Will U.S inflationary pressure ease?

This week sees another inflation test in the US in the shape of the July CPI data. The monthly CPI is forecasted to increase by an average of 0.2% per month since the start of the year which is probably a record. But economists expect inflationary pressure to ease as, crucially, does the Fed.

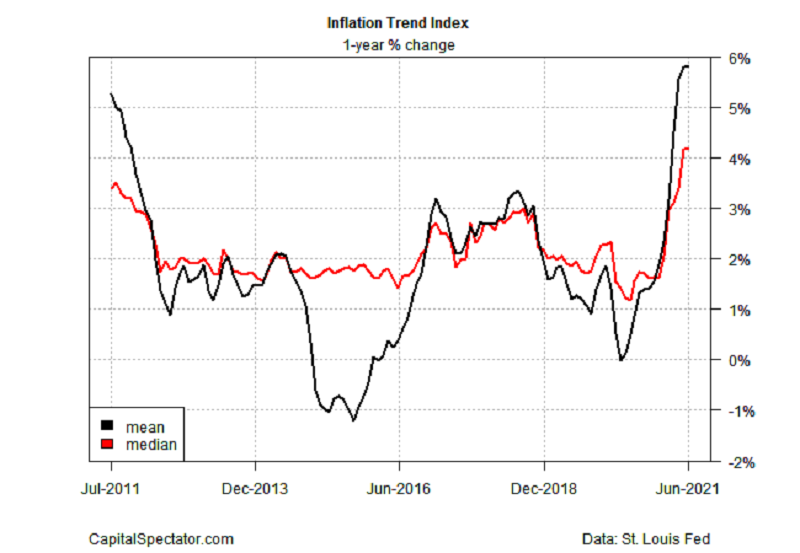

US inflation trend index

The sharp increases in CPI inflation to date have come primarily from base effects in terms of the annual rate (given low monthly increases during the height of the coronavirus crisis last spring), and supply shortages when it comes to high monthly prints. On the latter, a number of relatively low-weight components of the CPI produce outsized impacts on the overall figure. For instance, in June, over one third of the 0.9% monthly increase came from used cars. This in turn, continues to reflect the global chip shortage that has affected new car production. Airline fares, which account for a tiny 0.7% of the CPI index managed to lift the June CPI by two tenths on its own. Its impact was greater than shelter which is nearly a third of the CPI. Hence, we can understand when Fed Chair Powell and others argue that there is not too much to worry about because the rise in the CPI is being driven by a small number of relatively low-weight components and price pressures here will abate in time.

However, Mr. Steve Barrow, Head of Standard Bank G10 Strategy didn’t disagree that the rise in inflation is happening in this way. But what he fears is that, as these low-weight categories start to experience smaller monthly increases, their impact on the CPI will be usurped by bigger increases in the highly-weighted categories, specifically shelter. Why do he thinks this? The first thing to bear in mind about shelter prices, which comprise actual rents and what’s called “owners” equivalent rent (which is the “rent” homeowners would expect to collect if they rented their houses/apartments) move slowly. For a start, rental agreements are usually made for long periods; 3 months or even a whole year.

We think that this could mean that an acceleration in shelter inflation, which has not happened so far (it is running at a 2.6% annual rate), could start to occur soon. We think there’s very widespread evidence that market rental prices are rising quite fast now. There’s also evidence that consumers are anticipating much higher rents in the future. If we see these sorts of trends come through into the rental category of the shelter component, and perhaps have a bearing on owners’ equivalent rent in time, we could be looking at persistently higher inflation than policymakers and the market expects, said Mr. Steve Barrow.

For while the current crop of high-inflation, low-weight categories should start to see prices moderate in the future, this impact will be obliterated when it comes to the full CPI if a category as large as shelter, with its 1/3rd weight starts to accelerate even by just a few tenths in monthly terms. Another point is that millions of renters, who have faced legal protection from eviction since last September, have now lost this benefit. If that leads to a surge in evictions, or even just a rise in fears of evictions, as many expect, it will be an opportunity for landlords to bump up rents.

Of course, this may take some time to play out as far as the CPI data is concerned but it is still another factor that could keep shelter prices elevated in the future and frustrate the Fed’s hopes of returning inflation back to target. Of course, the target is not CPI inflation; it is PCE inflation and these shelter effects are slightly more modest for the PCE than the CPI (shelter has a smaller weight in the PCE price data than the CPI). Nonetheless, Mr. Steve Barrow do see risks and, with respect to the PCE itself, statisticians are said to be taking a closer look at the way in which rental prices impact the PCE which many think could eventually lift PCE prices a bit further if computational changes are made. “As we have noted before, official CPI/PCE price data does not tend to reflect the bouts of strength that we see in house prices and rental prices fully. Anything that closes this gap risks creating higher CPI and PCE price measures than before”, Mr. Steve Barrow stressed.