The US dollar may see further weakness

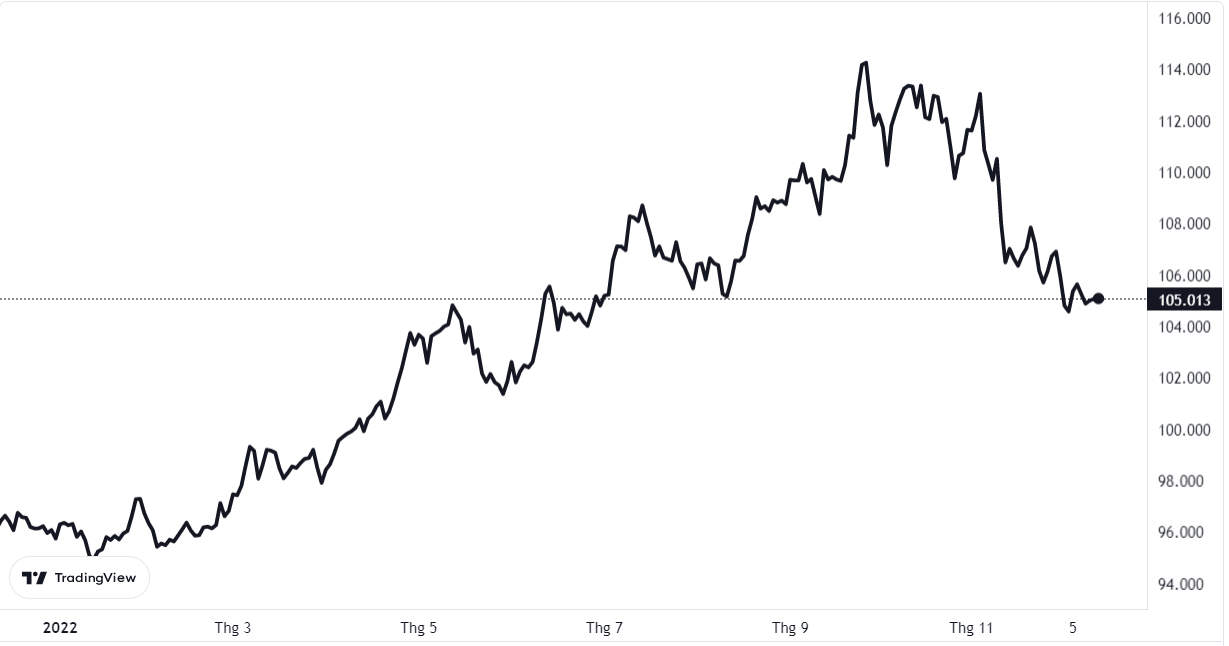

The US dollar surged through the first three quarters of 2022 against other developed currencies, but in Q4 it seems on course to give about half of that rally back.

The US dollar’s rally through much of 2022 seems to have been a consequence of many factors

>> How will the US dollar trade next year?

Does this suggest that the outlook is for further weakness as we go through 2023? We think the key is the performance of asset prices.

The US dollar’s rally through much of 2022 seems to have been a consequence of many factors, such as the sharp rate hikes from the Fed and positive US terms of trade movements compared to hefty energy importers like the euro zone and Japan. We’d stress the abysmal performance of financial assets as a key ingredient.

Now clearly, these big losses in bonds and stocks have been tied to things like aggressive Fed rate hikes and the surge in energy prices that we’ve already mentioned, but going forward, it is not clear that these things have to reverse for asset prices to rebound. For instance, bonds and stocks have rallied quite well so far in Q4, but we’re likely to see the Fed lift rates by more in this quarter (200 bps) than any quarter this year.

In terms of energy prices, we’ve seen a notable rise again in European gas prices in the last month or so as the tricky winter period approaches, and yet asset prices have rallied and the dollar has fallen. The bottom line in Mr. Steve Barrow, Head of Standard Bank G10 Strategy’s view, is that it is the performance of asset prices that is key and not necessarily things like Fed policy, energy prices, or many of the other macro factors that the market traditionally focuses on, like the recent surge in inflation, the prospect of recession, and more.

In recent weeks, we have spoken a number of times about why asset price performance is key because global investors fund investments through the FX swap market, which creates overhedging and underhedging in the dollar as asset prices fluctuate. Bank funding of international loans can operate in the same way as we talked about last week in the case of Japanese banks and the yen’s weakness this year.

>> Is the US dollar’s rise a speculative bubble?

Simply put, when asset prices collapse, as they have done this year, investors and banks can become short of dollars given their swap funding and, in some cases, will cover these positions with spot dollar purchases, which push the dollar higher. The impact of asset price movements on the US dollar is most acute when asset prices are collapsing dramatically, as we saw during the height of the global financial crisis, or COVID.

USD index is in downtrend

However, in Mr. Steve Barrow’s view, there’s no reason why this effect should disappear when asset price movements are more benign, so even if asset prices only stage a modest and slow recovery next year, the US dollar should still fall. The US dollar's weakness is associated with asset price strength, just as dollar strength and asset price weakness seem to go hand in hand. With all this in mind, just how likely is it that we will see a recovery in bonds and stocks through 2023? Of course, that’s hard to say. But one thing on the side of the asset price bulls and dollar bears is that 2022 was such a terrible year that many will presume that 2023 can’t be as bad and could conceivably be much better. And even if asset prices just flatline through the year, at least this should mean that the dollar fails to appreciate in the way that it has done for most of this year.

In other words, it does seem as if the risk/reward metrics are skewed towards a much weaker performance from the dollar next year than this year. Of course, new shocks could come along to tip asset prices down again and boost the dollar. In addition, we have to wonder whether equities have discounted the full toll of looming recessions or that bonds have grasped just how stubborn inflation could be.

Hence, nothing is certain at all, but we are biased to believe in the asset price recovery story and the weaker dollar scenario, which is why we have the euro going up to 1.10 in a year’s time and 1.20 in two. "These forecasts are based on only a very limit ed improvement in asset prices through 2023." "If bonds and stocks surprise to the upside, then so too should the euro/dollar, and the greenback should lose more ground to other currencies than we are currently assuming," said Mr. Steve Barrow.