Cash flow will tend to be more cautious

The widespread adjustment in the Vietnam stock market shows short-term profit taking pressure, but at the same time, cash flow will tend to be more cautious in the coming sessions.

During the week of September 3 - September 5, VN-Index traded in three sessions when the market was temporarily closed during the first two days of the week.

During the week of September 3 - September 5, VN-Index traded in three sessions when the market was temporarily closed during the first two days of the week. The main performance of the VN-Index during the week was to continue the movement to consolidate the momentum around the 1,670-1,690 range from last week and move up to conquer the 1,700 mark at the end of the week, before recording a fluctuating decline in the same session.

However, the index's upward momentum has not really broken out, as the large-cap group in particular and the market in general are still diverging. Some industry groups that attracted outstanding demand during the week include Real Estate - Industrial Parks, Steel, and Construction. Foreign investors maintained continuous net selling during the week and focused mainly on some blue-chip stocks such as VPB, MSN, MWG, and VHM.

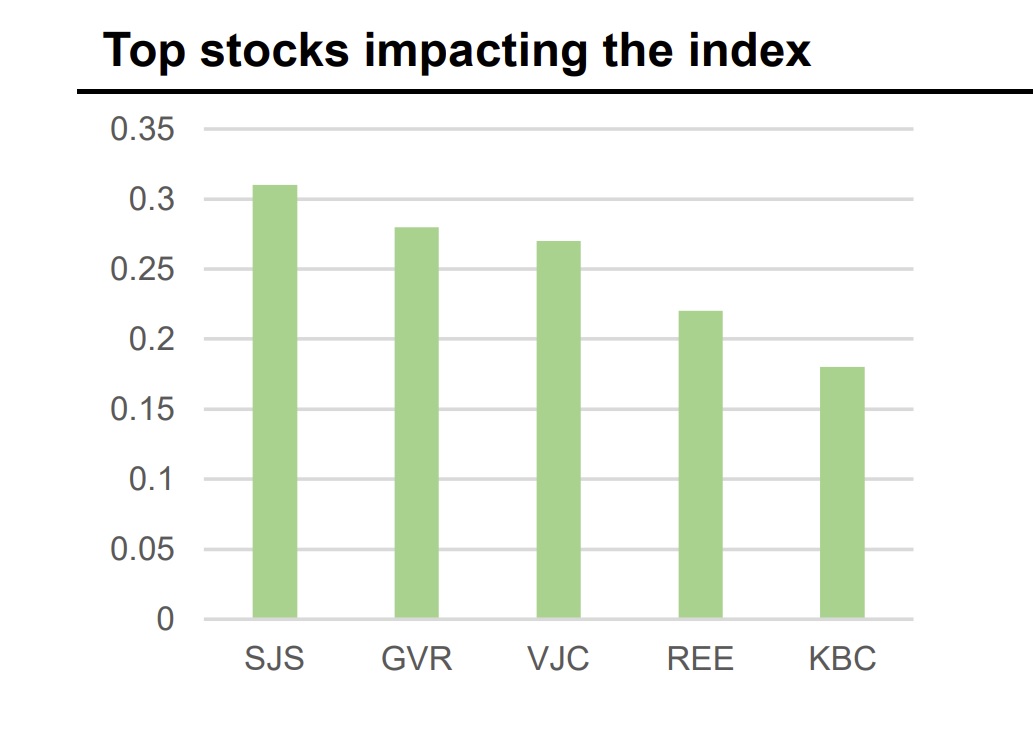

Opening the last session of the week on September 5, VN-Index created an increase gap and surpassed the 1700 mark. After that, it recorded a tug-of-war around the 1700 mark before widening the increase range and conquering the 1710 mark in the last trading hour of the morning session. Leading the market were stocks VIC (3.68%), TCB (1.64%), and GVR (3.05%), although the differentiation in the large-cap group was still a negative point that slowed down the index's upward momentum.

Regarding midcap stocks, this group continued to show signs of attracting good cash flow with outstanding developments in the Real Estate-Industrial Park, Public Investment, and Construction groups. In the afternoon session, selling pressure suddenly increased, starting from the banking group and then spreading to the whole market. At the same time, red dominated with 230 stocks, causing the VN-Index to lose momentum and slide below the 1670 mark at the end of the session. Stocks that increased well in the morning session also narrowed their increase range; some even fell back to the reference or reversed to red. Foreign investors sold strongly with a total net value of 1,350.94 billion, focusing on selling VPB, VHM, and MBB.

At the end of the session, VN-Index closed at 1,666.97, down 29.32 points, equivalent to 1.73%. At the end of the week, the VN-Index decreased by 15.24 points (-0.91%) compared to the previous week.

VN-Index ended the weekend session with a bearish engulfing candlestick pattern when the supply suddenly increased, putting pressure on the index. On the daily chart, the RSI and MACD indicators point down and form a negative divergence, indicating that the VN-Index is weakening in the short term. At the same time, the profit-taking sentiment is also increasing as the VN Index conquers the 1,700 mark in today's session, so the correction trend is likely to continue in the early sessions of next week with the nearest support level being 1,645, equivalent to the MA20 line.

On the hourly chart, the RSI and CMF indicators are pointing down to the low point area, further reinforcing the correction as well as the increase in selling pressure in the short term. The -DI line is rising while the DI line is gradually decreasing, so fluctuations and tug-of-war are inevitable in the next session.

VN-Index successfully conquered the 1700 mark. However, the rapid increase in supply caused the index to lose steam and slide below the 1,670 mark. The dominant red color and the widespread adjustment show short-term profit-taking pressure, but at the same time, cash flow will tend to be more cautious in the coming sessions. Accordingly, VCBS recommends that investors closely follow market developments and only disburse when there is a signal confirming the new market equilibrium. Along with that, investors also need to proactively reduce the margin ratio and maintain purchasing power to both manage risks and take advantage of market adjustments to find disbursement opportunities for short-term surfing purposes.