What will affect the USD/VND exchange rate in 2025?

Following new tariff policies under President Donald Trump, it is imperative to keep an eye on the interest rate differential between the United States and Vietnam as well as U.S. inflation, according to Dr. Pham The Anh, Chief Economist at the Vietnam Institute for Economic and Strategic Studies (VESS) and Head of the Economics Faculty at the National Economics University (NEU).

Commenting on the exchange rate, Dr. Pham The Anh said that trade deficits and a gap in interest rates between the global and local markets were the main factors influencing the USD/VND exchange rate in prior years.

According to the expert, tariff policies could prolong U.S. inflation and make it difficult for interest rates to decline quickly. Elevated U.S. interest rates will put pressure on all central banks to stabilize exchange rates.

In recent years, Vietnam has effectively addressed the trade deficit, maintaining a healthy surplus. However, over the past year, the interest rate differential has caused exchange rate instability, often leading to capital outflows.

Looking forward, Trump’s tariff policies will add another layer of uncertainty.

"I largely agree with the perspective that Trump will take an aggressive initial stance, but, in the long run, for the benefit of both the U.S. and its trade partners, his policies cannot be applied unilaterally or too harshly. Negotiation will be required," Dr. Pham The Anh shared.

The analyst clarified that while talks with China would focus on trade balance, those with Canada and Mexico might deal with immigration-related problems. The USD usually rises when Trump declares his trade policies. This is due to investors' expectation that tariffs will lower the U.S. trade imbalance, which will enhance the value of the USD by reducing its supply on the foreign exchange market.

Second, tariffs will unavoidably result in higher pricing for consumers. Dr. Pham The Anh contended that Trump's assertion that exporters will shoulder the tax cost and that American consumers will not is unrealistic. Tariffs will cause producers to raise prices, which will delay interest rate reductions and prolong inflation in the United States.

In order to avoid significant currency depreciation, the central banks of the United States' trading partners will likewise have to postpone interest rate cuts. For example, the central banks of China and Japan will need to step in.

According to Dr. Pham The Anh, these factors have the potential to intensify exchange rate conflicts, making this a crucial area to monitor.

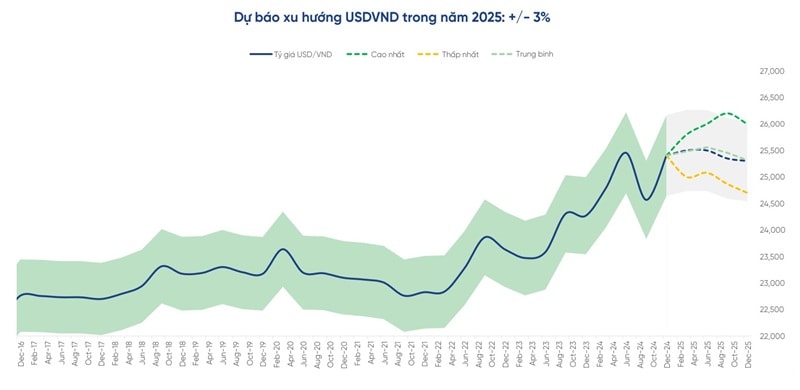

Source: VPBankS

As such, he emphasized the need to monitor two main factors: first, the U.S.-Vietnam interest rate differential and U.S. inflation post-tariff implementation. While U.S. inflation currently hovers around 3%, leaving room for interest rate cuts, the cuts will likely proceed cautiously. Second, the extent of Trump’s tariff application on goods from China, Mexico, and Canada. These two factors will primarily drive exchange rate fluctuations.

Mr. Tran Hoang Son, Market Strategy Director at VPBankS Research, talked about the exchange rate and tariff policies in the context of a possible "Trump 2.0" era. He recalled that during the "Trump 1.0" period, the USD increased by more than 4.4%, the CNY decreased by 5.33%, and the VND decreased by 2.13%. Tariffs had an immediate effect on exchange rates. The USD has likewise had a significant increase in 2024, rising by around 5% from the year's start. The CNY dropped by 1.82% and the VND depreciated by 4.46% at this time. According to VPBankS, if Trump imposes tariffs in 2025, China would react by modifying its exchange rate, which will cause the CNY to weaken in order to offset the duties.

"Looking back at the Trump 1.0 period, when tariffs were introduced in March 2018, the USD appreciated by up to 10% between 2018 and 2019, while the CNY depreciated by approximately 12%. Clearly, higher tariffs led China to widen its exchange rate band, causing the CNY to weaken proportionally.

The VND also dropped 2.9% in that case. If tariffs increase once more in 2025, Trump's actions may have a significant impact on exchange rates, especially those in Vietnam. According to Mr. Tran Hoang Son, "VPBankS projects that the VND exchange rate may fluctuate within a 3% range, impacting macroeconomic stability and the stock market."

Exchange rates have displayed fresh strain in the days after the State Bank of Vietnam injected cash into the banking system. The USD Index (DXY) hit 107 on the global market on December 13, which is only a little below the previous high of November 22, 2024.

The State Bank of Vietnam is anticipated to keep a close eye on exchange rate risks through the end of 2024 and into 2025 in order to maintain inflation control, exchange rate stability, and interest rates that support rapid economic growth. The pressure from the DXY and global USD interest rates brings exchange rate risks back into focus.