Will HVN continue to thrive?

Vietnam Airlines JSC (Vietnam Airlines, HoSE: HVN) would become more competitive with the rise in charter capital as per the National Assembly's policy.

On January 21, 2025, HVN is anticipated to hold an extraordinary shareholders' meeting to examine the plan to issue shares in order to raise funds. The National Assembly has decided on this as one of the ways to help HVN recover and grow in a sustainable manner.

Ready to raise capital

HVN would therefore issue additional shares to its existing owners in order to increase its charter capital, up to a maximum of VND22,000 billion. The National Assembly gave the Government permission to designate the State Capital Investment Corporation (SCIC) to purchase shares at HVN on behalf of the Government under the purchase rights of State shareholders when HVN carries out the plan to increase its charter capital in phase 01 on a scale of VND9,000 billion.

The Government was tasked by the National Assembly to oversee the plan's implementation in phase 2, which included transferring the State's power to buy shares to businesses at a maximum scale of VND 13,000 billion. If there are any issues, a report needs to be sent to the appropriate authority.

As of right now, HVN has not yet made the meeting documents public; it has just published the Resolution on the General Meeting of Shareholders. The fact that the General Meeting of Shareholders will take place in the midst of the streamlining of State agencies is one reason why a lot of investors and shareholders are interested in this meeting. What effect will it have on HVN's capital increase?

A financial specialist claims that the Commission for the Management of State Capital at Enterprises (CMSC), which represents State capital management at HVN, will cease operations and hand over the duties and rights of the State ownership representative for 19 State corporations and groups to the appropriate ministries in accordance with the new orientation.

Among the aforementioned 19 corporations is HVN. However, SCIC's ability to exercise its purchase rights will remain unaffected. In order to assist HVN's cash flow for payments and to make up for financial losses brought on by the pandemic, SCIC previously instituted the policy of allocating about VND 7,000 billion to purchase HVN shares in 2021. "It is not yet known which ministry or agency will take over the management of HVN, but the capital increase will help HVN increase its competitiveness against at least 120 international airlines coming to the Vietnamese market," said the aforementioned expert.

Outlook for 2025

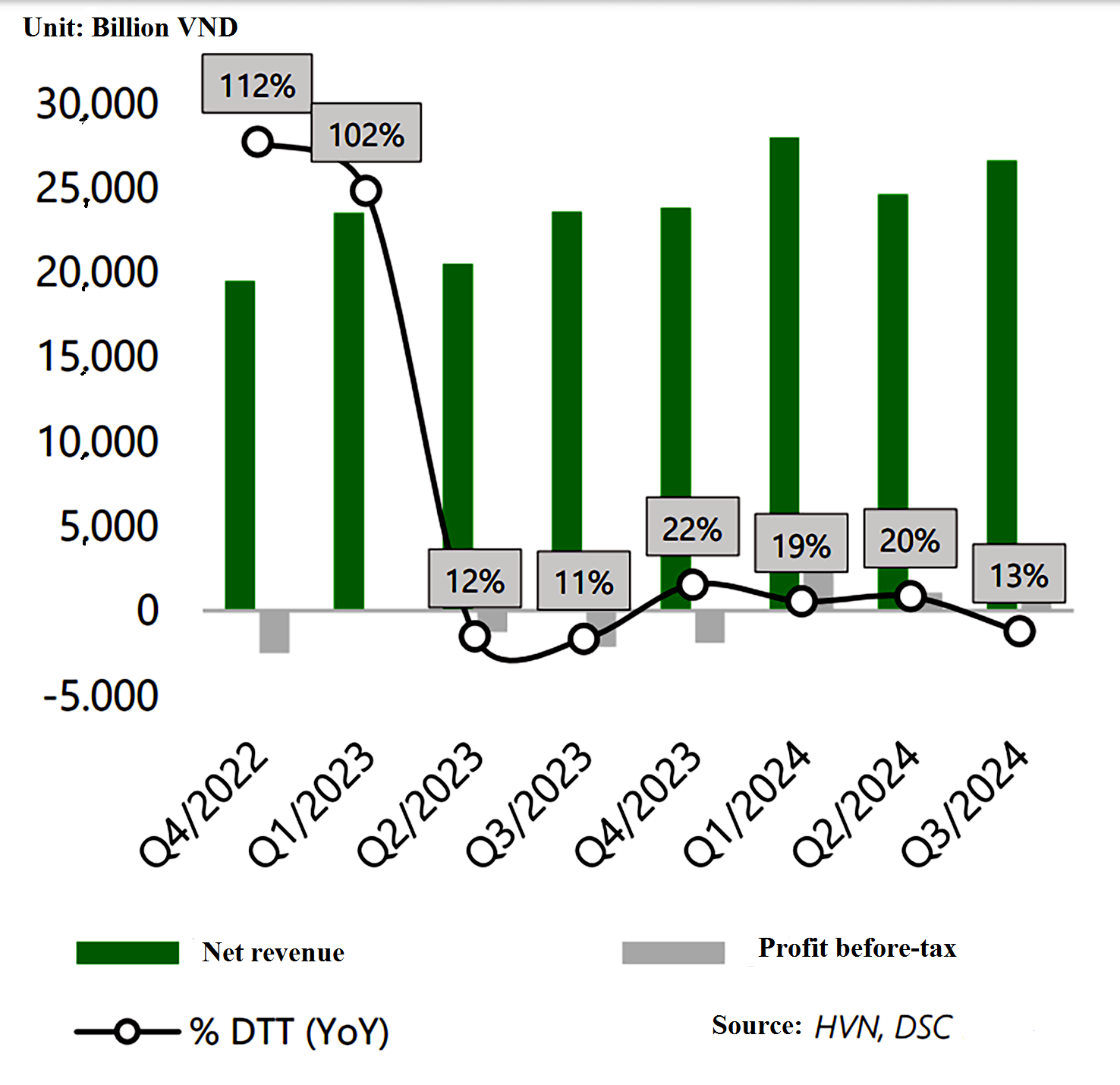

Financially speaking, unaudited estimates indicate that HVN will rank among the top 5 state-owned corporations under CMSC management in 2024, with revenue of VND 113,577 billion and pre-tax profit of VND 6,264 billion, surpassing the yearly budget by 7% and 38.5%, respectively. HVN's four-year losing streak has officially come to an end with this outcome.

Since HVN does not currently have a 4Q2024 financial report, even with this recovery, the company's equity was still negative at VND 11,086 billion in 3Q2024, and its total accumulated loss was VND 35,255 billion, down VND 5,832 billion from the start of 2024. HVN's total assets were VND 57,351 billion, a fall of VND 356 billion from the start of 2024. As of the end of September 2024, HVN had a total debt of VND 68,438 billion, of which VND 22,126 billion was its financial debt. This represents a 19% decrease from the start of the 2024 year.

The National Assembly had already consented to let HVN prolong the refinance loan's payback period at the end of June 2024. In order to get around the immediate problems, the State Bank of Vietnam automatically extended the repayment period for HVN's VND4,000 billion loan three times.

The aviation industry's business outlook is reflected in HVN's strong 2024 financial results, which are predicted to continue to improve in 2025, when both passenger traffic and revenue are anticipated to hit all-time highs. This is another aspect that is expected by investors with a big increase in stock price. The substantial rise in shares is also a motivating factor for investments in the State's equity capital, which is now held and is anticipated to grow even more through purchase rights soon.