ACV stocks attract cash flow

Airports Corporation of Vietnam (ACV)'s shares draws significant investment due to improving business outcomes and airport operations.

ACV stocks remain popular among investors because to continued corporate expansion. On June 11, the ACV stock price hit 121,100 VND/share, with a 500 thousand unit rise in trading volume and a transaction value of 62.2 billion VND. Despite the fact that it is listed on the UpCOM market, overseas investors have been buying this stock for several months straight.

ACV stock rises sharply due to leading the aviation monopoly sector

According to the business report for Q1/2024, ACV serviced 28 million passengers over its entire airport network. Notably, overseas travelers climbed by 47% to 10.5 million, while domestic passenger numbers fell by 15% to 17.5 million. As a result, ACV had excellent revenue and net profit increases of 19.4% and 78%, respectively, over the same time previous year (core profit climbed by 29%).

In 2024, ACV expects parent company sales of 20 trillion VND (up 2%) and parent business pre-tax profit of 9.3 trillion VND (up 6%). ACV is presently awaiting a modification to Decree 140/CP that will allow dividend payments in shares, allowing it to use equity to fund planned investments that are scheduled to be finished by June of this year.

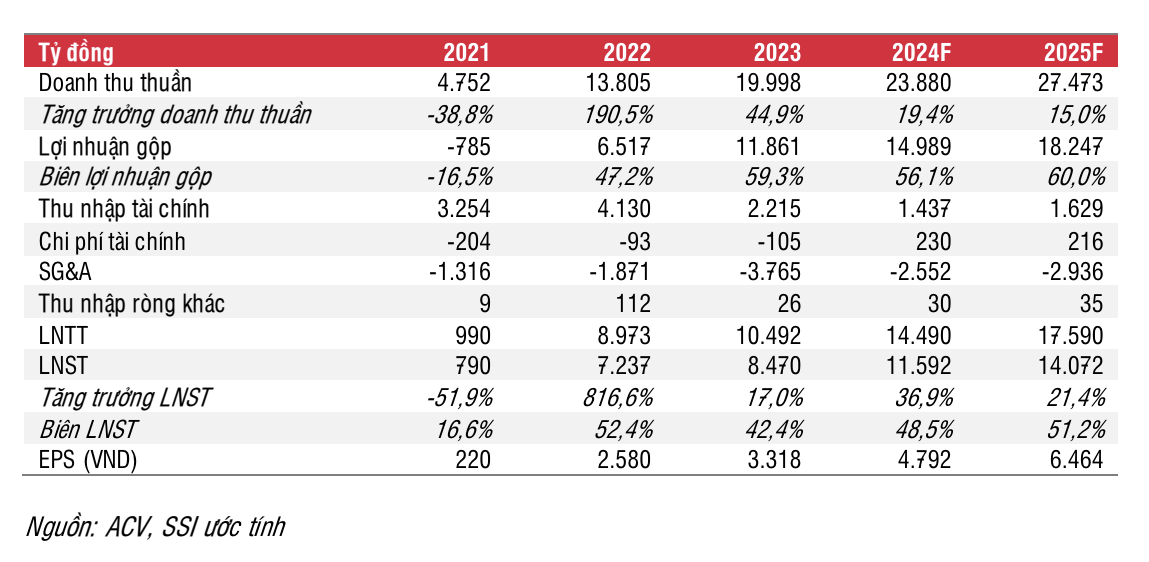

According to recent SSI Securities Company projections, ACV's revenue for 2024-2025 is predicted to be 23.9 trillion VND (up 19.4%) and 27.5 trillion VND (up 15%), with pre-tax profit of 14.5 trillion VND (up 38%) and 17.6 trillion VND (up 21.5%). This expected revenue level is historically high, assuming a 14% rise in passengers in 2024 and a 10% typical growth rate in 2025.

SSI predicts that the rebound in the number of foreign passengers will be the primary growth driver for ACV in 2024 and 2025. Domestic passengers may fall by 3% in 2024 as some aircraft are stopped for engine repairs before recovering in 2025, however foreign passengers are predicted to rise by 67% in 2024 and 18% in 2025. SSI predicts that the JPY exchange rate would fluctuate insignificantly against the VND this year.

On the cost side, ACV may gradually reduce provisioning in 2024-2025 due to improved cash flow from airlines (HVN, VJC) or downsizing (Bamboo Airways, Pacific Airways).

Regarding the Long Thanh airport project, it is forecast to become operational by 2027. With an investment of 100 trillion VND and a depreciation period of 20 years, ACV will have to recognize an additional 5 trillion VND/year in depreciation expenses by 2027, which will slow ACV's growth rate. Therefore, investors should consider holding ACV stocks in light of these short-term risks.

Based on the above analysis, SSI recommends ACV stock, with a 1-year target price of 136,000 VND/share based on EV/EBITDA and a 2025 target price of 160,000 VND/share. Short-term stock price support factors include strong growth momentum due to passenger recovery, reduction in aviation-related provisions, and approval for dividend payments in shares that have been pending since 2019.