement flows into Vietnam could drop in the period 2025–2026. This will mainly depend on the US’s tariffs on Vietnam. Therefore, DPR could have some difficulties developing industrial parks.