Gold price next week: Beware of Powell’s "hawkish" testimony

Fed Chairman Powell will testify before the Senate Banking Committee on the Federal Reserve's semiannual monetary policy report. If he maintains his hawkish stance, gold prices may fall next week.

The market will be watching for Fed Chairman Powell's testimony before Congress next week

>> Gold prices could remain sideways on FED rate hike

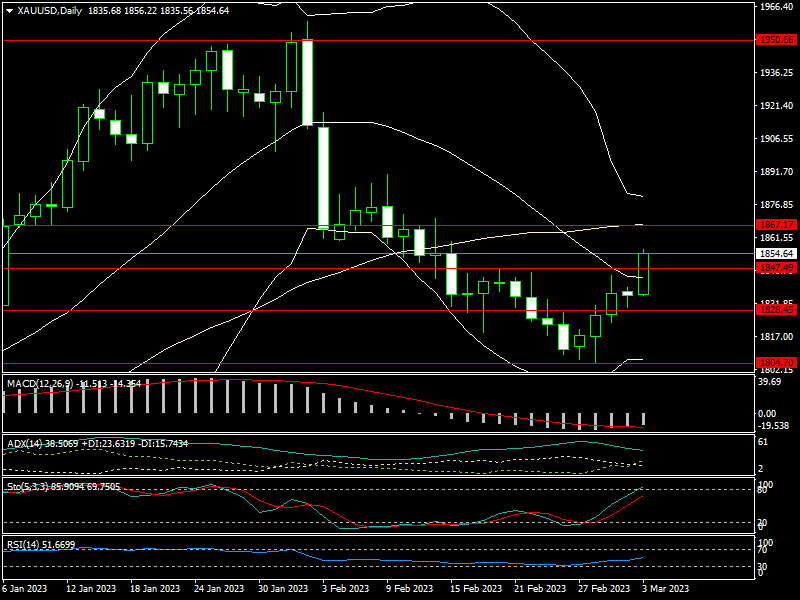

After five weeks of losses, the gold price has increased this week. As a result, the gold price rose from 1,804 USD/oz to 1,856 USD/oz before closing at 1,854 USD/oz.

The price of SJC gold bars listed by DOJI in the Vietnamese gold market has risen from 66.6 million dong/tael to 66.9 million dong/tael.

Gold prices rose this week as the dollar fell and US bond yields fell from four-month highs.

The market will be watching for Fed Chairman Powell's testimony before Congress next week, as well as US job data. The US nonfarm employment (NFP) data, in particular, is expected to reach 206,000 jobs, while the unemployment rate will remain around 3.4%.

According to a recent Fed report, consumer spending in the United States has been on a downward trend as a result of a sharp increase in interest rates, particularly when households have spent all of their savings accumulated during the pandemic. The evidence is that the Conference Board's Consumer Confidence Index fell for the second consecutive month in February 2023. The index is currently at 102.9, down from 106 in January.

Furthermore, rising geopolitical tensions and unpredictable weather are driving up commodity prices. This reduces consumer income, forcing them to borrow more. As of today, the total private debt in the United States is approximately 280% of GDP. Consumer spending slows when delinquent debt becomes a problem.

>> Gold price faces the "headwind" from the FED

With inflation not falling as sharply as expected and consumers tightening their belts, the Fed Chairman is likely to be asked in his upcoming testimony whether the rate hike was necessary when the FED's monetary policy had little impact on inflation.

With the Fed's "hawkish" policy stance and the US jobs data remaining at the same level as forecast, the gold price is likely to be under downward pressure next week.

Many experts believe that the FED Chairman will still adopt a "hawkish" stance in his upcoming testimony in order to gradually return inflation to the 2% target. However, if the Fed continues to raise interest rates "too much," the US economy, and the global economy in general, will enter a recession. The sharpest inversion of the US government bond yield curve in 40 years has also revealed investors' apprehension about this bleak scenario.

According to Mr. Colin, an FX analyst, the impact of the Fed's tightening monetary policy often has a lag on inflation. If the Fed continues to raise interest rates to or above 6%, the economy will quickly enter a recession, forcing the Fed to rotate its policy axis to prevent it. "This will be much worse than the Fed ending the tight monetary cycle at the right time, with interest rates estimated to be around 5.25-5.5%," Colin said.

Mr. Colin believes that regardless of whether 2023 ushers in a period of stagflation or an economic recession, the current macroeconomic environment is laying a solid foundation for gold prices to surpass the $2,000 level later this year.

With the Fed's "hawkish" policy stance and the US jobs data remaining at the same level as forecast, the gold price is likely to be under downward pressure next week. As a result, if the gold price does not surpass the level of 1,867 USD/oz (MA50) next week, it will quickly fall to 1,828 USD/oz, followed by the 1,800 USD/oz zone. Although the likelihood of the gold price exceeding $1,867/oz next week is low, if it does, the gold price could rise to $1,890/oz.