Banking sector: Credit growth as a main momentum

Credit growth will be the main momentum for Vietnam's banking sector to get the best performance in 2022.

Among banking shares, KB Securities recommends watching Techcombank (TCB) and VietinBank (CTG).

Business performance in 2021

According to the State Bank of Vietnam (SBV), as of November 25, 2021, the economy’s credit growth was 10.1% (138bps MoM). The average CASA of the listed banks studied hit 23.0% (0.8% YTD) in 3Q21. CASA's improvement, along with the SBV's policy of cutting interest rates to support the economy, made the average deposit interest rates in 3Q21 reach only 3.43% (-85bps YTD).

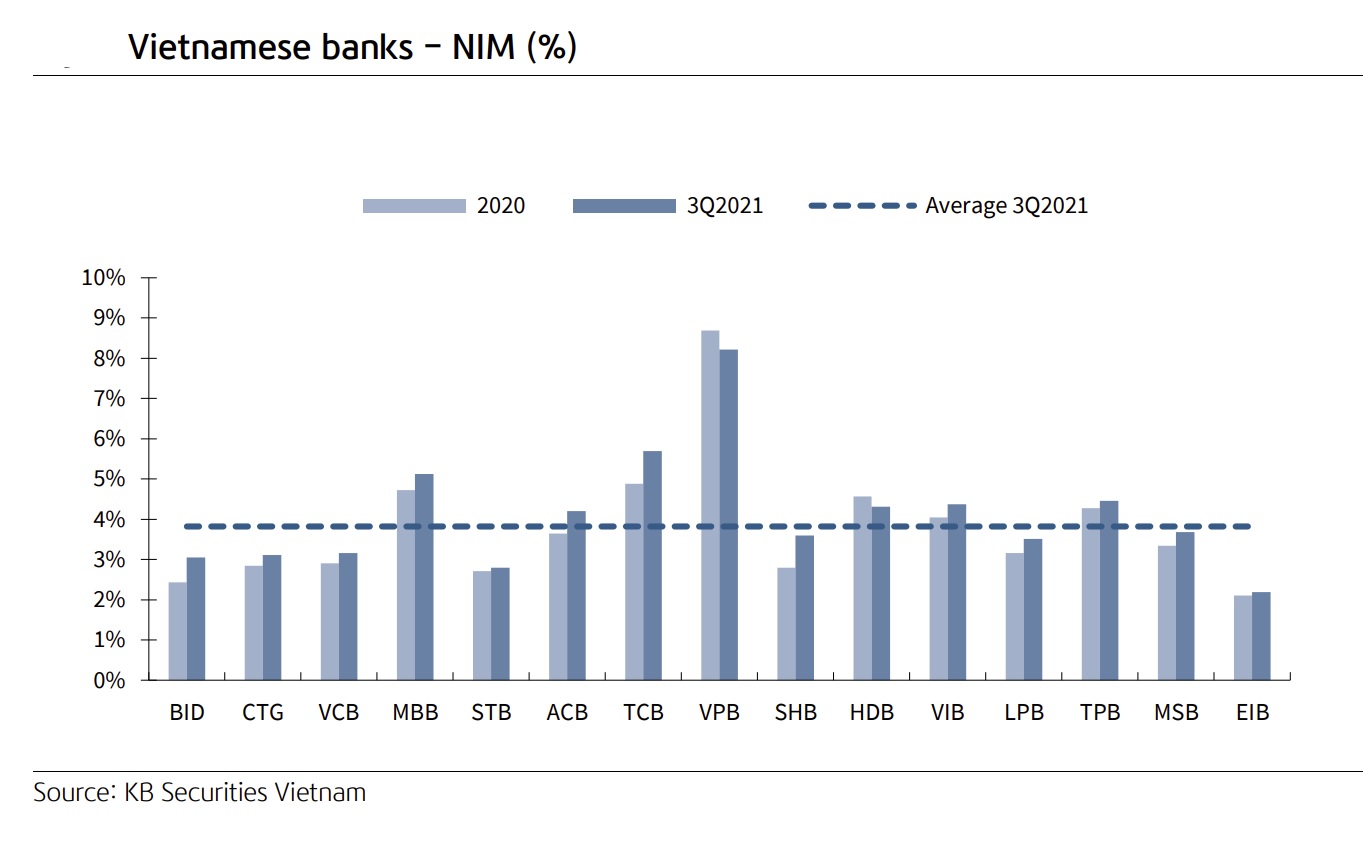

Meanwhile, the average earnings yield hit 7.04% (-42bps YTD), and 3Q21 NIM was 3.82% (38bps YTD). The third wave of COVID-19 had a negative impact on the asset quality of banks in 3Q21. The bad debt ratio of banks under KB Securities’ coverage reached 1.58% (24bps YTD) and special mention loan sat around 1.40% (41bps QoQ). As of the end of September 2021, banks made a total provision of VND121.8 trillion (45.3% YTD), thereby raising the provisioning rate to 122.9% (13.76% YTD).

With the SBV’s raising credit caps for banks for the second time in 4Q21, Vietnam's high COVID-19 vaccination rate, and the resumption of production and business activities, KB Securities expects credit growth in 2021 to reach 12%. This should be 13- 14% for 2022, with the expectation that the pandemic will end in 2H22 and businesses will step up borrowing for operations in the context of low interest rates.

In KB Securities’ view, retail banking will still be the priority of Vietnamese commercial banks in the medium and long term when household debt to GDP in Vietnam stays low as compared to other regional peers. In addition, the development of digital banking has also been promoted, thereby enhancing the customer experience, increasing non-interest income and reducing costs for banks. The system's average cost-income ratio (CIR) in 3Q21 reached 37%, compared to 45% in 2019.

NIM reduction risk

