Gold price will be driven by the US default risk

The Fed's decision to scale back its rate hike, US default risk, and other factors will support the gold price next week.

U.S. Treasury Secretary Janet Yellen said the US would reach its debt ceiling on January 19, 2023

>> The US dollar may see further weakness

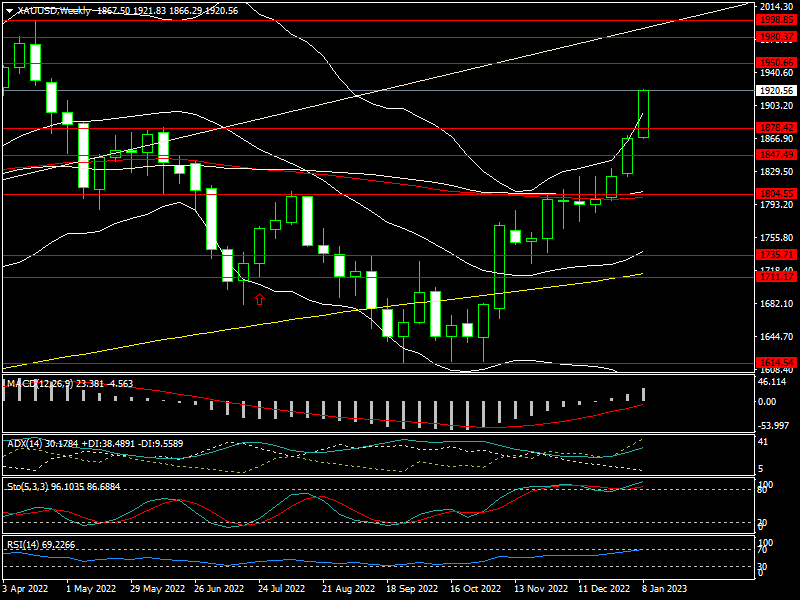

The price of gold has been steadily increasing since the beginning of 2023 as expected. The price of gold increased significantly this week, climbing from $1,866/oz to $1,921/oz before closing at $1,920/oz.

The price of SJC gold bars has also climbed significantly on the Vietnamese gold market, going from 66.6 million dong/tael to 67.4 million dong/tael.

The market's expectation that the FED would scale down its rate hike and soon end the current monetary tightening cycle in light of the fact that several major economies across the world are at risk of recession is what caused gold prices to continue to rise sharply this week.

Markets anticipate that the U.S. central bank will increase the Fed Funds rate by 25 basis points next month, according to the CME's FedWatch Tool.

In addition, even if the US economy showed indications of recovery in 3Q22 (3Q22 GDP climbed by 3.2% after the first two quarters of negative growth), it still confronts many difficulties, particularly the risk of a US default.

After U.S. Treasury Secretary Janet Yellen informed Congress in a letter that the US would reach its debt ceiling on January 19, gold prices began to rise.

As the Republican Party's tenuous hold on the U.S. House of Representatives is anticipated to complicate discussions, there are growing concerns that the U.S. will potentially default on its debt commitments. Republican legislators have already stated that significant spending cutbacks must go along with any increase in the debt ceiling.

Mr. Edward Moya, senior North American market analyst at OANDA, said: "we knew the debt issue was going to be a problem in 2023, but we weren't expecting it to rise to prominence so soon". He also stated that the short-term reaction in gold is justified given the current level of uncertainty.

>> FED scales back its rate hike, gold price will break out?

Another major factor that has contributed to the gold price moving higher has been eastern central banks swapping U.S. dollars for gold. In December 2022, the People’s Bank of China (PBOC) publicly disclosed for the first time in three years that it was increasing the share of gold in its foreign-exchange reserves.

Gold's price will be driven by the US default risk

In addition to the customary monthly acquisitions, 32 additional tons of gold were purchased by the PBOC in November 2022. The World Gold Council states that 30 more tons were added in December after that. For many years, the majority of China's reserves have been made up of US treasuries, but this might change at any time, just as it did when the US sanctioned Russian central bank reserves.

According to Mr. Moya, there is some resistance for gold at $1,950 per ounce, and if that level is broken, not much will prevent the market from rising again to $2,000 per ounce.

The senior market analyst at Barchart, Mr. Darin Newsom, predicted greater gold prices since both the short- and medium-term trends are inexorably upward.

He did, however, caution that bullish investors might need to be quick-thinking because gold could quickly correct. The U.S. dollar, which he claimed was significantly oversold, will be the key to gold's short-term momentum, according to him. He pointed out that the pivotal retracement level from the spectacular gain last year is at 102.17.