Gold prices could remain sideways on FED rate hike

Gold prices may remain flat next week due to rising expectations that the Fed will raise interest rates by 0.5% at its upcoming meeting.

The Fed could raise interest rates by 0.5% at its upcoming meeting.

>> Gold price faces the "headwind" from the FED

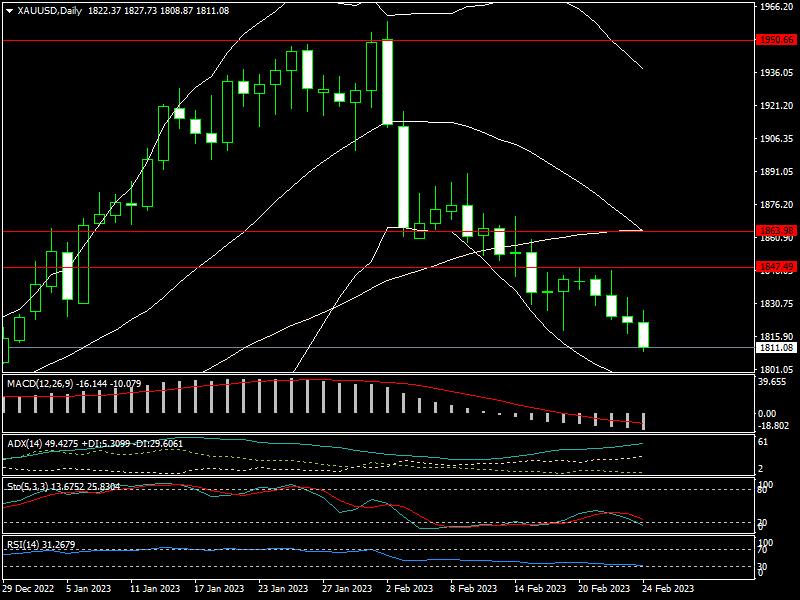

This week, gold prices fell from $1,847 to $1,808 before closing at $1,811. In the Vietnam gold market, SJC gold bar prices fell from VND 67,2 million to VND 66,9 million per teal.

Inflation and rising bond yields are the two main factors weighing on gold, as the Federal Reserve is expected to continue aggressively raising interest rates.

The core Personal Consumption Expenditures price index in the United States rose 4.7% in the previous year, up from 4.6% in December and faster than the consensus estimate of 4.3%.

Inflation continues to be a significant threat to the US economy, and the Federal Reserve must deal with it. Consistently higher inflation has pushed the yield on US two-year bonds to 4.8%, the highest level since 2007; at the same time, US 10-year bond yields are approaching 4%.

Bond yields are rising as long-shot expectations mount that the Federal Reserve will raise the Fed Funds rate above 6% during this aggressive tightening cycle. This marks a significant shift in interest rate expectations.

According to the CME FedWatch Tool, markets believe the Federal Reserve will raise interest rates by 50 basis points next month by 27%. While the odds remain low, they have increased dramatically; markets saw an 18% chance a week ago, and less than a 3% chance last month.

>> How does the FED run its quantitative tightening?

Along with rising bond yields, a shift in interest rate expectations is providing new momentum to the US dollar, which is trading at a one-month high against a basket of global currencies.

Gold prices could remain sideways on FED rate hike

According to Mr. Colin, an FX analyst, there will be a major reset in how high rates will go. People are now considering 6%. That is significant enough to break gold's back.

With markets recognizing the difficulty of achieving the Fed's 2% inflation target, gold will remain vulnerable in the short term.

"There is some support at $1,750, but nothing significant until possibly $1,730. This is a significant shift in sentiment "Mr. Colin stated.

Analysts will be looking for any signs of weakness after a strong start to the year in the macro data scheduled for next week, which includes US durable goods orders, US pending home sales, US CB consumer confidence, US ISM manufacturing PMI, US jobless claims, and US ISM non-manufacturing PMI.