When will NVL bounce back?

Nova Real Estate Investment Group JSC (Novaland, HoSE: NVL) has recently been removed from HoSE’s warning list. Along with that, several factors are fueling expectations that NVL might finally be on the verge of a turnaround.

According to documents prepared for the 2025 Annual General Meeting of Shareholders (AGM), scheduled for April 24 in Binh Thuan, NVL has proposed two business scenarios for the year. Under the first scenario, projected net revenue is VND 13.411 trillion, with a post-tax loss of VND 12 billion. In the second scenario, net revenue is estimated at VND 10.453 trillion, with a post-tax loss of VND 688 billion.

A "Positively Negative" Business Plan

Compared to 2024, this outlook is considered a “positive loss,” as the company posted a net loss of VND 6.4 trillion last year (down from a net profit of VND 606 billion in 2023 after minority interests). The 2024 loss was largely due to provisions related to the Lakeview City project in Ho Chi Minh City, made in response to auditors’ requests for caution in the reviewed financial statements for H1/2024. Given that the pace of legal resolution for projects is beyond the company’s control, such conservative measures are deemed necessary to limit losses.

NVL is also in the thick of debt restructuring. As of end-2024, total outstanding debt stood at VND 61 trillion, a 5% increase from the previous year, mainly due to new bank disbursements for project construction. Debts maturing within 12 months total VND 36 trillion, for which NVL has mapped out plans to deal with domestic bank loans. For international loans and domestic retail bonds, negotiations and extension plans are underway to stretch repayments to between 2025 and 2027. In early 2025, NVL has continued repurchasing some bond tranches, but others have reached maturity without repayment due to cash flow constraints.

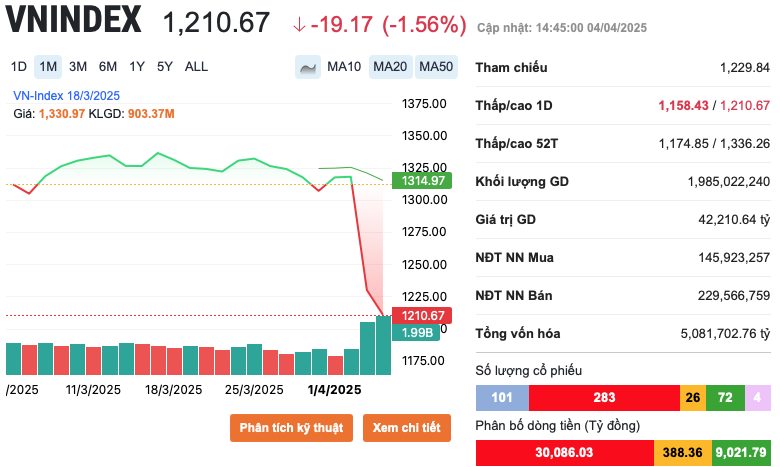

The removal of NVL from the warning list on April 3 could help lift its stock price, alleviating pressure on collateral value for certain depreciated bond tranches. However, this alone is not sufficient for NVL to successfully launch new share issuances—partly due to prevailing conditions in the stock market. The company has thus factored in a less optimistic outlook in its 2025 business strategy.

Waiting for “Products Out – Cash In” From Projects

Before finalizing its cautious business targets, NVL shared some positive expectations in a February online investor meeting. For 2025, the company expects to deliver over 3,000 units, with NovaWorld Phan Thiet contributing 31%, Aqua City 27%, NovaWorld Ho Tram 19%, and HCMC-based projects 23%. NVL plans to deliver 12,500 units in 2026 and 6,900 in 2027. Construction capital is projected to come mainly from additional bank disbursements and proceeds from previously sold units.

The company also plans to launch two new high-rise projects in HCMC—Park Avenue and Palm City—with construction permits expected in March and June 2025 respectively, and sales launches slated for Q2 and Q3.

NVL expects key legal approvals in Q2/2025 for major projects:

- Aqua City: revision of the 1/500 detailed zoning plan;

- NovaWorld Phan Thiet: one-off land use fee payment and construction permits for several subzones;

- NovaWorld Ho Tram: approval of sub-projects like Binh Chau Onsen, Happy Beach, and Long Island.

Additionally, two projects in HCMC—Lakeview City and Water Bay—fall under Resolution 170/2024 and may soon receive legal clearance. For Lakeview City specifically, the resolution proposes reassessing the land use right fee (LURF), previously set at over VND 5.1 trillion by the HCMC Tax Department. If revised, NVL may be able to reverse part of the provisions it booked in the H1/2024 reviewed financial statements. In terms of receivables, NVL anticipates collecting around VND 13.7 trillion from sold units worth over VND 96 trillion, mostly in 2026 and the remainder in 2027.

Vietcap has observed early legal progress at key projects, and domestic banks are continuing to disburse loans for ongoing construction. However, the fundamentals—debt restructuring, legal clearances, project execution, and rebuilding homebuyer confidence—will take time to fully address.

In 2025, NVL is expected to focus on two priorities: Restructuring debt, including negotiating with bondholders for maturity extensions or asset swaps; Step-by-step legal and construction problem-solving to begin delivering sold units to buyers.

Cautious Optimism Amid Structural Challenges

According to Doan Minh Tuan, Head of Research and Investment at FIDT, NVL is among the firms likely to benefit from future economic space expansion under upcoming urban merger plans. Infrastructure developments could boost the value and liquidity of projects like Aqua City, NovaWorld Ho Tram, and housing projects in HCMC (e.g., Palm Marina – 7.4ha, The Grand Manhattan – 1.4ha).

However, NVL still faces significant liquidity risks due to its high financial leverage during aggressive land acquisition and development phases. Many projects remain stuck in legal limbo, slowing down cash turnover and jeopardizing debt repayment and business continuity.