What growth driver for PVS?

The gross profit margin of the Mechanical & Construction (M&C) segment of PetroVietnam Technical Services Corporation (HoSE: PVS) is expected to improve in 2025.

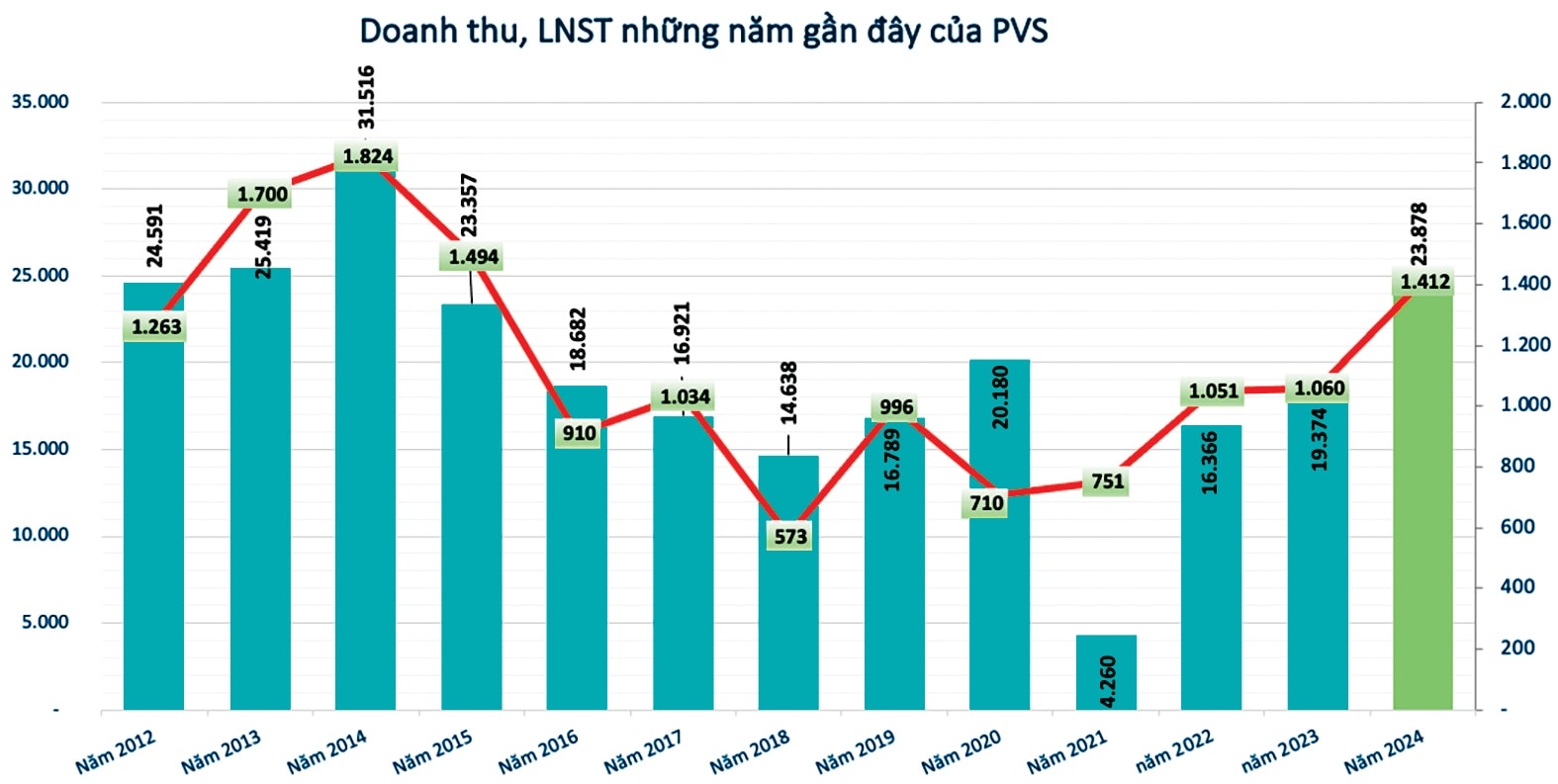

Revenue and post-tax profit of PVS in recent years. Unit: VND billion.

