Base scenario for inflation and interest rates in 2025

Economists Brian Lee Shun Rong and Chua Hak Bin of the Maybank Group propose that the State Bank of Vietnam (SBV) should maintain policy interest rates in 2025 as long as inflation stays under control and the government concentrates on growing the economy.

The base scenario predicts that the SBV will maintain policy interest rates in 2025, but the exchange rate remains a variable

GDP Growth Exceeds Expectations

In 2024, the economy reported impressive numbers, particularly in Q4. In Q4, GDP growth sped up to 7.55% from 7.4% in Q3, increasing annual growth to 7.1% from 5% in 2023. Slower manufacturing growth (10% YoY in Q4 vs. 11.4% in Q3) was more than compensated by improvements in services (8.2% YoY in Q4, same as Q3) and construction (8.3% YoY in Q4 vs. 7.4% in Q3).

Growth in wholesale and retail commerce (9% YoY in Q4 vs. 8% in Q3), transportation and storage (10% YoY vs. 9.9% in Q3), and lodging & food services (10.3% YoY vs. 9% in Q3) all showed that trade, transportation, and hospitality fared better than expected.

The 7.1% growth in 2024 exceeded expectations (Maybank GDP forecast: 6.7%) and the government’s 7% target. Maybank forecasts GDP growth of 6.4% in 2025, with export growth cooling, supported by solid consumption and increased public infrastructure investment.

The government is targeting 8% growth in 2025. However, it remains unclear whether this goal is achievable, given the upcoming implementation of Trump 2.0 tariffs, which may slow global trade and impact Asia’s manufacturing supply chain. Key factors to monitor include public administration reforms and Vietnam’s relations with the U.S., which could attract more FDI.

Export Growth Reaches 4-Month High in December

Alongside an improvement in manufacturing output (10.2% YoY vs. 10% in November), export growth reached a four-month high of 12.8% YoY in December (compared to 8.2% in November). Export growth for the entire year was 14.3%. Due to uncertainty surrounding President-elect Donald Trump's tariff policy, the export rise most likely reflects frontloading before his inauguration.

The trade surplus dropped to $524 million, the lowest level in seven months, as a result of greater import growth (19.2% YoY in December compared to 9.8% in November).

Trade Policies and Their Impacts

Given the expanding U.S.-Vietnam trade surplus and the uncertainty surrounding whether Trump's tariffs will target Vietnam, export growth may decrease in the upcoming months. As American consumers take a wait-and-see stance, orders may decline.

For the first time in three months, December's manufacturing PMI dropped into contraction zone (49.8 vs. 50.8 in November), mostly due to a three-month low in new orders and a second consecutive drop in export orders. It was the lowest level of manufacturer confidence in 19 months.

Tariff uncertainties are hurting FDI, but positive catalysts could provide a buffer for the future. FDI commitments are slowing due to tariff-related uncertainties, with businesses delaying FDI decisions for fear that tariffs might target Vietnam, reducing its appeal compared to other ASEAN manufacturing hubs.

However, progress in administrative reforms (e.g., streamlining government agencies and reducing bureaucracy) could improve the business environment and boost FDI. A positive development is the newly issued Investment Support Fund Decree (January 4), which allows up to 50% initial investment cost support for companies involved in high-tech projects, including semiconductor/AI production and R&D.

FDI commitments ($38.2 billion) fell by -3% in 2024, weaker than the January-November increase (1%), though the full-year figure remained higher than during 2019-2022. FDI disbursement rose 9.4% YoY to a record $25.3 billion in 2024 as prior commitments were fulfilled.

Brighter Consumption Outlook, Tourism Close to 2019 Levels

The consumption outlook is improving as the impact of Typhoon Yagi subsides, with increases in retail sales and passenger vehicle sales. A stronger labor market and financial support are positive factors for consumer demand. The government extended the 2% VAT reduction policy through June 2025 to support spending.

Tourist arrivals rose 27.4% YoY in December, with full-year arrivals (1.76 million; 39%) modestly below the record 1.8 million in 2019. December arrivals surpassed pre-pandemic levels (102.2% vs. 94.6% in November) for the first time since June, driven primarily by a surge in arrivals from China and ASEAN. These factors support domestic retail consumption.

Inflation Outlook and Exchange Rate Scenario

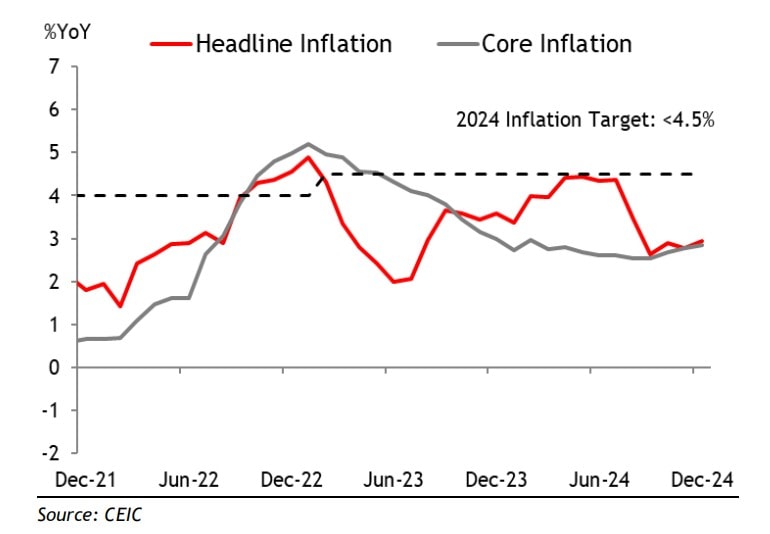

Inflation remains manageable, but exchange rate pressures are increasingly concerning for the SBV. Headline inflation is forecast at 3.4% in 2025. Average inflation stood at 3.6% in 2024, close to the estimated 3.7%.

Headline inflation (2.9% YoY in December vs. 2.8% in November) remained stable, as slower food price growth (3.9% YoY vs. 4.1% in November) offset a narrowing decline in transportation prices (-0.9% YoY vs. -3.3% in November). Core CPI edged up to 2.9% in December (vs. 2.8% in November), averaging 2.7% for the year.

Both headline and core inflation rose in December 2024, but the annual rate remained below the SBV target

The experts’ base scenario is that the SBV will maintain policy rates in 2025, as inflation remains controllable and the government focuses on economic growth.

However, USD/VND rate challenges remain a concern, with the VND testing the upper limits of the SBV’s managed float. VND depreciated by -4.6% in 2024. SBV’s foreign reserves fell to an estimated $80 billion by year-end 2024, down from a peak of $109.6 billion in January 2022 after multiple interventions.

The risk of the SBV being forced to raise policy rates or devalue the currency cannot be ruled out if the USD strengthens and the DXY rises further.