Will VN-Index hit 1,480 points by end-year?

The average 2021F EPS of businesses on the HSX should rise 13% compared to the current level, KB Securities Vietnam forecasts VN-Index could reach 1,480 points by end-year.

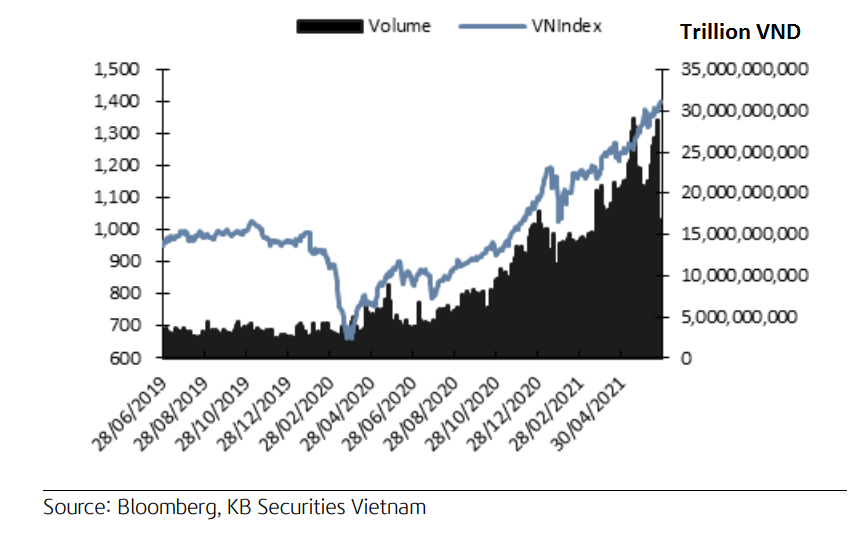

VN-Index and trading volume over the past time

Vietnam's stock market in 1H21 was mainly boosted by the recovery in production and business operation of listed companies, and also supported by low interest rates, controlled inflation and stable exchange rates. The VN-Index has increased 23% since early 2021 despite the COVID-19 pandemic, while trading value quadrupled that in the same period last year.

However, with strong performance of businesses in 1Q 2021 (which helped average TTM EPS increase 14%), the P/E of the VN-Index is still maintained at a reasonable level of 18.6 times, which is far higher than 15.9 times of the last two years.

In KB Securities Vietnam’s view, KB Vietnam's stock market has outstanding attractiveness compared to regional markets thanks to same factors. First, strong earnings growth thanks to a growing economy and lowering interest rate (VNIndex's P/E was much lower compared to the other three markets in ASEAN4. Second, better P/B correlation with ROE, and P/E correlation with EPS CAGR in the last three years.

In H2, the driving force for the market growth should be the successful performance of listed companies (especially bluechips of the banking, steel, securities, utilities, and IT sectors), and the market conditions are expected to be favorable (high economic growth, controlled inflation, low interest rates and stable exchange rates).

Based on the comparison between the current VN-Index and regional indices and VN-Index itself in the past, KB Securities Vietnam expects the fair level of the VN-Index at the end of this year to be 1,480 points (corresponding to P/E of 18 times, the average TTM EPS 2021 of businesses in the VNIndex basket up 13% compared to the current level).

With positive outlook of the market in H2, any significant correction of the market (given the risk factors do not change the basic conditions of the market in the long term) should be a good chance for raising the portfolio proportion.

“The most likely correction phase will occur in the second half of the 3Q as the positive effects from the 2Q earnings season faded, the profit-taking pressure at high price zones needs to be relieved, and other risks emerge (the Fed mentioned asset purchase reductions in the September meeting, escalating commodity prices raises the risk of inflation, the resurgence of the COVID-19 is more unpredictable amid the emergence of new variants and slow vaccine rollout). We believe that buying & holding is a reasonable strategy for most investors amid a volatile market in 2H21”, KB Securities Vietnam recommended.

KB Securities Vietnam said, real estate, industrial parks, power, container ports, information technology, banks, fisheries, and oil & gas are sectors that have a positive outlook in 2H21. The main growth drivers of these sector are: low interest rates (banks & real estate), the relocation of production bases to Vietnam, and trade recovery thanks to accelerated vaccination programs in developed countries (real estate, industrial parks, container ports and fisheries), an uptrend in commodity prices (oil and gas) or maintained growth rate of some sectors despite macro fluctuations (information technology and electricity).