Big changes in Vietnam’s stock market

Vietnam’s stock market has seen a surge in retail investors and the number of retail accounts more than doubled between December 2018 and 2021.

The stock market in Vietnam was in the past highly concentrated around a few large stocks.

A series of reforms underway

Vietnam has outperformed all the major regional indices in the last 10 years and the market has nearly quadrupled in size since the start of 2012, with trading recently exceeded USD1bn a day. There are good reasons for all this – amongst others, being able to eke out earnings growth during the global pandemic in 2020 when others markets faced a decline in profits. In 2021, the capitalization of the stock market surpassed USD350bn, exceeding 120% of the country’s GDP.

So far this year however, the Vietnamese market is down 10%, although that still means it is marginally a relative outperformer. The reasons for this muted performance lie not just in higher USD bond yields and lockdowns in China. A series of high-profile corporate arrests has also had an impact on sentiment.

But the message is that when it comes to growth and profits, Vietnam has been on a roll.

And HSBC said there would be much to like about Vietnam’s growth story – strong economic growth in the midst of a series of reforms that are underway, a strong currency with stable FX reserves, an economy that’s well integrated in the global value chain and many Vietnamese companies benefiting from increasing infra spending and rising domestic consumption. But more about that later.

A remarkable change

As people found employment in new factories dotted around the nation, they got a steady salary, higher wages and a bank account, credit card or mortgage. That’s why the stock market saw a remarkable change in its make-up; while Consumer companies dominated in 2015, these days it is Financials and Real Estate that make up the largest portion in this market.

The stock market in Vietnam was in the past highly concentrated around a few large stocks. But those days are over too. In 2013, the top-5 accounted for 52% of total market cap; in 2022, it stands at 25%. The top-10 market caps now account for less than 20% of overall turnover. That is low.

But contrary to what many believe, the investors that pushed this market higher were not foreign, but local. The stock market has seen a surge in retail investors and the number of retail accounts more than doubled between December 2018 and 2021.

These local investors account for as much as 87% of all trading in the market, while foreigners make up the remaining c13%. In fact, as these retail investors came into the market, foreign investors withdrew (and that is still the case, at least in the last 27 of the last 33 months). In the past few weeks, foreign investors have started to dip their toes into this market again.

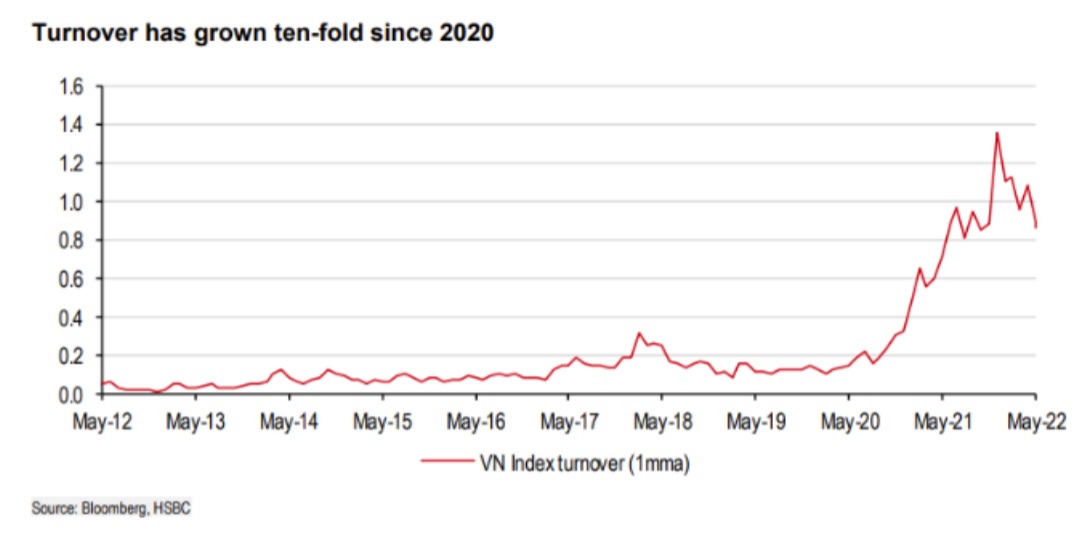

Trading liquidity is up, a lot

The result of this influx of local investors has been a tenfold rise in the average daily turnover on the Ho Chi Minh Stock Exchange, which recently crossed the USD1bn mark. That is 10x the average of USD100m (in daily trading) seen in early 2020.

“This is quite remarkable for a market that is generally considered very small and illiquid. In fact, the Vietnam market has the second highest liquidity in ASEAN, now surpassing even Singapore and Indonesia”, HSBC said.

Foreign ownership limit s are not a limit

One question that regularly pops up in discussions on Vietnamese equities are foreign ownership limit s (FOL). If foreign investors buy up to the allowed quota, they can only trade amongst themselves and a foreign price will be established, independent of the local price.

Overall the VN Index has a FOL of 44%, while current foreign holdings are less than half the limit , at c20%.

“Obviously, this ignores the possibility that foreign investors might not be interested in certain stocks –maybe they are too small or too illiquid – and that might explain why foreign ownership levels have not yet been reached”, HSBC stressed.

But in HSBC’s view, this might not necessarily hold up. Of the 30 stocks in the VN30 Index, seven have reached their foreign ownership limit s, while 12 have market caps above USD5bn and 14 have liquidity of more than USD10m a day. Eight companies have increased their foreign ownership levels since 2019. In short, foreign ownership levels in most cases no longer limit foreign investors from buying.

Local ETFs also enable foreign investors to gain exposure to FOL-restricted companies. But ETFs trading on the Ho Chi Minh City Stock Exchange (HOSE) reported a turnover of only USD600m for the whole of 2021, followed by USD275m so far in 2022. This is hardly 0.5% of total market turnover.