A boost needed for green credit

Hoang Nguyen Khai, an expert from the Ho Chi Minh City University of Technology, believes that the message conveyed by the Prime Minister at COP28, stating "said to do, done must be committed," along with a green vision to address climate change, is the right time to boost green credit.

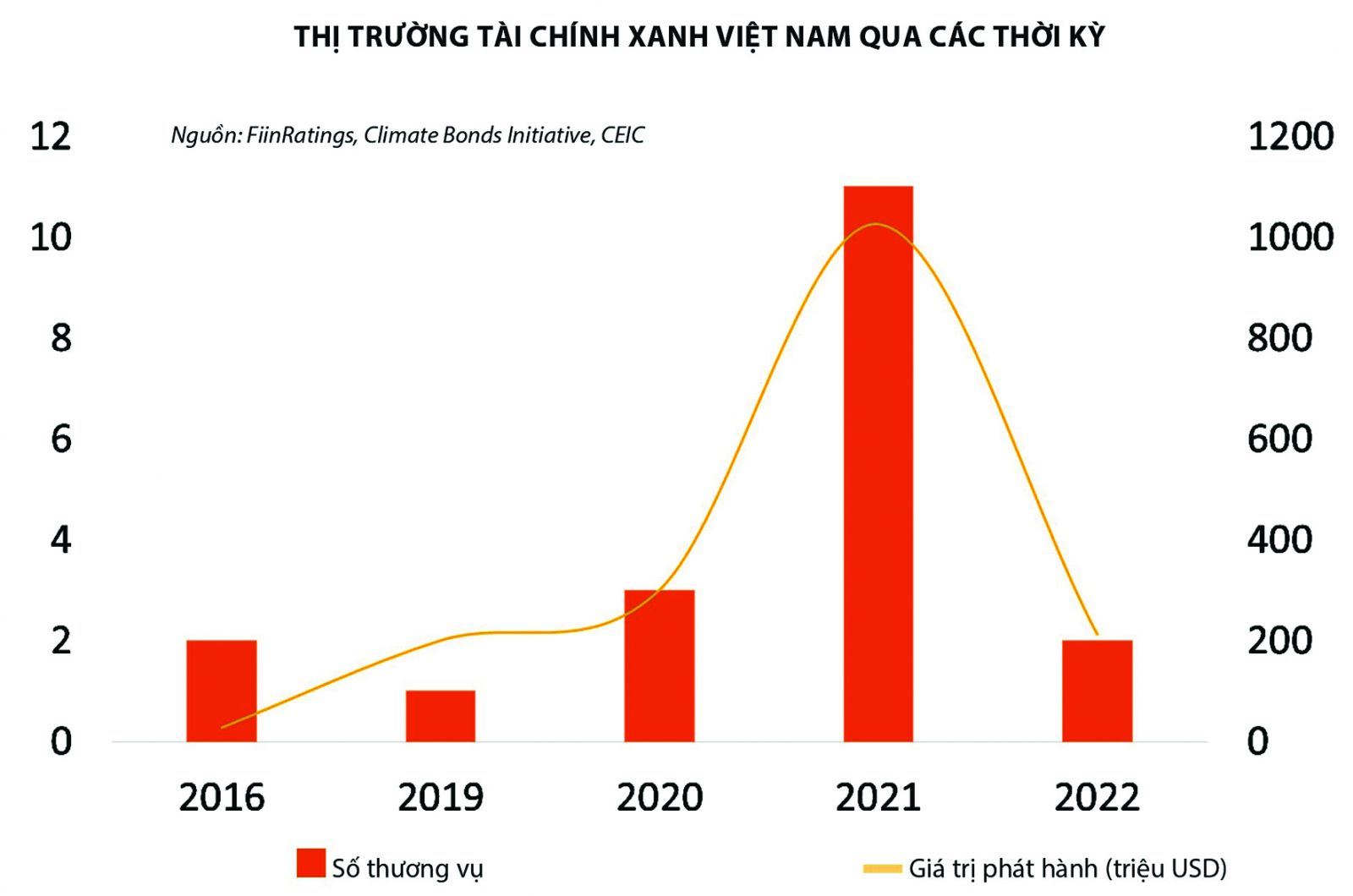

Foreign banks operating in Vietnam have demonstrated serious interest in green financing since the late 1990s. Vietnamese banks are also making a concerted effort to provide green loans to enterprises, in line with international integration and the government's international obligations to green economic growth.

