Will the Fed hike rates at least once more?

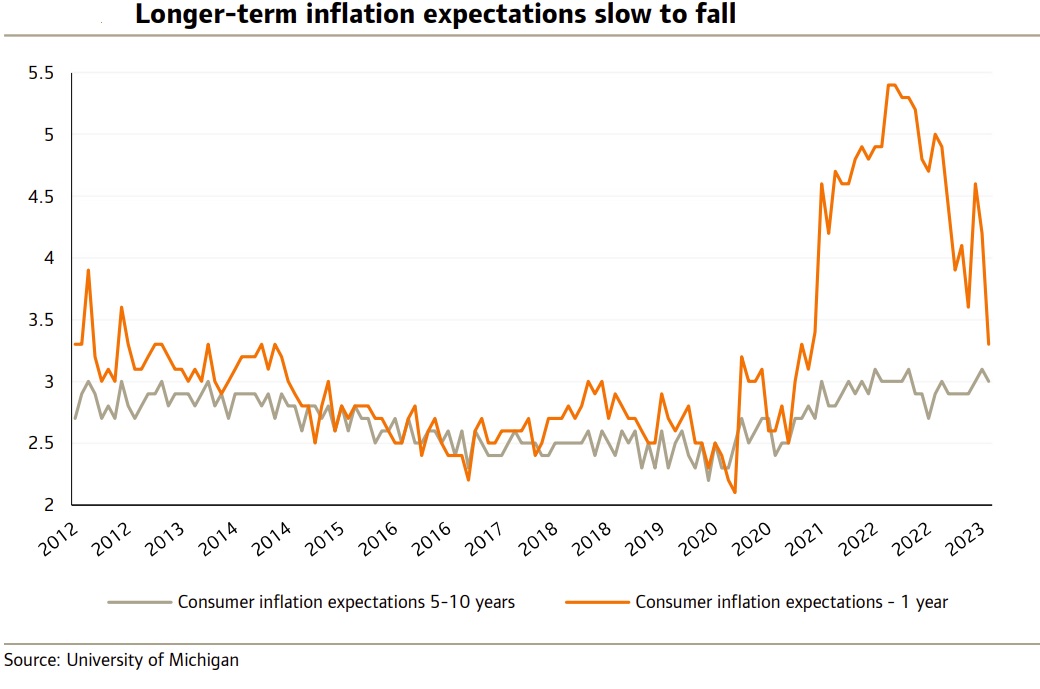

Since the US CPI fell significantly in June, the FED might only raise interest rates once more.

FED funds rate have nearly reached their top, which means that in the coming year, anticipation for rate decreases will truly take off.

>> Will the US dollar move by the end of the FED’s tightening cycle?

The US dollar has traded in a pretty tight range so far this year against other major currencies. We had been expecting this to continue until clearer signs emerged that the Fed had reached the peak on rates, allowing expectations for rate cuts to really ramp up. But in recent days, the dollar has fallen through the bottom of these ranges, and it matters whether it is now entering the next decisive downleg in what we expect to be a multi-year decline.

The US dollar has been remarkably stable so far this year, trading inside a rough 5% trading range against other advanced-country currencies using the Fed’s trade-weighted measure, or mostly inside a 1.05–1.10 range if we just want to use the euro or dollar.

Mr. Steve Barrow, Head of Standard Bank G10 Strategy, said that these ranges would persist for a while yet before the US dollar gives way to the downside and a 10–20% trade-weighted fall over the next couple of years, consistent with the euro/dollar rising to the 1.30 region. But the earlier ranges are being broken now following the sub-consensus US CPI data earlier in the week. Hence, it seems that we might not have to wait to see the dollar begin its next lurch lower. But could this be jumping the gun? After all, it is only one CPI number.

The Standard Bank’s call for the dollar to enter a multi-year downtrend is partly based on the fact that the Fed’s tightening cycle will morph into an easing cycle, and this will pull the dollar down even as other central banks cut as well. However, there is a key condition here, which is that the transition from tightening to easing happens in a smooth way as the Fed gets on top of inflation. Such a transition should allow asset prices such as bonds and stocks to rise, and this ‘risk-on’ environment should exacerbate the dollar’s weakness.

But should Fed easing come about because of some adverse development, such as the realization that central banks have mistakenly overtightened massively, then the dollar would be more likely to rally as this would be consistent with risk-averse sentiment among global investors. In Mr. Steve Barrow’s view, the policy transition will be smooth, and in spite of some scares on this front, like US regional banking strains in March, he still feels that this is justified.

But a key judgment has to be made around timing as well. For instance, if the US dollar is going to fall as the Fed transitions from tightening to easing, when will this occur? Here we are not just talking about the timing of the Fed’s last hike or its first cut, but also how the FX market will lead or lag these developments. The US dollar bears will try to get ahead of the Fed’s easing cycle by a considerable amount. This is what usually happens. One way to see this is to look at how the dollar’s rise in recent years came when the US yield curve started to flatten (as the market anticipated future rate hikes); it did not start with the first rate hike. By the time the Fed first lifted rates in March 2022, the dollar’s DXY index had already rallied by 10%, and that started when the US curve began to flatten.

>> Will the FED leave rates unchanged?

In short, the US dollar bulls tried to get ahead of Fed rate hikes, and now the bears will try to get ahead of Fed rate cuts. Hence, anything like a sub-consensus CPI only adds fuel to those dollar bears looking to get short well ahead of the easing cycle. But have the bears jumped the gun here?

The US curve has not clearly re-steeped yet, and the Fed does still have at least one more rate hike up its sleeve. So, from this, it does seem that it is a bit too early to be jumping on the weaker dollar bandwagon, despite the slide we’ve seen this week. This being said, we should not forget that the US dollar has been broadly rallying since 2011 and is significantly overvalued on many measures. This suggests that the US dollar bears won’t be easily put back in their cage. So, now that the break lower has happened, it seems more likely to us that it will continue rather than unwind significantly.