KB Securities assessed that the NIM of the banking sector would likely shrink in 2022, supported by: (1) continued decrease in lending rates to support the economy and lower interest income due to rising bad debts; and (2) limit ed room to reduce the average cost of funds from its low base currently, along with inflationary pressure, which may cause the SBV to raise the operating interest rate in 2H22.

Meanwhile, provisioning pressure is expected to remain high in 2022. KB Securities believed that in 2022, a high NPL ratio would pose more pressure on provisioning. Besides, the appearance of Omicron may negatively affect the asset quality of Vietnamese banks. VCB, MBB, TCB, and ACB are among the few banks with an NPL ratio below 1.2% and a provisioning rate of above 180%.

Stock picks

Among banking shares, KB Securities recommends watching Techcombank (TCB) and VietinBank (CTG). Regarding TCB, it disclosed strong 3Q21 performance with an EBT of VND5,562 billion (-7.6% QoQ, 40.0% YoY) and high credit growth of 33.0% YoY/17.0% QoQ. The 3Q NIM decreased slightly but remained high at 5.69% (-11bps QoQ, 84bps YoY) thanks to the low cost of funds and a small decrease in earnings yield since the main customer group was not affected much by the pandemic.

In 3Q21, TCB successfully mobilized a foreign syndicated loan worth USD800 million. This unsecured loan consists of two amounts: USD600 million with a term of three years and USD200 million with a term of five years. This bond source significantly complements TCB's medium and long-term capital, ensuring the bank's liquidity in the coming period.

KB Securities recommend buying TCB with the target price of VND65,600 per share, 26.2% higher than the closing price on November 15, 2021.

As for CTG, In 3Q21, it recorded net interest income (NII) of VND9,872 billion (- 9.3% QoQ, 8.7% YoY) on TOI of VND12,255 billion (-13% QoQ, 6.6% YoY). However, provision expenses stayed high at VND5,548 billion (-21.9% QoQ, 14.2% QoQ), making 3Q21 NPAT hit VND2,466 billion (7.4% QoQ, 5.3% YoY). Credit growth reached 9.5%, which is the credit cap granted by the State Bank to CTG. CTG submitted to expand the limit to 10-12%. CTG expects 2021 PBT to reach VND16,800 billion, equivalent to 4Q21 PBT of VND2,889 billion.

Based on valuation results, business outlook as well as potential risks, KB Securities recommends buying CTG with a target price of VND45,900/share for 2022, 29.7% higher than the closing price on November 24, 2021.