Commodity exchange: essential tool of modern economy

Trading through commodity exchange is increasingly affirming its role as an essential tool in the modern economy, offering functions such as price insurance, and market risk prevention.

Solving the “good harvest, low price” problem

Recently, the price of durian has plummeted in many localities, leaving growers in distress. While high-quality Ri6 durian fetched as much as 170,000 VND/kg two years ago, current prices have dropped sharply to just 35,000–40,000 VND/kg.

According to traders, the primary reason is over-reliance on export markets, which are currently tightening regulations, making it harder to ship durians abroad. Moreover, the sharp increase in durian prices in recent years has led to a rapid expansion in cultivation areas, causing oversupply and, consequently, price crashes.

Clearly, this unrestrained dependence on market forces, coupled with the lack of effective price risk management tools, has left both farmers and businesses vulnerable when supply outstrips demand or export activities face disruptions.

This recurring pattern of abundant harvests leading to plunging prices seems to have become a vicious cycle for many Vietnamese agricultural products. Crops such as coffee, watermelon, longan, and lychee have all experienced similar fluctuations.

Thus far, coffee is the agricultural product that is considered to have temporarily escaped this vicious circle.

Following a deep crisis between 2008 and 2016 when many coffee growers abandoned their plantations for other crops, coffee cultivation in Viet Nam has stabilised. Production has steadily increased, and prices have remained high.

According to a report from the US Department of Agriculture (USDA) on May 19, 2025, Viet Nam's coffee output for the 2023–2024 season reached 27.5 million GEB (around 1.65 million tonnes) and is expected to rise to 29 million GEB (1.74 million tonnes) in the 2024–2025 season and 31 million GEB (1.86 million tonnes) in the 2025–2026 season. Meanwhile, coffee prices have surged from 50,000–60,000 VND/kg in early 2023 to around 130,000 VND/kg at present and are projected to remain at this level in 2026.

According to Do Xuan Hien, Chief of Office of the Viet Nam Coffee Association, this result is largely attributable to trade via the commodity exchange. With direct connectivity to international platforms such as ICE and CME, Vietnamese enterprises can access real-time global benchmark coffee prices, improving the transparency and pricing capabilities of business.

A notable example occurred in mid-February 2025, when global coffee prices peaked, with Arabica surpassing 9,000 USD/tonne (around 225,000 VND/kg) and Robusta nearing 6,000 USD /tonne (150,000 VND/kg). At that time, domestic coffee prices also reached a record high of 133,000 VND/kg.

Significantly, trading in futures contracts has enabled businesses to hedge against price volatility, stabilising both revenue and profits by locking in sale prices in advance, instead of depending on market fluctuations. This is also a strategic step to help improve financial management capacity and gradually integrate deeper into the global value chain.

Not only related to coffee, Dr. Nguyen Minh Phong emphasised that trading through commodity exchange contributes to information transparency, supports market supply-demand balance, and creates a fair competition environment in accordance with market principles. This aligns with the spirit of the Politburo’s recently issued Resolution 68.

“Because prices are publicly determined based on supply and demand and use market tools such as forward contracts, futures contracts, or international standard clearing mechanisms to regulate the market, it helps businesses proactively hedge risks and optimise production and business efficiency,” the expert shared.

A market-shaping role

Dr. Nguyen Minh Phong also noted that the development of commodity trading through exchanges plays a vital role in building a modern financial investment channel. This includes the concurrent development of related markets and the improvement of institutional frameworks to promote fair and transparent competition among market participants. It also reduces dependency on intermediaries and limits price manipulation, thereby concretising the Party’s major policy direction on private economic development, positioning it as a key driver of economic growth, innovation, competitiveness improvement, job creation, and social welfare within Viet Nam’s socialist-oriented market economy in the coming time.

Fulfilling this role, the Viet Nam Commodity Exchange (MXV), commodity exchange licensed in Viet Nam, has laid a solid market foundation by facilitating the trading of 46 commodities and connecting with 10 major international commodity exchanges, including CME, ICE, and SGX.

