Who will benefit from public investment?

From the end of 2022, public investment may be accelerated. This operation will be advantageous to numerous economic sectors in Vietnam.

Huu Nghi- Chi Lang project.

>> Rising public investment to lift various stocks

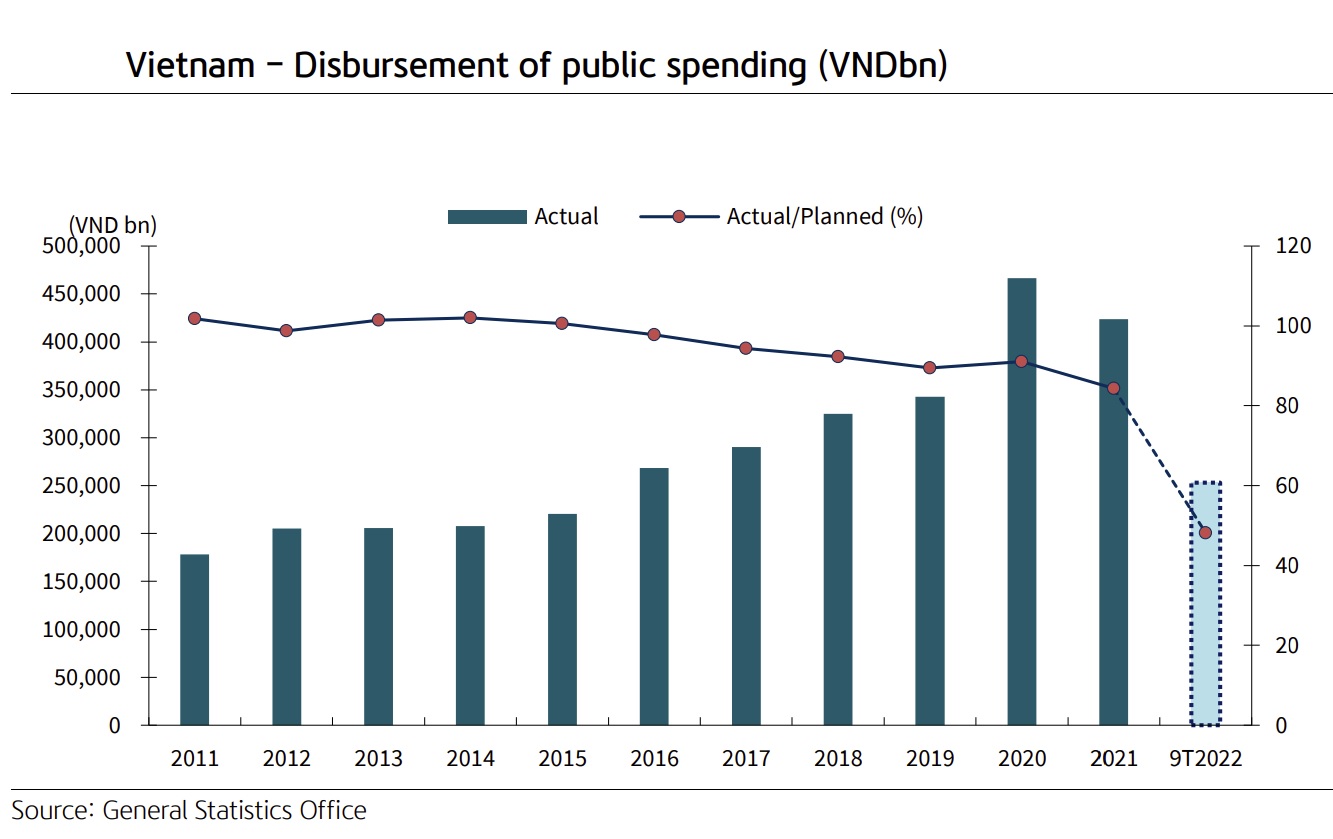

Public investment is regarded as a crucial tactic for boosting the economy, with long-term spillover effects on other industries. Between January and August 2022, the state budget provided a total of VND285.4 trillion ($12.18 billion), or 51% of the year's budget. Given the uniqueness of public investment capital, which is low in the first months of the year and rises sharply in the last months of the year, especially in 4Q22, the disbursement rate is still constrained because contractors need time to build and accumulate enough volume for acceptance and payment.