Current situation of Green Credit

Vietnamese financial institutions' green loan portfolios continue to grow, particularly in projects connected to wind and solar power, circular economy projects in the textile and garment sector, high-tech agriculture development, and clean agriculture projects.

From 2017 to 2022, the credit outstanding for green industries in the banking system increased at a rate of more than 23% each year on average. Green credit outstanding at financial institutions reached almost VND 528.3 trillion as of June 2023, accounting for around 4.2% of overall credit outstanding in the economy.

Credit is predominantly focused on renewable energy (45%), and green agriculture (31%), among the 12 green sectors advised by the State Bank of Vietnam for financing. Environmental and social risk assessments in credit operations have been strengthened by financial institutions, with ecologically and socially evaluated credit totaling roughly VND 2.485 trillion, accounting for over 20% of total banking system lending to the economy. The scope and share of financial institutions' lending capital for green economic sectors has grown over time, going from 3.33% of total economic credit in 2018 to 4.20% in 2022.

Notably, many financial institutions have adopted internal environmental and social risk laws, with 80-90% of credit institutions incorporating ESG (Environmental, Social, and Governance) into their operations. Almost half of banks and financial institutions have risk management divisions dedicated to green credit environmental protection. Agribank regularly has the largest green credit outstanding in the banking sector, and BIDV is a pioneer in green economic financing, with green credit outstanding growing at a pace of 45% on an annual basis. Other Vietnamese banks, such as Vietcombank, Vietinbank, MB, Techcombank, VPbank, and others, have achieved yearly growth rates of more than 45% in green credit outstanding for their clients.

Renewable energy, circular economy in the textile sector, environmental elements of wood processing goods, and climate change projects in the Mekong Delta are among the projects that finance institutions are focusing on.

Proposed solutions

Despite initial achievements, the total amount of green credit outstanding remains relatively modest, needing solutions to accomplish greater goals. Following are some proposals based on the existing circumstances and economic needs:

First, key sectors, communities, and enterprises must see this as both an opportunity and an urgent need to adopt green economics. It is necessary and voluntary for businesses to proactively submit clear and complete environmental impact assessments when approving investment strategies, project investment approvals, and when enterprises develop investment projects or seek bank financing. This is a critical basis for financial institutions to increase their green credit outstanding.

Second, the State Bank of Vietnam should enhance the legislative framework for green financing as soon as possible, providing clear and thorough documentation in this regard. The State Bank of Vietnam should continue to work with relevant ministries to advise the government, including the Ministries of Natural Resources and Environment and Finance, on perfecting the legal framework for sustainable development, green economics, and green credit in order to create mechanisms to attract international financial resources suitable for green development goals. Furthermore, the State Bank of Vietnam must raise awareness and spread information on green credit not only for regulatory purposes, but also to assist banks in analyzing risk management and environmental and social norms.

Third, the government authorizes the State Bank of Vietnam and several key ministries to publish an urgent Green Credit Portfolio for the economy, which will serve as the foundation for financial institutions to properly and swiftly evaluate green credit loan applications.

Fourth, the government should immediately direct relevant ministries to improve the Vietnam Carbon Market Development Project, defining the State Bank of Vietnam's responsibilities and the role of financial institutions in lending and mobilizing funds through the green bond market.

Fifth, financial institutions must continue to raise awareness about the need of growing green credit for the economy, so establishing the framework for supporting green economics in other business areas. Financial institutions must recognize this as a critical area in need of efficient execution. Whether the outcomes are good or not, financial institutions must combine with improving credit officers' professional understanding of green economics.

To help promote green credit, green banking, the capital market development plan, and participation in the bond market in order to concentrate resources on sustainable development in Vietnam, it is necessary to raise awareness of the role of green credit and green banks in achieving the goals of the National Green Growth Strategy, implementing the results of COP26-COP28, and carrying out the National Climate Change Strategy until 2050. Financial firms should develop proactive ESG risk assessment departments.