Boosting consumer stimulus packages to support growth

Experts from Maybank Investment Bank say that in order to spur economic growth, Vietnam needs to boost domestic consumer stimulus packages and trade while avoiding the risk of being monitored for currency manipulation.

President Donald Trump is expected to sign his first executive orders. Trump's tariff policies could redirect global trade flows in a new direction. Maintaining Vietnam's high growth targets will require special stimulus policies to encourage domestic consumption, attract foreign direct investment (FDI), and reduce the bilateral trade deficit with the U.S.

Potential Tariff Increases and Their Timing

Whether Trump will boost trade defense probes and apply import taxes as soon as he becomes office is a crucial topic. Maybank analysts anticipate that Trump's government will swiftly carry out his campaign pledges, with a particular emphasis on deregulation, immigration, taxes, and tariffs. They forecast that in the first three months, he will give deregulation and immigration first priority, with tariffs to follow.

Experts predict that China will be the first target of tariff increases before other nations, and that broad, quick tariff increases are improbable. Potential trade disruptions could start in early 2025 and be implemented by late 2025 or early 2026, as trade investigations typically take 6–12 months before tariffs are enforced. Trump's tariff threats on Vietnam and other nations, aside from China, might be more of a negotiating ploy than a real enforcement measure.

During Trump's first term (Trump 1.0), the U.S. initiated an average of 78 trade investigations per year, a 110% increase compared to Obama's tenure and a 55% increase compared to Biden’s first three years. Many of these investigations targeted China, leading to the Phase One trade agreement in 2020. If Trump adopts a similar approach in his second term, the number of trade defense investigations could rise again.

Responding to the Risk of Currency Manipulation Monitoring

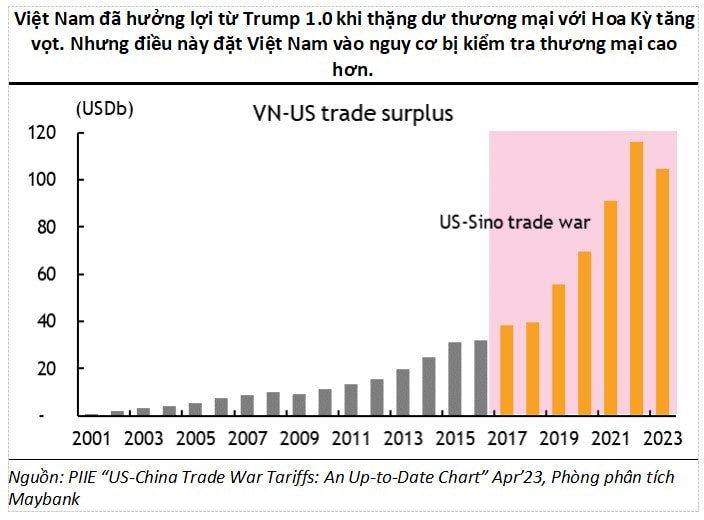

Although Vietnam may not be a direct target of U.S. tariffs, its rising trade surplus with the U.S.—which tripled from $28 billion in 2017 to $104 billion in 2023—poses a risk. The U.S. Treasury has placed Vietnam on its currency manipulation monitoring list since 2019. Trump previously used currency manipulation accusations to pressure trade partners, though their practical impact was limited.

Vietnam's trade is scrutinized more just because it is on the monitoring list. Sixty-two percent of U.S. trade investigations, including anti-dumping and anti-subsidy charges, have been conducted in 14 of the nations on this list since 2016. Vietnam's "bamboo diplomacy" approach could not be enough to protect it from more probes during Trump's second term.

Raw honey, frozen shrimp, paper file folders, shopping bags, aluminum extrusions, corrosion-resistant steel, and solar panels are among the Vietnamese exports that Maybank expects to be the subject of future inquiries. Vietnam's role in rerouting Chinese commodities is highlighted by the fact that many of the targeted enterprises have ties to China.

Strategies to Address Trade Imbalances

To mitigate risks, Vietnam is expected to increase imports of U.S. goods, such as liquefied natural gas (LNG), aircraft, and technology. Since 2019, Vietnam and the U.S. have entered comprehensive energy cooperation agreements, with U.S. firms investing in large LNG power plants. These projects could result in annual LNG imports worth $5-6 billion, primarily from the U.S. Vietnam is also expected to import additional aircraft and security equipment, potentially increasing U.S. imports by $6-7 billion annually and narrowing the trade surplus by about 6%.

The Need for Timely Consumer Stimulus Packages

Amid geopolitical uncertainties and their potential impact on Vietnam’s FDI and trade, the Vietnamese government must take a proactive role in boosting domestic investment and consumption. While domestic consumption has been sluggish, purchasing power remains resilient, awaiting well-timed stimulus measures. Infrastructure investment and domestic consumption will play crucial roles in sustaining economic growth in 2025.

The government is accelerating major infrastructure projects to stimulate the economy, leveraging fiscal policies to compensate for limited monetary policy flexibility. Despite a real estate and bond market crisis in late 2022, Vietnam's export sector has driven recovery through 2023-2024, with steady demand from the U.S. However, by 2025, domestic consumption is expected to take on a larger role in driving economic growth.

It is anticipated that important real estate regulations, including as the Land Law and the Real Estate Business Law, which go into force in 2025, will reduce delays in project approvals and boost the real estate market. It is anticipated that the number of new project launches would rise in 2025–2026, boosting market confidence and liquidity.

Indicators of consumer spending point to a possible rebound, with high demand for cars and ICT products. For example, Mobile World (MWG), the biggest ICT store in Vietnam, had a recovery in Q3 2024, while domestic auto sales reached their highest level in three years in November 2024. These patterns show that there is domestic demand, which may be increased with the help of government subsidies.

Finally, a well-timed government push can accelerate domestic consumption in 2025 and promote confidence in economic growth by producing a wealth effect.