Will real estate credit become more accessible?

Successive initiatives to address issues and obstacles in the real estate (RE) and corporate bond markets are projected to ease access to real estate finance.

Many policies boosting real estate credit have been enacted, in addition to Resolution 08/2023 supporting the corporate bond market and Resolution 33/2023 taking steps to remedy challenges in the RE and corporate bond markets.

Removing Credit Barriers

Significant policies promoting real estate loans, according to financial analyst Nguyen Le Ngoc Hoan, include:

First, Circular 02/2023/TT-NHNN states that credit institutions and foreign bank branches may renegotiate debt repayment conditions and maintain debt groups to assist customers who are experiencing problems in their commercial activities and customers who are struggling to repay loans for personal and living costs.

Second, Circular 03/2023/TT-NHNN states that the execution of Clause 11, Article 4 of Circular 16/2021/TT-NHNN regulating credit institutions and foreign bank branches purchasing and selling corporate bonds is suspended.

Circular 10/2023/TT-NHNN, finally, suspends some provisions of Circular 06/2023. If Circular 10 "clears" barriers to credit, particularly in the RE sector due to legal progress-related regulations (now temporarily suspended), Circular 06, with the remaining provisions remaining in effect until September 1, 2023, is favorable for credit, particularly for developers and homebuyers.

With bank programs that facilitate transfers and maximum loan durations of up to 35 years, banks may easily target project development and house buying for loans.

Furthermore, Resolution 144/NQ-CP from the regular government meeting in August 2023 continues to direct the State Bank of Vietnam (SBV) to vigorously disburse credit packages totaling VND 40 trillion to support interest rates, VND 120 trillion for social housing loans, VND 15 trillion for the forestry and aquatic sectors, and other funds.

It is worth noting that the government urgently requires the evaluation and adjustment of risk coefficients for various RE segments in Resolution 144; review lending and corporate bond investment regulations to align with the comprehensive development policy for the corporate bond market in accordance with Resolution 33/NQ-CP dated March 11, 2023.

Finally, after four interest rate reduction, the deposit interest rate has reduced dramatically. This condition permits banks to keep existing loan interest rates low and new loans for medium and long-term requirements at a "acceptable" level.

What to expect?

Market observations show that, while the banking system is "overflowing with money," as recognized by SBV Deputy Governor Dao Minh Tu, lending is difficult. Banks must accept responsibility for their credit quality; in the context of continuous debt restructuring owing to the effects of Covid-19, bad debts in the system remain high, making banks wary of lending.

Furthermore, the real estate market is vulnerable to stagnation, liquidity difficulties, and payment defaults for many developers. As a result, banks are wary about financing to developers, new projects, and especially lending against future assets.