Construction work has been slowed down over the past year due to site clearance difficulties and soaring raw material costs while contractors wait for pricing changes. Additionally, the resolution on the medium-term public investment plan was passed by the National Assembly in July 2021, therefore contractors have mostly proceeded with ongoing projects since the year's beginning. New projects are still in the planning stages for the legal processes, which typically take 6 to 8 months.

Phase 2 of the Eastern North-South highway will consist of 12 sub-component projects totaling 723.7 km in length. This will cut the preparatory phase in half and speed up the implementation phase. This December, major roads to the Long Thanh airport will begin to be built, and phase 1 expressway projects will see a boost in work until they are finished. This will give the nearby quarrying industry growth drive.

The Prime Minister also adopted three thematic resolutions on public investment capital disbursement, three dispatches, and designated six working groups to continue inspection, assisting in the removal of challenges and barriers, in order to facilitate public investment disbursement for the year-end period. Additionally, the Government has published Resolution No. 124/NQ-CP dated September 15, 2022 on tasks and methods to encourage public investment disbursement in the remaining months of 2022 to attain 95-100% of the plan set by the Prime Minister.

By year's end, the government plans to have distributed 50% of the socioeconomic recovery package. Consequently, Mr. Tran Duc Anh, Head of Macro & Strategy at KB Securities, anticipates that public investment disbursement would reach 90-95 percent of the target, or more than VND200 trillion released between September and December. The payout may, however, fall short of expectations due to factual and subjective reasons like sluggish construction progress, high raw material costs, and site clearance obstacles.

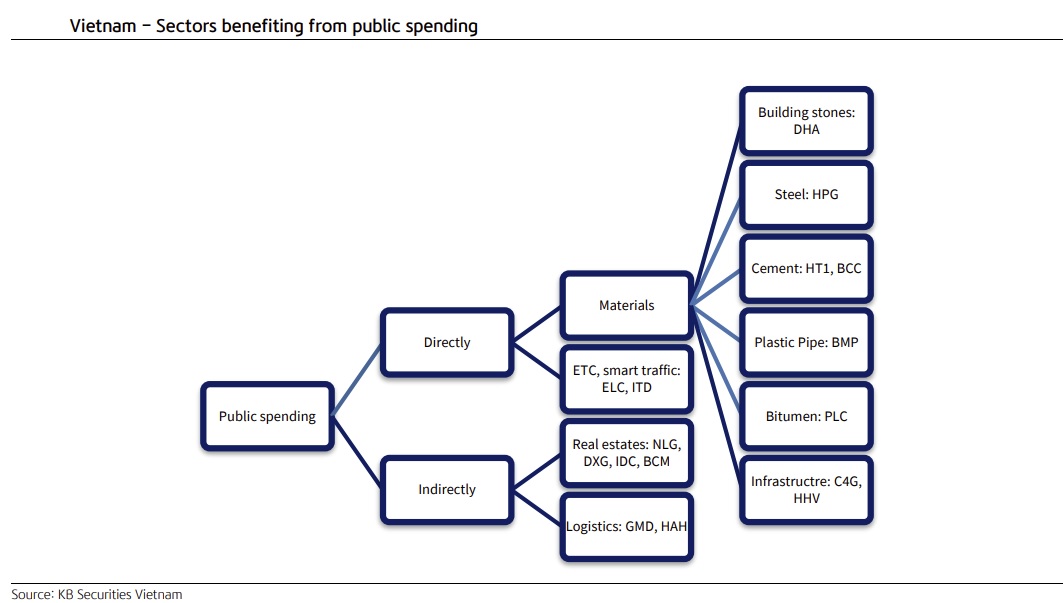

In Mr. Tran Duc Anh’s view, sectors benefiting from public spending include direct beneficiaries (building materials and infrastructure construction) and indirect beneficiaries (residential and industrial real estate). Specifically, the steel industry will benefit from the promotion of infrastructure projects. Particularly, Hoa Phat Group (HPG) is the top priority, given its leading market share in Vietnam and sustainable competitive advantage.

