More rooms for monetary easing

The VND/USD exchange rate has cooled, while capital absorption capacity may expand, creating a more favorable environment for monetary policy and credit growth.

Exchange rate lower as predicted

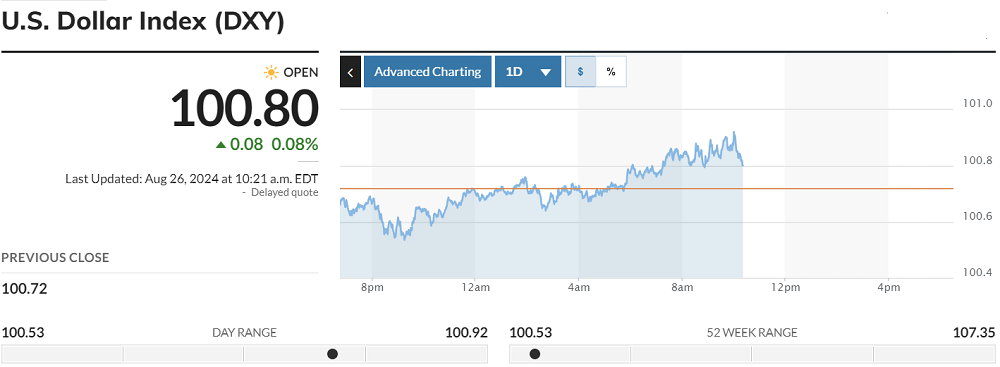

The USD Dollar Index (DXY) was marginally higher at the commencement of trade on August 26 (8:50 a.m., EDT), trading at 100.82. The DXY has declined swiftly over the previous five trading days, from 101.88 on August 19 to a low of 100.56 on August 25, indicating good reactions to the "dovish" words made by the US Federal Reserve Chairman during his address in Jackson Hole last weekend.

USD Index approaches 100 for the first time. Source: Marketwatch

With the DXY falling rapidly to the 100 region for the first time in two years, this is one of the first signs of the Fed's likely shift in monetary policy.

Similarly, U.S. Treasury bonds are sliding swiftly as the Fed's words prompt a rethink of the interest rate forecast. The 10-year US Treasury bond yield fell to 3.8%, its lowest level in two years.

"These factors have a highly beneficial influence on the global financial market and alleviate exchange rate pressure on various currencies, notably in Southeast Asia, including Vietnam," stated Mr. Đoàn Minh Tuấn, Head of FIDT Research and Analysis Division.

Along with the severe and quick depreciation of the US dollar on the international market, the VND/USD exchange rate is likewise trending downward.

Despite the central bank's (SBV) announcement of a 4 VND increase over the previous weekend, the USD exchange rate at commercial banks fell dramatically in the first session of the week on August 26, with some institutions cutting rates by up to 131 VND.

Specifically, according to SBV’s announcement, the central exchange rate of the Vietnamese dong to the USD on August 26 was set at 24,254 VND/USD. Based on the 5% trading band, commercial banks can trade with an upper limit of 25,467 VND/USD and a lower limit of 23,041 VND/USD. The reference buying and selling rate of USD at SBV’s exchange office remains around 23,400-25,450 VND/USD.

At Vietcombank, the USD purchasing and selling rate as of early August 26 was 24,700 - 25,070 VND/USD, down 100 VND for both buying and selling compared to the start of the previous weekend session.

Similarly, USD trading rates at VietinBank were lower than the permissible ceiling rate, and USD rates at several commercial banks, such as Techcombank, Sacombank, and Eximbank, were similarly lower, with the highest selling price recorded at 25,083 VND/USD.

Previously, according to SBV statistics for the week of August 12-16, 2024, interbank market transactions in VND showed a general decline compared to the previous week. The one-week and two-week terms decreased by 0.09%, while the six-month term saw the largest drop of 1.75%.

Compared to the previous week, interest rates for two-week, three-week, three-month, and six-month maturities fell by 0.04%, 0.02%, 0.13%, and 0.36%, respectively. Interest rates for overnight and one-month contracts increased by 0.01% and 0.2%, respectively.

According to the average interbank interest rate table for important periods between August 12 and 16, 2024, the overnight borrowing interest rate in VND with the highest transaction volume was 4.46%. However, by the session on August 23, 2024 (the conclusion of last week), this rate has fallen to 4.42%.

Similarly, the average interbank interest rate for USD borrowing across all durations varied from 5.32% (overnight) to 5.45% (one month), which was close to the Federal Funds Rate.

Further liquidity and capital support needed

According to one expert, the high USD interest rates on the interbank market may remain elevated in the short term and are likely to fall below 5% only when the Fed cuts interest rates as expected in September. However, if import demand remains high in the third quarter while export contract revenues are delayed, USD interest rates or transaction volumes on this market may stay high until these pressures fully ease.

SBV is flexibly managing monetary policy to support growth. Illustrative image

On the other hand, if the SBV maintains its easing policy following two interest rate adjustments via treasury bills and open market operations (OMO), as well as additional liquidity injection to support short-term liquidity at lower costs for banks, this will provide critical support for banks borrowing in VND or USD converted to VND for short-term payment needs and re-lending.

From the beginning of Q3 2024 to mid-August 2024, the SBV injected more over 90,700 billion VND through treasury notes and OMO; including just the beginning of August, the total is approximately 29,400 billion VND. The central bank is demonstrating its willingness to support both capital costs and liquidity, particularly for smaller banks that rely on the interbank market, since they face higher capital costs due to lower CASA and NIM ratios, providing them more room to extend credit into the market.

“With a weak DXY and the effective intervention of SBV through prior foreign exchange sales, these effects have now filtered through the market, reducing pressure on the VND/USD exchange rate. The key factor to watch now isn’t Fed policy anymore but gold prices, as gold price volatility, if any, could significantly impact the VND/USD exchange rate,” said an expert.

According to the analysis division at MBS Securities, the SBV’s policy of maintaining high interbank interest rates has helped narrow the interest rate gap between the USD and VND, thus supporting the prevention of the VND’s depreciation. While interbank interest rates have dropped to around 4.2-4.42%, further decreases are unlikely.

However, the early cooling of the VND/USD exchange rate, falling below the 5% band at commercial banks and even lower than the forecasts of financial institutions, is a highly positive signal for the economy, capital flows, and businesses with USD-denominated loans. MBS predicts that the exchange rate in Q4 will be around 25,100 – 25,300 VND/USD, which is lower than the current trading rates at commercial banks.

MBS also notes that positive factors such as the trade surplus (14.1 billion USD in the first seven months of 2024), FDI inflows (12.6 billion USD, 8.4% year on year), and a strong tourism recovery (51% year on year in the first seven months of 2024), as well as "the stability of the macroeconomic environment is likely to be maintained and further improved," will serve as a foundation for exchange rate stability in 2024. Furthermore, with inflation remaining constant, there is a chance for flexible monetary easing, which will encourage credit expansion.