According to MXV, it currently works with 30 member and brokerage companies, with average trading values ranging from 5 to 7 trillion VND per day, sometimes reaching as high as 11 trillion VND. From 2023 to 2024, this represents a growth rate of 10%.

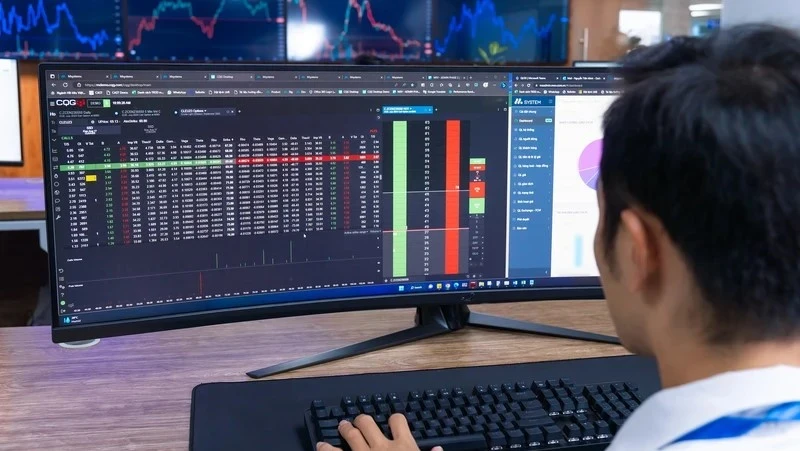

Nguyen Ngoc Quynh, Deputy General Director of MXV, said that in pursuit of a modern, internationally aligned commodity trading market, MXV has, over many years, built an effective management and trading system that has earned high praise from foreign partners.

“For example, our M-System trading platform, developed by MXV, can handle large volumes securely and rapidly, serving thousands of investors daily,” Quynh shared.

Notably, the development of commodity exchanges via MXV has received close attention and direction from the government and management agencies.

As the supervisory authority, the Ministry of Industry and Trade has shown strategic foresight in shaping the legal framework for Viet Nam’s commodity trading market. The ministry has proactively developed new policies aimed at aligning with international standards, creating a solid foundation for sustainable development of commodity trading activities.

A key initiative is the drafting of a new decree to replace Decrees No. 158/2006/ND-CP and No. 51/2018/ND-CP. The Ministry of Industry and Trade reflects a breakthrough vision based on three key reforms: (i) optimising market entry conditions and procedures, ensuring only capable and reputable organisations are allowed to participate in operation; (ii) completing the legal framework governing the activities of all market participants, from businesses to individuals, to enhance transaction quality and efficiency; (iii) establishing a modern state management mechanism with stringent oversight, robust legal enforcement, and timely violation handling, thereby creating a transparent and equitable business environment.

Meanwhile, the Ministry of Finance has helped create a favourable environment for commodity exchanges market development through tax management policies, including VAT regulations aligned with both international practices and the reality in Viet Nam. This helps reduce transaction costs and improve market competitiveness.

Additionally, to ensure transparency in financial reporting and risk management of financial products, the Ministry of Finance plans to work closely with the Ministry of Industry and Trade to establish specialised accounting standards to commodity trading activities. This aims to complete the legal framework for derivative commodity trading, a crucial tool for businesses to manage price risks. Developing specialised accounting standards for commodity derivatives will not only enhance professionalism but also boost the confidence of international investors.

As for the State Bank of Viet Nam, the central bank has issued regulations on payment and money transfers specifically for commodity trading through Circular No. 20/2022/TT-NHNN. This guides one-way money transfers from Viet Nam to overseas and payments for other current transactions, significantly improving the efficiency of commodity trading and demonstrating strategic foresight in building modern payment infrastructure to support the commodity trading activities.

Notably, the State Bank has also established stringent supervision mechanisms for all payments and money transfers of the commodity exchange. These strict provisions create a “firewall” that not only enhances safety and robust protection for the commodity trading market but also safeguards the security of the financial payment system.