Building stone companies are the next significant beneficiaries of public investment, especially those owning quarries near key public projects with large reserves in Dong Nai and Long Thanh, namely Tan Cang and Thien Tan quarries. Two listed companies with quarries meeting the above criteria are Hoa An JSC (DHA) and Bien Hoa Building Materials Production and Construction (VLB). However, Mr. Tran Duc Anh prefers DHA considering its strong financial position, high performance, and attractive dividend.

>> Accelerating public investment disbursement

For the cement industry, Vicem Ha Tien Cement (HT1) and Bim Son Cement (BCC) are of top interest, according to Mr. Tran Duc Anh. However, he said it would not be an attractive sector due to the following reasons: (1) domestic supply exceeds demand; (2) key raw material prices, such as coal (which accounts for 30-35% of total cost), remain high, while cement prices cannot offset the increase in input prices.Also, exports seem subdued, especially to the major export market of China. However, investors may consider investing in this industry when the situation improves and stocks fall sharply to more attractive prices.

The plastic pipe industry has a bright prospect on the expectation of increased output and improved profit margin thanks to prices of PVC, key input material, plummeting and approaching pre-pandemic levels and rising plastic pipe prices since late 2021. However, plastic pipe companies often have to offer discounts to gain market share since there are no optical barriers to entry. Moreover, enterprises are running at only 50-70% of the design capacity and do not export plastic pipes due to product characteristics. Tien Phong Plastic (NTP) in the north and Binh Minh Plastics (BMP) in the south. "We prefer BMP given its favorable geological location in a key economic region with public investment promoted and that it can capitalize on input materials from the parent company. However, we assess that the current stock price has partly reflected the potential", said Mr. Tran Duc Anh.

The asphalt industry may benefit from public projects in the final stage when the construction work on road surfaces is complete, but there are simply a few listed enterprises. "We pick out Petrolimex Petrochemical Corporation (PLC) given its largest share (25-30%), the production capacity of 350,000 tons/year (much higher than that of its competitors), seven factories nationwide, many warehouses, and distribution system through PLX stores," said Mr. Tran Duc Anh.

Three construction enterprises, Deo Ca Traffic Infrastructure Investment (HHV), CIENCO4 Group (C4G), and Vinaconex (VCG), won the bid packages for the construction of public projects. C4G is seasoned and experienced in developing traffic infrastructure in Vietnam with large-scale projects such as the North-South expressway (Mai Son Expressway-National Highway 45 (VND2.498 billion), Vinh Tuy 2 Bridge (VND1,255 billion), Vinh Hao - Phan Thiet Expressway (VND3,225 billion), Phan Thiet - Dau Giay Expressway (VND2.299 billion), and taxiways. It helped C4G continue to win new bid packages in the 2022-2025 period.

Meanwhile, HHV is bidding for and investing in four projects Cam Lam - Vinh Hao, Huu Nghi - Chi Lang, Dong Dang- Tra Linh, and Tan Phu - Hoa Loc. The construction of these megaprojects is under the new PPP (Public-Private Partnership) law in which the State will contribute up to 50% of the total investment amount, thus easing the pressure of borrowing on BOT construction businesses. However, only Cam Lam-Vinh Hao has begun capital formation, whereas HHV is preparing legal procedures for the remainders and conducting feasibility studies.Furthermore, the BOT construction often lasts 30 months, so HHV can only turn a profit from these projects in 2024. Investors should pay special attention to the projects’ profitability, financial structure, and corporate governance efficiency when investing in this sector.

"Companies with intelligent traffic management also benefit from the North-South expressway project phase 1 and 2. Innovative Technology Development (ITD) and Elcom Technology Communications (ELC) are the two largest enterprises in terms of market share in this segment", said Mr. Tran Duc Anh.

Electrical contractors are benefiting from the implementation of infrastructure projects. One typical stock is Refrigeration Electrical Engineering (REE). REE will likely win the contract for the Long Thanh airport project thanks to its long experience in previous airport projects such as Noi Bai, Tan Son Nhat, and Da Nang airports.

Residential and industrial real estate businesses owning landbanks adjacent to key projects and logistics companies are likely to benefit indirectly from public projects. However, it still depends on the implementation and scale of these projects. Typical stocks are Nam Long Group (NLG), Dat Xanh Group (DXG), IDICO Corporation (IDC), Investment And Industrial Development (BCM).