Gold price faces the "headwind" from the FED

Gold price has fallen for the fourth week in a row, as investors are concerned about how aggressive the Federal Reserve will have to be in order to bring inflation down to 2%.

Ms. Loretta Mester, President of the Cleveland Federal Reserve, stated that she would have liked the FED to have been more aggressive at the upcoming meetings.

>> Gold price will be driven by the US default risk

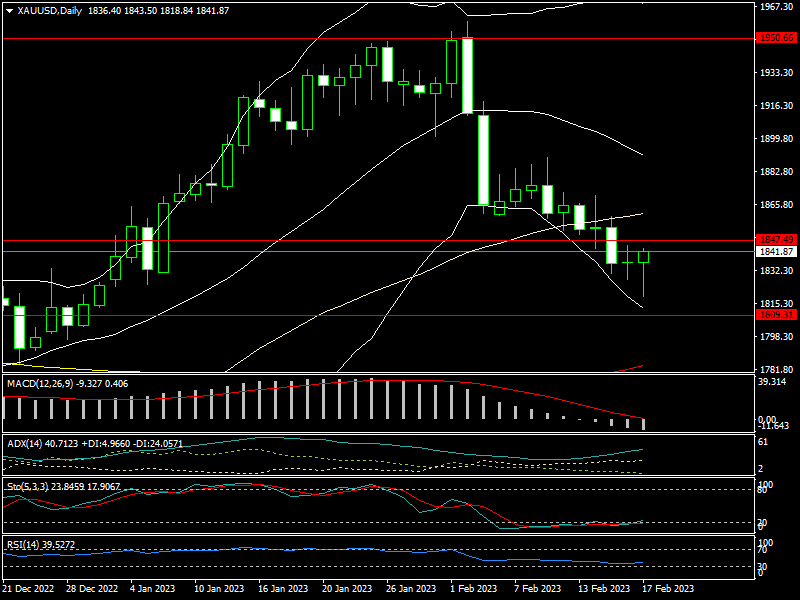

This week, the international gold price fell to 1,818 USD/oz before recovering and closing at 1,841 USD/oz as the market expected the FED to continue raising interest rates aggressively.

The price of SJC gold bars listed by DOJI in the Vietnamese gold market fell from 67.35 million dong/tael to 67 million dong/tael, but it is still much higher than the international converted gold price.

Recent statements by the Federal Reserve's more hawkish faction have raised genuine fears that the current monetary policy to reduce inflation is about to undergo an unwelcome change.

Ms. Loretta Mester, President of the Cleveland Federal Reserve, stated that she would have liked the FED to have been more aggressive at the upcoming meetings. Her message was clear: "We must do more to ensure that inflation returns to our target of 2%."

She is not the only Federal Reserve official who believes this. Both regional Fed presidents, James Bullard and Loretta Mester, spoke to reporters after delivering a speech to a business group in Jackson, Tennessee, in which they advocated for a 50-basis-point increase in interest rates at the central bank's meeting next month.

Advocates of a more hawkish monetary policy at the Federal Reserve point to recent inflation reports that show inflation is much more persistent than previously thought and is not declining as quickly as projected.

The January inflation data was higher than expected this week, with the US CPI rising 6.4% year on year. Economists predicted a 6.2% increase. Meanwhile, the US PPI increased 6% year on year, versus a 5.4% increase expected.

As a result of the latest inflation data, markets now expect the Fed to raise interest rates by 50 basis points next month. In the short term, this interest rate shift is negative for gold; however, analysts have noted that the more the FED raises rates, the greater the risk of a recession.

To put gold's price action into context, we must first examine the bond market. Bond yields are rising once more, as persistently higher inflation may force the FED to raise interest rates to 5.50% in the coming months.

What makes it even more difficult for gold is that short-term bonds now offer positive returns to investors, making them attractive safe-haven assets once again. However, this is where the problem arises.

>> FED scales back its rate hike, gold price will break out?

The yield curve in the US bond market has inverted to the greatest extent in 40 years. The United States' economy has proven to be more resilient than expected, but that does not mean the threat of a global downturn has subsided.

Gold prices may continue to correct and accumulate around 1,800 USD/oz.

Mr. Colin, an independent forex analyst, believes that there are two issues that require immediate attention.

First, while the market and some Fed officials predict that the Fed will raise interest rates by 0.5% rather than 0.25%, this is unlikely to occur. However, the Fed will continue to raise interest rates at its meetings in March, May, and June, as well as in the months following.

Second, if the Fed continues to raise interest rates, the likelihood of a recession increases.

In response to this situation, Mr. Colin stated that the gold price for next week, in particular, and the short-term gold price in general, may continue to correct and accumulate around 1,800 USD/oz. If the gold price remains above $1,776/oz (MA200 on the daily chart) next week, it will recover quickly. On the contrary, the gold price is expected to fall further to $1,731/oz (MA200 on weekly chart).

In the long run, however, Mr. Colin believes that the gold price will continue to rise sharply, possibly surpassing $2,000 per ounce by the end of this year or early in 2024.