Will Vietnam’s stock market continue to recover in June?

The recovery of the Vietnamese stock market might continue in June, but market liquidity remains low.

The VN-INDEX plummeted 18.7% ytd

>> Will Vietnam's stock market bottom out in 2Q22?

Negative sentiment spread out

Following the sell-off in April, the VN-INDEX continued to suffer from negative sentiment and dramatically fell to 1,218.81pts (-10.8% mtd, -18.7% ytd). The market sell-off momentum could be attributed to three factors: (1) the Federal Reserve tightened monetary policy more aggressively to control inflation; (2) concerns about a slowdown in global economic growth due to high inflation, supply chain disruptions, and tightening global financial conditions; and (3) unfavorable movements in the global stock market.

Regarding year-to-date performance, the VN-INDEX plummeted 18.7% ytd, as well as many other markets. Only the JCI Index (3.9% ytd) and the STI Index (3.0% ytd) have shown positive performance since the beginning of 2022.

The average trading value of three bourses decreased 33.2% MoM (-33.8% yoy) to VND17,587bn (HOSE: VND15,167bn/trading day, -32.1% mom; HNX: VND1,669bn/trading day, -34.6% mom; UPCOM: VND750bn/trading day, -47.7% mom). "We believe market liquidity lost steam due to negative market sentiment about global economic prospects in the context of (1) high inflation globally due to supply chain disruptions; (2) the FED stepped up tightening of monetary policy to curb inflation; and (3) a gloomy growth picture of China's economy due to the pursuit of zero-COVID policy," VNDirect said.

In the context of high fuel prices due to sanctions imposed on Russia, only the oil sector witnessed money inflows in May, at a modest level of 1%, when money outflows from every other sector.

Steel (-6% mom), Transportation (-10% mom), Brokerage (-14% mom), Banking (-20% mom), Electricity (-30% mom), Food & Beverage (-31% mom), and Real Estate (-31% mom) have experienced less liquidity reduction than the overall market.

On a month-to-month basis, other sectors including gas supply (-40%), chemicals (-41%), construction (-43%), construction materials (-45%), IT (-46%), and retail (-48%) had a larger decrease than the general market.

>> Foreign capital returns to Vietnam's stock market in 2022: SSI

Factors to support the market

VNDirect expects Vietnam's economy to grow 5.6% yoy (/- 0.2% pts) in the second quarter of 2022, improving from a 5.0% growth in 1Q22. Vietnam's GDP would grow 7.1% yoy in 2022F.

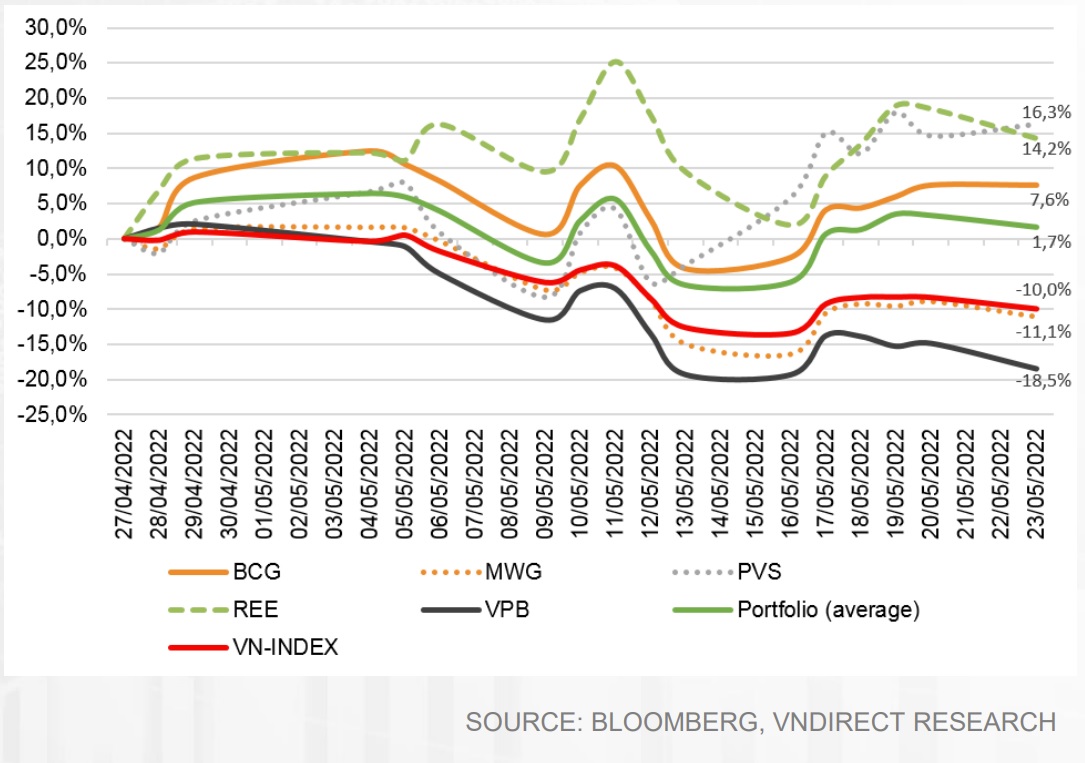

Performance of the recommended stocks in May (data on 23/05/2022).

The main supports to Vietnam’s economy come from (1) a low base in 3Q21 when Vietnam's GDP dropped 6.0% yoy; (2) the reopening of non-essential services, including public transport, tourism, and entertainment; (3) new economic stimulus packages (VAT reduction, raising the size of interest rate compensation package, disbursing infrastructure investment package...); (4) the recovery of FDI inflows after the government allowed international commercial flights; and (5) strong export activities.

Companies listed on HOSE have strong business prospects for the period 2022–2023. VNDirect forecasts the net profit growth of companies listed on HOSE to increase by 21% yoy over the next two years. This growth rate doubles that of the past 15 years. Some sectors would see a strong improvement in earnings growth in 2022, including industrial goods and services (huge contribution from ACV), retail, and real estate, while the performance of oil & gas, utilities, and technology remains relatively strong.

According to historical data, VN-INDEX mostly recorded positive growth in the years when the profit growth of listed companies was over 10% (15 years on average), except in 2010 when Vietnam had to deal with high inflation and Vinashine's default.

As at May 23, 2022, the VN-Index was trading at 13.1x trailing 12-month P/E, which is a 24.6% discount to the peak this year and a 21.1% discount to the 5-year average P/E. VN-INDEX's P/E had just fallen below the -2 standard division (of the 5-year average P/E). According to statistical probability, less than 5% of the time P/E falls below this level, indicating that the market valuation is at a very cheap level compared to the historical average.

"We expect market earnings growth of 23% yoy and 19% yoy over FY22-23F, which brings market valuation to 11.9x FY22F P/E and 10.1x FY23 P/E, much lower than the 5-year historical average P/E of 16.5x. The valuation of Vietnam's stock market is discounting on average by about 20% compared to other markets in Southeast Asia. "Weighing both catalysts and concerns above, we think the stock market valuation is very attractive for long-term investors who seek good corporate governance companies with strong earnings growth," VNDirect said.

This stock company expects the market's recovery will continue in June. However, the market has not established an uptrend yet and market liquidity is still low. Therefore, investors should maintain a moderate proportion of stocks and limit the use of leverage (margin) at the moment to minimize risks. The first resistance level of the VN-INDEX is 1,280-1,300 points. The second resistance level of the VN-INDEX is 1,320–1,330. The strong support level of the market is 1,200-1,220 points.