This improvement is also seen as a key driver of PVS’s overall profit growth. That said, PVS faces several challenges, such as thin profit margins in the M&C segment and the risk of delays in major projects due to falling oil prices.

Slight Profit Decline

In Q1, PVS recorded revenue of VND 6,013 billion, up 62.1% year-on-year. Of this, construction contracts brought in VND 3,972 billion, oil and gas technical services contributed VND 1,988 billion, and sales activities generated nearly VND 53 billion. However, cost of goods sold surged by 66%, outpacing revenue growth, which led to a drop in gross profit to VND 257 billion.

Meanwhile, PVS’s financial income jumped 125.7% in Q1 to VND 339.9 billion, mainly due to gains from asset revaluation and foreign exchange differences. Financial expenses also rose by 138.8% to VND 33.6 billion. Selling expenses and general & administrative expenses increased by 3% to VND 22.7 billion and by 82% to VND 372.8 billion, respectively.

By the end of Q1, PVS posted a post-tax profit of over VND 299.6 billion, down 1.6% year-on-year.

As of March 31, 2025, PVS’s total assets reached VND 35,208 billion, up 3.3% from the end of 2024. Short-term assets accounted for 70.8% of total assets, with cash and cash equivalents rising 8% to VND 12,331 billion, representing 35% of total assets. Inventories also increased by 11.7% to VND 2,045 billion, making up 5.8% of total assets. In terms of liabilities, PVS’s total debt rose by 4.3% to VND 20,174 billion. Short- and long-term borrowings stood at VND 826 billion and VND 843 billion, respectively.

Looking to Long-Term Projects

According to financial analysts, PVS’s revenue and profit will largely depend on long-term projects. For example, the Block B gas project, operated by Phu Quoc POC, is progressing on schedule, aiming to receive first gas in August 2027. The EPC consortium is committed to completing all offshore fabrication and installation by December 31, 2025, including the CPP jacket, LQP platform, wellhead platforms, gathering platforms, and infield pipeline systems.

Similarly, the Lac Da Vang (Golden Camel) project is on track to start production by the end of 2026. Murphy Oil plans to invest USD 110 million in 2025, of which USD 90 million is for field development and USD 20 million for production drilling. Previously, in 2024, Murphy had already invested USD 40 million in the project.

Additionally, the Vietnam–Singapore offshore wind power project, jointly developed by Sembcorp and PVS, is progressing as planned. The Lidar wind and oceanographic measurement system is expected to be installed in mid-2025 to support technical surveys (2024–2026) and the overall FEED (Front-End Engineering Design). Studies are scheduled for completion in Q3/2026, with FID expected between 2027–2028 and commercial operation (COD) in 2032–2033. The project has a planned capacity of 2,300 MW and is expected to deliver 1,200–1,400 MW of commercial output. PVS expects significant income from 2032 onward.

Opportunities Accompanied by Challenges

VCBS forecasts that the gross profit margin of PVS’s M&C segment will improve from 1.5% in 2024 to 3% in 2025, playing a vital role in driving the company’s overall profit growth. This forecast is based on the following factors:

- Depreciation Policy: PVS has adopted a three-year depreciation policy for investments in paint workshops and infrastructure to boost its M&C capacity, instead of spreading depreciation over 10–20 years. This led to low gross margins in 2023–2024, but from 2025 onward, the cost burden will decrease significantly, paving the way for profit growth.

- Higher-Margin Domestic Projects: Historically, PVS’s domestic exploration and production projects have yielded better margins than overseas projects. With Block B entering its main construction phase, it is expected to contribute positively to gross margin improvement and overall profit growth.

- International Positioning: After completing the Greater Changhua 2a & 4 project (33 jackets), PVS has reinforced its position in the international market. This is further reflected in its successful bid for the 35-jacket Formosa offshore wind project at the end of 2024. This new project is expected to generate higher margins than previous ones, providing continued momentum for profit growth in the coming years.

Nonetheless, PVS still faces significant challenges. A potential sharp drop in oil prices due to increased OPEC production could delay large-scale projects. Moreover, despite revenue recovery in its core M&C segment, project margins in this segment tend to be thin due to intense international competition—especially with persistently high input material costs.