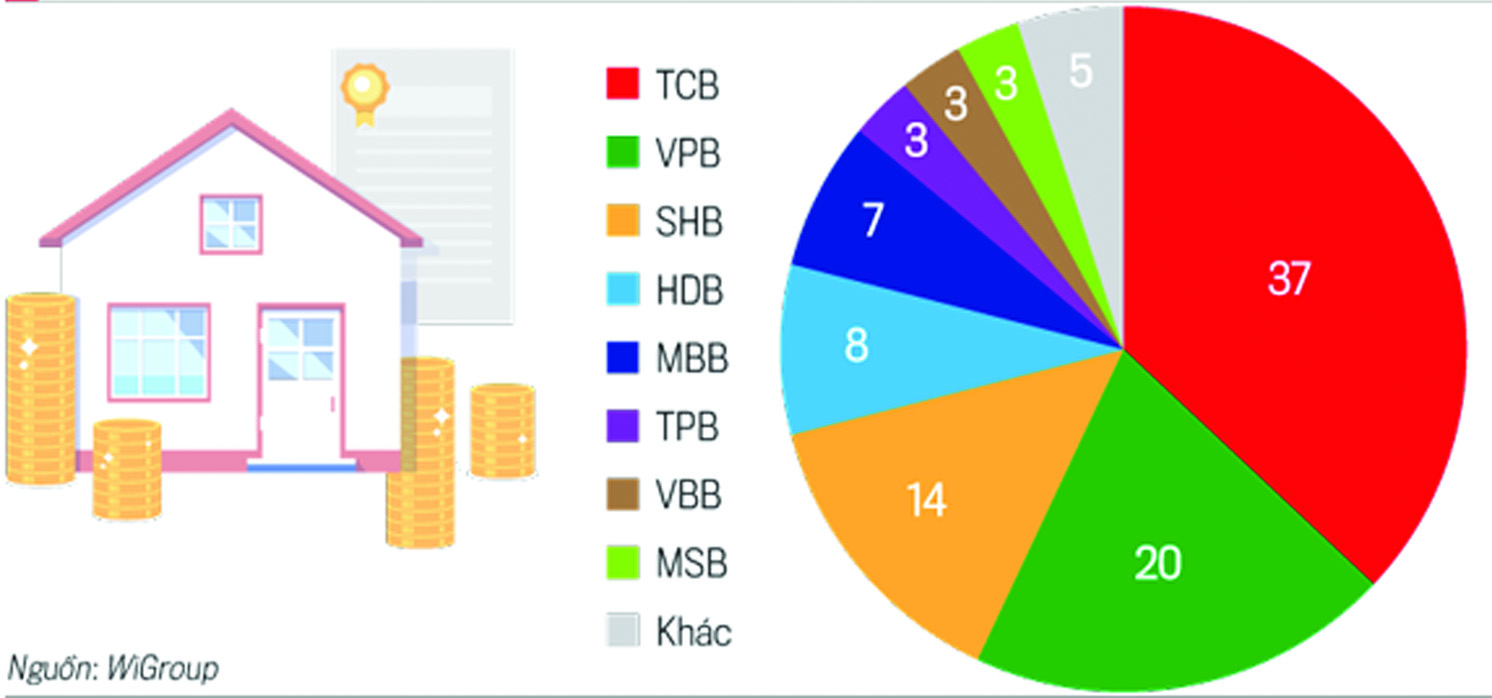

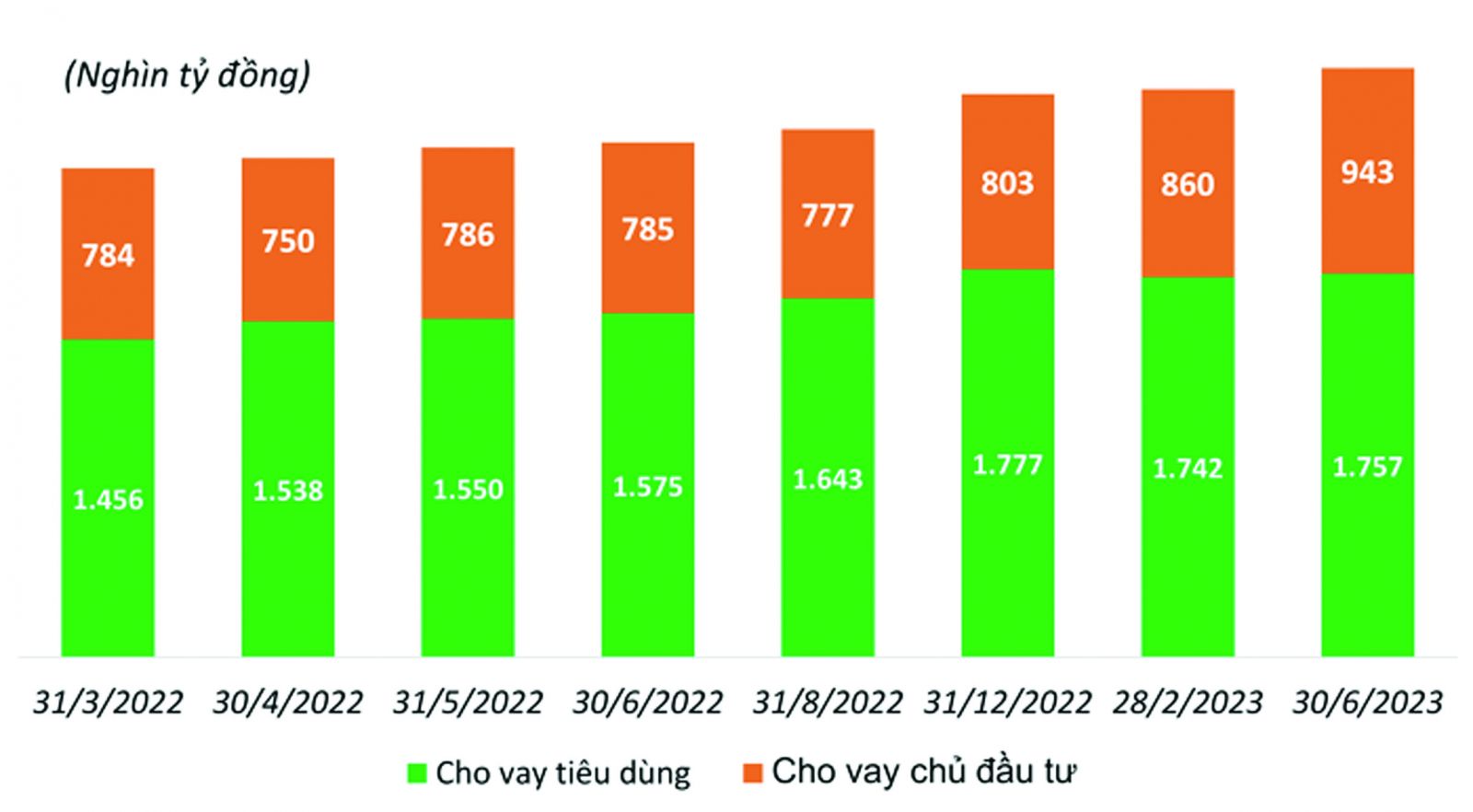

According to SBV figures, RE credit now represents for around 20% of overall credit in the economy. Business RE debt climbed by 17.41% in the first six months of 2023, above the growth rate of the full year 2022 (10.73%). However, consumer debt, or self-use of RE, accounted for 65% of RE credit, a 1.12% decrease. It may be claimed that 2023 is the first year in three that a pattern of decreasing consumer RE credit has emerged. Previously, consumer RE credit climbed by 31.01% by the end of 2022.

This demonstrates that credit funds are focused on the supply side of the market, whereas credit to acquire RE for consumption and self-use is declining. To estimate the actual capital supply to the real estate sector in recent times, look at the total value of existing debt and determine how much is accumulated debt and how much is fresh debt.

According to experts, given the existing scenario, RE credit cannot increase greatly. If banks readily embrace this program, there is a prospect of a rise in RE lending (owing to the circulation of loans through the system), but this is accompanied with concealed dangers of rising bad debts in the future. Credit, in general, cannot flow as freely into real estate as it did during periods of high market liquidity.

Furthermore, this is dependent on banks' favorable interest rates on RE loans. Consumer debt and self-use of RE will continue to drop in the face of the danger of loan capital costs when applying high floating rate spreads, as they are now.