Despite the Fed's rate hike, gold price will set a new record?

Many analysts believe gold prices will reach a new high despite the fact that the Fed will raise interest rates by 0.25% next week.

The Fed may raise interest rates by 0.25% next week.

>> Gold price may continue to upswing on SVB’s collapse

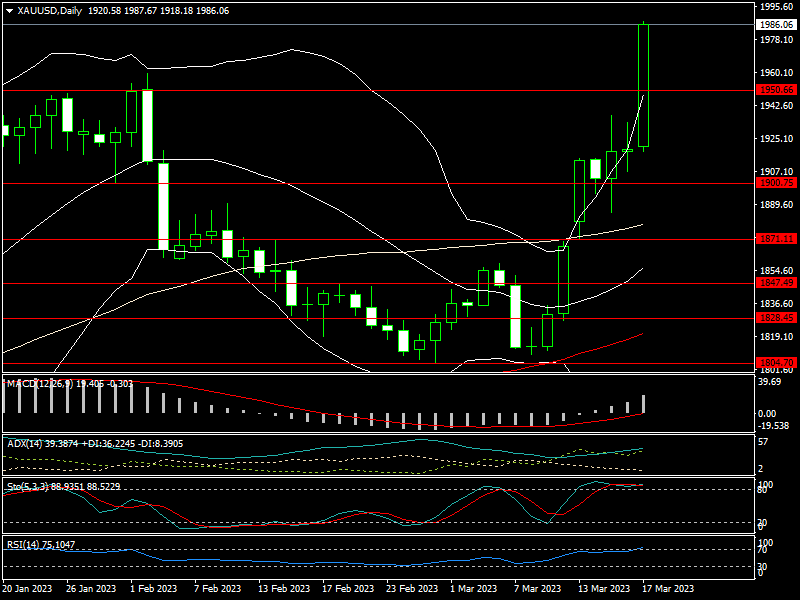

The gold market is set to conclude the week near a one-year high as a late-afternoon rally pushes prices over resistance of $1,975 per ounce to $1,987. Gold futures for April delivery were last trading at $1,988.80 per ounce, up more than 3% on the day. Meanwhile, gold is seeing its highest weekly price rises in three years.

On March 10, 2023, news surfaced about the Silicon Valley Bank collapsing after a bank run by depositors challenged the bank's stability, resulting in today's probable bankruptcy declaration. The SVB was unique in that it funded venture capitalists and start-up tech businesses as its core business. To obtain the money, they sold a large amount of their balance-sheet assets at a $1.8 billion loss.

The FDIC and banking authorities immediately intervened to ensure that depositors' funds were made available. Consequently, yesterday, 11 major US banks established a $30 billion fund at the first Republic Bank to provide as a safety net for banks such as SVB and Signature Bank of New York. Federal banking authorities commended this huge bank group's backing because it confirms the resiliency of the US financial system.

To allay consumer fears, Treasury Secretary Janet Yellen, Fed Chair Jerome Powell, and FDIC Chairman Martin Gruenberg issued a joint statement Sunday evening saying that the government would protect all deposits held at Signature Bank and Silicon Valley Bank, both of which were taken over by the FDIC on Friday.

Despite promises, the risk of contagion appears to be increasing. "As people continue to migrate their money to larger banks, all regional banks are in risk of failing. Nobody is secure right now, therefore it's no surprise that gold and even Bitcoin are on the rise "Colin, a currency analyst, stated.

>> Gold price next week: Beware of Powell’s "hawkish" testimony

This leads us to the FOMC meeting next week. The Federal Reserve is expected to approve a 0.25% rate rise, with the financial crisis eventually supporting the view that the Federal Reserve would step up its rate hikes with a 0.5% rate hike next week. Although the Fed has been speculated to halt, many analysts feel that the Fed must continue to hike rates despite the financial crisis in order to retain its reputation.

The gold price is on road to $2,000

This week, the Fed has been assisting banks with liquidity challenges, prompting concerns that last year's tightening will be partially reversed. According to the most recent Fed data, banks borrowed $164.8 billion from two Federal Reserve backup facilities this week.

According to JPMorgan Chase & Co., the extra funding from the US central bank's new 'Bank Term Funding Program' may amount to up to $2 trillion in liquidity.

With the danger of more financial contagion spreading, gold is expected to hit $2,000 per ounce next week before seeing significant profit-taking, according to experts.

"I wouldn't be shocked if gold retested last year's highs of more than $2,000 per ounce. We can't look into the future, but the banking situation is becoming increasingly worrying. The Fed is caught between a rock and a hard place in terms of rescuing troubled banks while still battling inflation", said Colin.