Which challenges face airlines?

The airlines' business results and fleet expansion plan have been impacted by the rise in fuel prices, interest rates, and the stronger USD.

VJC is less at risk from a stronger USD and rising USD interest rates.

>> Risk of overloaded aviation infrastructure

Rising fuel prices

The price of worldwide Jet A1 fuel is predicted by VNDirect to increase by 79.2% yoy in 2022F before declining by 13.0% yoy in 2023F as a result of the tension between Russia and Ukraine. The cost of jet fuel is expected to remain at its highest level since 2015 in 2022–23F, causing numerous challenges for the airline industry.

VNDirect thinks low-cost carriers (LCCs) would be less impacted than full-service carriers in the face of rising jet fuel prices. The weight of an aircraft has a significant impact on its fuel consumption. Wide-body aircraft with greater capacity and weight are typically used for long-distance flights. Long-distance flights also use a lot of fuel, making the aircrafts heavier.

As a result of their narrower bodies and lighter weight, short-haul aircraft typically use less fuel than long-haul aircraft for takeoff and altitude maintenance. As all of VJC's fleet are short-haul narrow-body aircraft, it will use less fuel on average and have a lower average speed (ASK) than HVN's fleet, which comprises roughly 30% wide-body long-haul aircraft. The following are specifics of the impacts on the two models:

First, VNDirect forecasts that HVN's fuel cost per available seat kilometer (ASK) will increase by 65.4% yoy in FY22F and decrease by 8.3% yoy in FY23F, while VJC's fuel cost per ASK will only increase by 54.3% yoy in FY22F and decrease by 7.1% yoy in FY23F due to the increase in the price of jet fuel in FY22-23F.

Second, this stock company predicts that despite the high cost of jet fuel, VJC's core gross margin will be positive in FY22-23F at 0.4%/2.0%, while HVN's core gross margin may be lower at -3.5%/1.4%.

Rising interest rate and stronger USD

The USD/VND exchange rate is under pressure due to a stronger USD. Following the FED's latest interest rate increases, the USD 3-month LIBOR likewise achieved its highest point in over 10 years. When the majority of airlines finance their fleet with USD, the USD's appreciation and rising interest rates have a negative effect on capital-intensive industries like the airline industry.

According to VNDirect, the challenges that the airlines must overcome in light of exchange rate volatility and rising US interest rates include:

First, when reevaluating debt in USD, greater USD causes the airlines to incur FX loss. Additionally, the cost of investing in aircraft (priced in USD) has increased, making it more challenging for airlines to expand their fleet. However, these challenges are arguably lessened when airlines selling international tickets have a USD revenue source.

Second, because interest rates for financing existing fleets are typically fixed, they have little impact on interest expenses. However, because airlines are financing new fleet during this time, they are required to borrow money at higher interest rates, which could have an impact on future business results.

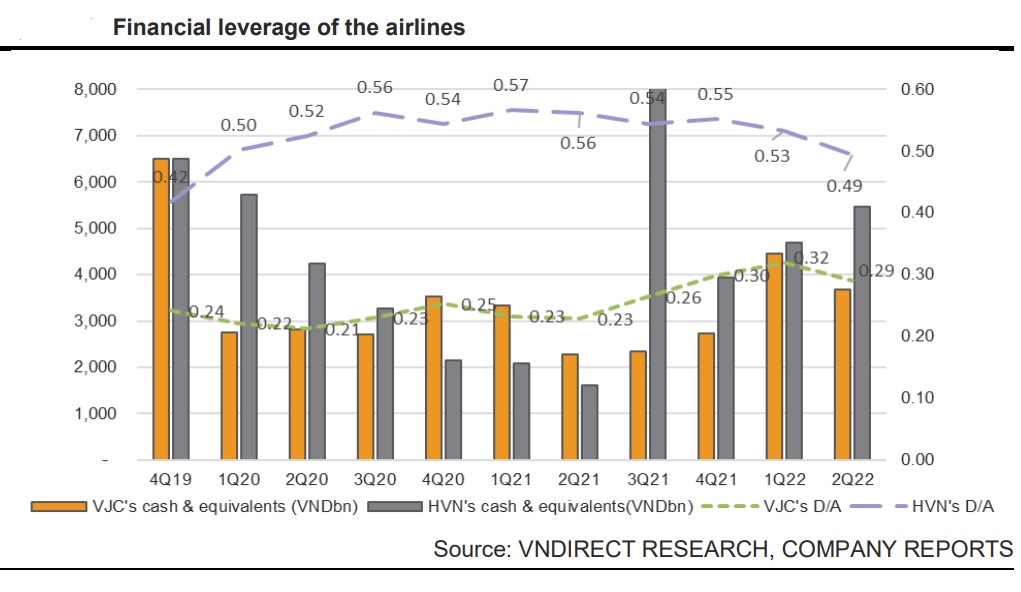

>> International air traffic will take the spotlight

With a balance of VND21,815 billion in USD loans as of June 30, 2022, HVN has the highest proportion of USD loans among domestic airlines (66.3%); in contrast, VJC has a balance of VND3,227 billion. As a result, VJC is less at risk from a stronger USD and rising USD interest rates. Additionally, VJC's leverage ratio is safer than HVN's, giving it the potential to finance fleet expansion for the recovery of international air traffic in the future. While Bamboo Airways faces difficulties during the restructuring period, HVN's recovery potential will be reduced due to the reduction in fleet size.

Which airline offers the best potential?

According to Mr. Nguyen Dzung, senior analyst at VNDirect, VJC's status as Vietnam's premier low-cost carrier - which will have a domestic market share of 40% in 2020 - will account for the country's greatest domestic market share. The second-largest worldwide market share of the Vietnamese aviation sector belongs to VJC.

With a recovering travel demand, Mr. Nguyen Dzung anticipates a 245.4% yoy increase in domestic pax for VJC in FY22F. From the high base of FY22F, growth may drop to 12% yoy in FY23F. Regarding international aviation traffic, we predict that VJC will carry 2.43 million passengers in FY22F (up from 0.1 million in FY21) and 7.83 million passengers in FY23F (97.4% of FY19 base).

“We think the China zero-covid policy risk is lower for VJC because there aren't as many Chinese travelers abroad during the pre-pandemic period (FY19). According to our predictions, VJC's NP would increase by 168.3% yoy in FY23F to VND3,533bn from VND175bn in FY21 to VND1,317bn in FY22F”, said Mr. Nguyen Dzung.

Along with a reliable and dedicated management team, VJC is currently the airline in Vietnam with the lowest financial leverage, which can guarantee the fleet expansion plan. Mr. Nguyen Dzung thinks VJC has the best chances to profit from the impending revival of Vietnamese aviation.