What stocks will benefit from market upgrade?

KBSV reiterate its positive view on the potential for upgrading the Vietnamese stock market. What stocks will benefit from Vietnam stock market upgrade?

FTSE Russell showed its appreciation for the commitment of the Vietnamese market regulators to pursue regulatory reforms to make foreign trading more convenient.

KBSV continues to update and briefly reiterate its view on the possibility of the Vietnamese stock market being approved for upgrading in September 2025. This has been an attention-catching topic for many years and recently became hot again as the State Securities Commission accelerated the process of improving mechanisms and simplifying regulations to meet the criteria of the rating agencies.

FTSE Russell continues to keep Vietnam on the watch list for upgrading from Frontier Markets to Secondary Emerging Markets in the April 2025 review period. Vietnam has been on the watchlist since September 2018. According to the response from FTSE, both the criteria ‘Delivery versus Payment’ (DvP) and ‘Settlement – costs associated with failed trades” are still rated as ‘limited’.

In addition, Vietnam needs to improve the new account registration process as current market practices may prolong registration time. At the same time, the introduction of an effective mechanism to facilitate transactions among foreign investors for stocks that have reached or are approaching the foreign ownership limit (FOL) is also considered important.

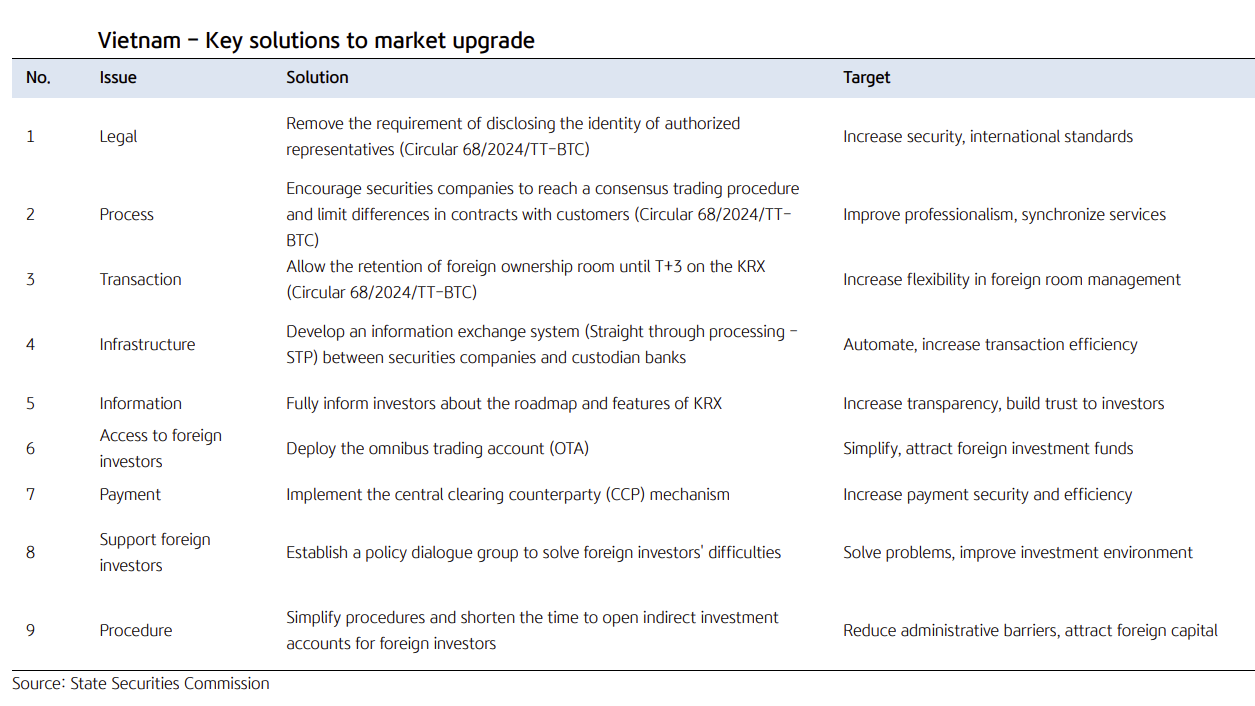

However, FTSE Russell showed its appreciation for the commitment of the Vietnamese market regulators to pursue regulatory reforms to make foreign trading more convenient. The Securities Commission earlier in March proposed nine solutions to achieve market upgrade in 2025-2026, focusing on addressing the most important aspects of the emerging market criteria.

The KRX system was officially put into operation on May 5. This will be an important process to create a foundation to prepare for new trading methods and tools in the future, especially the opportunity to deploy a CCP, an important criterion in the upgrading journey of FTSE Russell and MSCI.

KBSV reiterates its positive view on the potential for upgrading the Vietnamese stock market. Once approved, the market could attract a big capital inflow, estimated at USD800 million to USD1 billion from passive funds modeled after the FTSE index, and this figure would be even larger when other indexes are included. Notably, capital flows from active funds are forecast to be stronger, possibly reaching USD4-6 billion.

Accordingly, leading stocks that meet the criteria for capitalization and liquidity such as Vietcombank (VCB), Masan Group (MSN), Vinamilk (VNM), Hoa Phat Group (HPG), Vingroup (VIC), Vinhomes (VHM), and SSI Securities (SSI) will be the top candidates to be added to the index basket.

Besides, stocks with good growth prospects and ownership room for foreign investors will also catch the attention from active funds.

In addition, the group of securities companies, especially those with the largest brokerage market share for foreign organizations like Vietcap Securities (VCI), Ho Chi Minh Securities (HCM), and SSI will also directly benefit from the increase in profits and transaction fees.