Black Swan risks for the stock market in 2025?

Investors' psychological preparedness to cope with risks can potentially transform 'Black Swan' risks (if any) into 'Gray Swans,' or even 'White Swans.'

Risk of Extreme Tariff Policies

The first risk is whether Donald Trump, if elected, would implement extreme trade policies as previously stated. Trump has declared intentions to impose a 60% tariff on China and 25% on other countries. This remains an "unknown variable" that has drawn significant attention from many economies and investors. Should such new tariff policies be enacted, they would not only reshape global trade but also impact inflation, GDP, currency values, and both active and passive investment channels.

Mr. Nguyen Viet Duc, Digital Business Director, VPBank Securities Joint Stock Company (VPBankS)

Mr. Nguyen Viet Duc, Digital Business Director of VPBank Securities (VPBankS), stated during the program "Vietnam and Indexes: Prosperous Finance" that he does not believe this scenario will occur. "In a recent interview, when questioned about his first 100 days in office, Trump claimed that tariffs are only a negotiation tactic. Mr. Duc reasoned that if compromises can be achieved on matters such as stopping immigration or regaining control of the Panama Canal, or if surplus-heavy nations import more US-advantaged items such as oil, the scenario will not come to fruition.

He also stated that the most serious concern with excessive tariff policy would be the return of inflation. "This is why Trump's tariff ideas are simply bargaining tactics, presumably leading to responses such as increased imports from the United States. As a result, the 'Black Swan' scenario about US tariffs has already been accounted for by the market."

For financial markets, the true impact will be realized only when Trump takes office. If his public remarks aren't too alarming, the market could continue to thrive in the coming year. If Trump implements tariffs and only China retaliates, the impact on markets will be minor, as both nations have been fighting a trade war for 5-6 years and have made adjustments to prevent big consequences.

If, however, all nations retaliate against the U.S., a "Black Swan" scenario may emerge. However, this second scenario is unlikely because Trump has stated that tariffs are applied for a reason, and if resolved, the U.S. will not impose tariffs, Mr. Duc hypothesized.

Inflation in the United States is an important indicator for Federal Reserve policy. Last week, the Fed declared that it would not decrease interest rates as swiftly as the market had anticipated. Initially, investors projected the Fed to lower interest rates three times in 2025, but that prediction was decreased to two cuts, causing a negative market reaction. "This is more troubling than Trump's tariff policy. On the plus side, the Fed's unwillingness to swiftly slash rates suggests that the US economy is still strong. As a result, we could witness a 'Goldilocks' scenario: 2% economic growth with a tolerable 3% inflation rate. While not ideal, it promotes worldwide commercial expansion. As a result, most analysts globally still predict US stocks to expand by roughly 10% next year," Mr. Duc stated.

Exchange Rate Risks

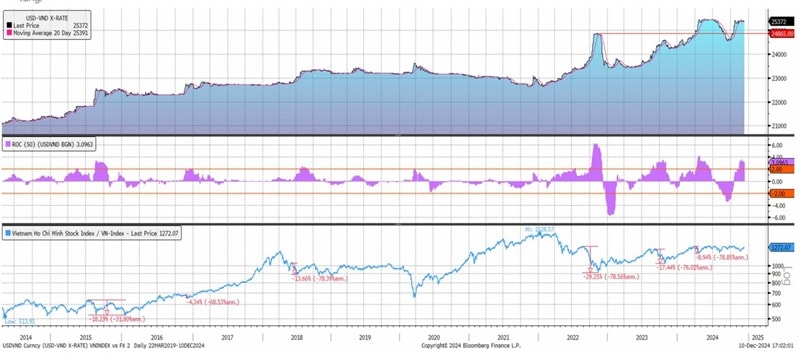

Another potential "Black Swan" risk to watch is the exchange rate issue. In 2024, market corrections in April, June, and October were all triggered by exchange rate fluctuations.

Exchange rates are a key factor influencing the market. Source: VPBankS

In emerging economies like Vietnam, China, and Brazil, exchange rates, rather than inflation, are the most critical factor. Changes in growth, CPI, and inflation are immediately reflected in exchange rates.

Vietnam's economy is highly open. With such openness, exporters need to consider not only the VND exchange rate but also the Chinese yuan exchange rate. For instance, if China or Indonesia adjusts its currency, Vietnam will also be affected. Next year's exchange rate dynamics will be influenced directly or indirectly by global trends. However, the impact is expected to be less pronounced.

During moments of high currency rate volatility, the State Bank of Vietnam (SBV) acted fast. Looking ahead, the SBV has acknowledged the concerns, and monetary and fiscal policies will be coordinated to keep the exchange rate stable.

To keep exchange rates stable, monetary expansion cannot be excessive. Positive real interest rates, or a balance between domestic and international rates, must be maintained. Those expecting aggressive monetary expansion, such as 18-20%, will probably be disappointed. Monetary policy is likely to expand by only 13-15%, ensuring GDP growth and keeping exchange rates stable.

If we list potential "Black Swan" events for 2025—such as extreme tariff policies leading to inflation and high interest rates, or exchange rate risks—they represent the greatest uncertainties. If investors are unprepared, these events could catch them off guard. However, with foresight and preparation, these risks may not materialize. Preparedness can turn "Black Swans" into "Gray Swans" or even "White Swans," the expert emphasized.