Will Vietnamese economy maintain its recovery?

After a very tough few months caused by the need for severe lockdowns, we are now finally on some firmer ground.

According to the General Statistics Office of Việt Nam, about 1.3 million labourers returned to their hometowns from July to mid September due to COVID-19 restrictions. Photo: Quoc Tuan

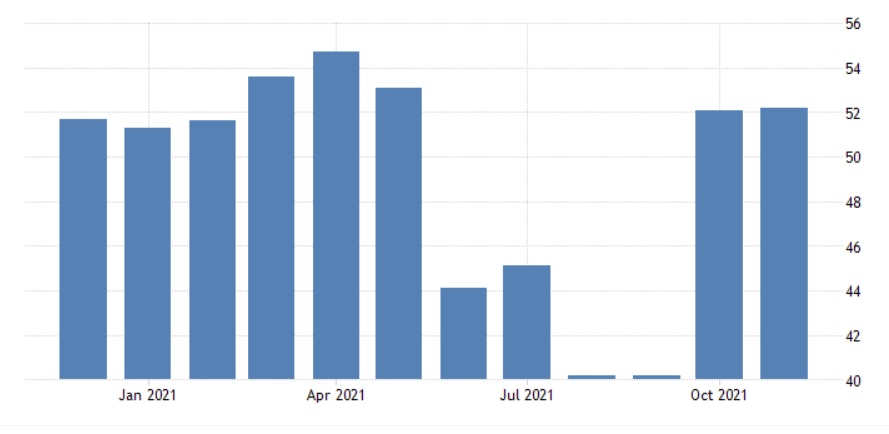

The PMI index which reflects confidence, ticked up to 52.2 in November signalling a second successive modest improvement in business conditions following a period of decline caused by the 4th Covid wave that started in April. Activity has picked up over the last few months and confidence is slowly returning though challenges remain around getting workers back into factories. Vietnam’s supply chain recovery has been impacted by widespread shortage of labour, particularly in labour-intensive sectors. According to the General Statistics Office of Việt Nam, about 1.3 million labourers returned to their hometowns from July to mid September due to COVID-19 restrictions. As a result, 17.8% of the 22,764 businesses they surveyed experienced a shortage of workers with the highest rate being recorded in the Southeast region at 30.6%. That said, new export orders have started to stabilize, as manufacturers are catching up with their backlogs of orders. Price pressures have also eased over the past month as raw material prices have started to cool.

Whether we are about to embark on a strong return to sustained growth remains to be seen. As a result of the easing of production disruptions and pent-up pressures in global supply chains, we are starting to see a bounce but we need to be mindful of any slowdown in export growth as developed markets start to move consumption from goods back to services.

We should also take a closer look at the tech sector which has had a significant positive impact on the Vietnamese economy. We are starting to see orders for consumer electronics starting to cool down a little. This is partly because during the first wave of lockdowns, households around the world spent heavily on everything from laptops to networking gear and new TVs to gaming consoles.

As a result, demand has started to subside but this has been in part offset by rising demand for industrial electronics, comprising components that feed into machinery and other production equipment. We anticipate that if the world can continue to pull out of the Covid crisis, there will be a significant capital investment cycle that will take place across the world which should ensure that demand for industrial electronics remains robust and this will benefit the Vietnamese economy.

The PMI index which reflects confidence, ticked up to 52.2 in November signalling a second successive modest improvement in business conditions following a period of decline caused by the 4th Covid wave that started in April.

Another key and growing contributor to Vietnam’s economic performance prior to Covid was tourism. For the Vietnamese economy to fire on all cylinders, we will need at some stage to see a resumption in tourist flows.

In 2019, Vietnam had 18M tourist arrivals and they generated a contribution to GDP of $33bio. Prior to the onset of Covid, Vietnam was forecasting 20M tourist arrivals in 2020 with a contribution to GDP of $36bio which would have represented c. 14% of total GDP. By November, Vietnam had only 140,106 foreigner arrivals, which represents a reduction of over 96%.

This revenue engine has fallen silent over the past 24 months but as the Delta wave gradually subsides alongside increasing vaccination rates, discussions are starting about potentially relaxing some travel restrictions and gradually re-opening borders. The Vietnamese tourism sector has direct implications for growth and the local job market. The challenge in 2022 will be how the Covid pandemic evolves especially with the latest Omicron variant. While Vietnam’s daily infections have fallen dramatically by 70% from their peak of in August, there are signs of surging cases again which could delay any material reopening of the tourist sector which will have a knock on effect to overall economic recovery in the year ahead.